Click image to open full size in new tab

Article Text

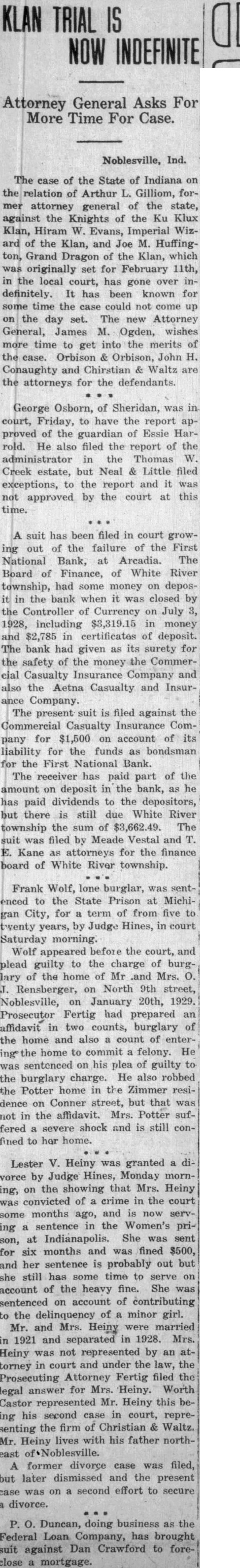

KLAN TRIAL IS NOW INDEFINITE

Attorney General Asks For More Time For Case.

Noblesville, Ind.

The case of the State of Indiana on the relation of Arthur L. Gilliom, former attorney general of the state, against the Knights of the Ku Klux Klan, Hiram W. Evans, Imperial Wizard of the Klan, and Joe M. Huffington, Grand Dragon of the Klan, which was originally set for February 11th, in the local court, has gone over indefinitely. It has been known for some time the case could not come up on the day set. The new Attorney General, James M. Ogden, wishes more time to get into the merits of the case. Orbison & Orbison, John H. Conaughty and Chirstian & Waltz are the attorneys for the defendants.

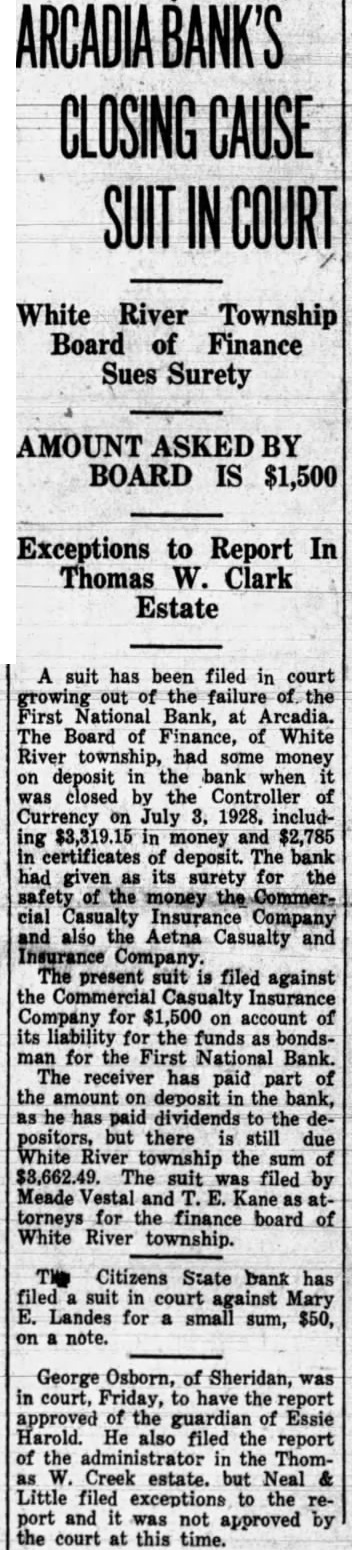

George Osborn, of Sheridan, was in court, Friday, to have the report approved of the guardian of Essie Harrold. He also filed the report of the administrator in the Thomas W. Creek estate, but Neal & Little filed exceptions, to the report and it was not approved by the court at this time.

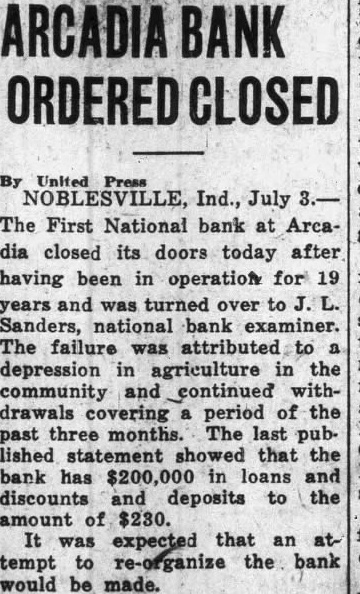

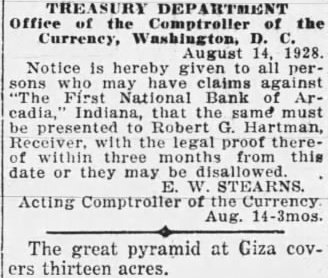

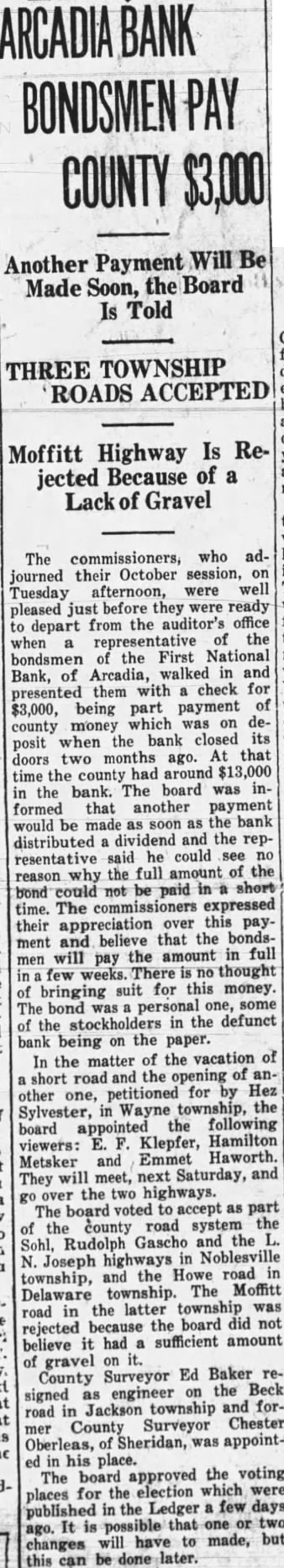

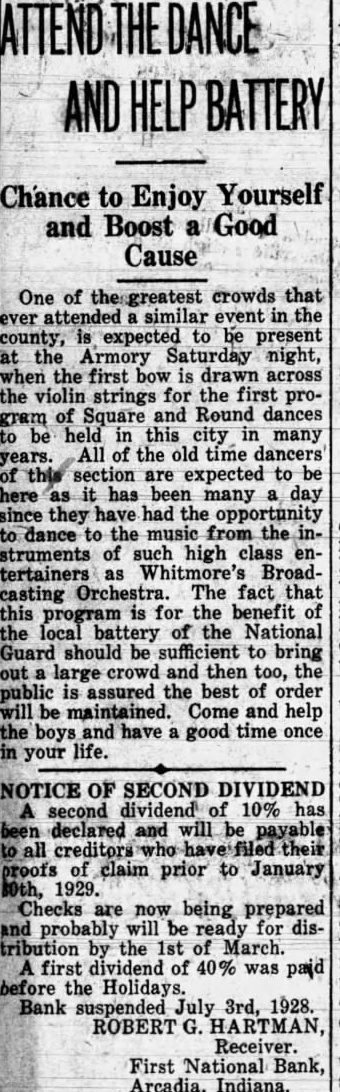

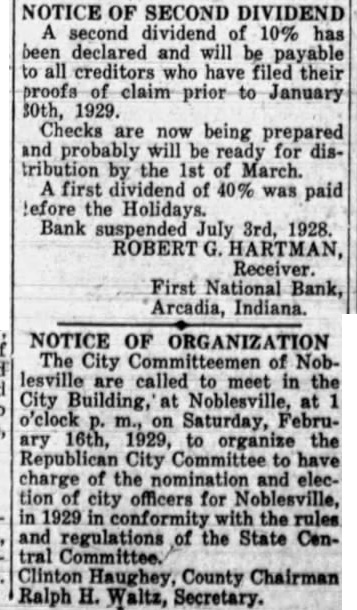

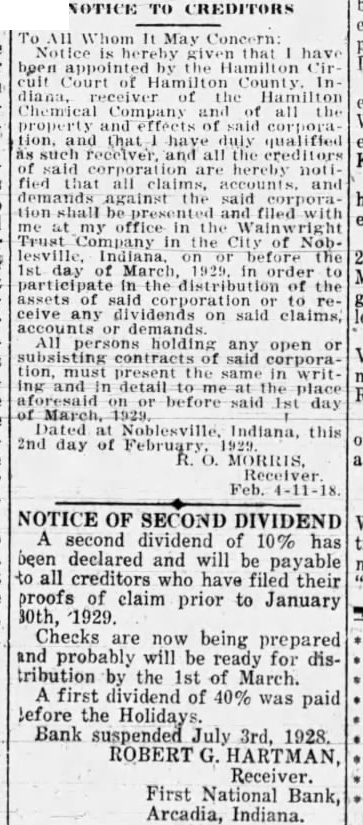

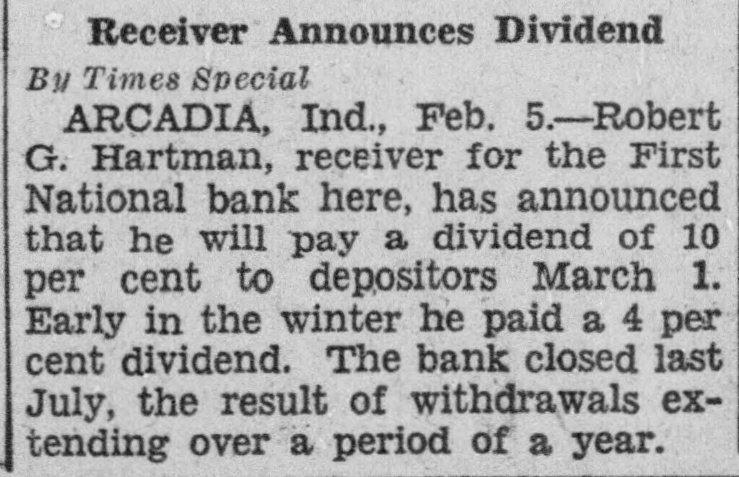

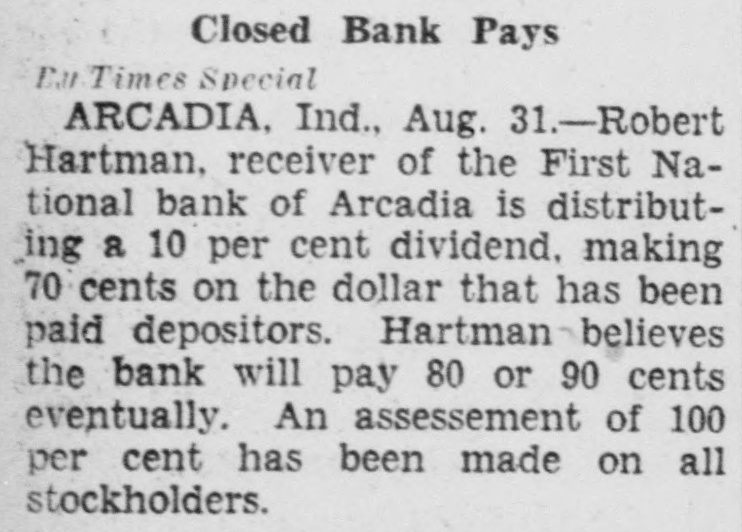

A suit has been filed in court growing out of the failure of the First National Bank, at Arcadia. The Board of Finance, of White River township, had some money on deposit in the bank when it was closed by the Controller of Currency on July 3, 1928, including $3,319.15 in money and $2,785 in certificates of deposit. The bank had given as its surety for the safety of the money the Commercial Casualty Insurance Company and also the Aetna Casualty and Insurance Company. The present suit is filed against the Commercial Casualty Insurance Company for $1,500 on account of its liability for the funds as bondsman for the First National Bank. The receiver has paid part of the amount on deposit in the bank, as he has paid dividends to the depositors, but there is still due White River township the sum of $3,662.49. The suit was filed by Meade Vestal and T. E. Kane as attorneys for the finance board of White River township.

Frank Wolf, lone burglar, was sentenced to the State Prison at Michigan City, for a term of from five to twenty years, by Judge Hines, in court Saturday morning. Wolf appeared before the court, and plead guilty to the charge of burglary of the home of Mr and Mrs. O. J. Rensberger, on North 9th street, Noblesville, on January 20th, 1929. Prosecutor Fertig had prepared an affidavit in two counts, burglary of the home and also a count of entering the home to commit a felony. He was sentenced on his plea of guilty to the burglary charge. He also robbed the Potter home in the Zimmer residence on Conner street, but that was not in the affidavit. Mrs. Potter suffered a severe shock and is still confined to her home.

Lester V. Heiny was granted a divorce by Judge Hines, Monday morning, on the showing that Mrs. Heiny was convicted of a crime in the court some months ago, and is now serving a sentence in the Women's prison, at Indianapolis. She was sent for six months and was fined $500, and her sentence is probably out but she still has some time to serve on account of the heavy fine. She was sentenced on account of contributing to the delinquency of a minor girl. Mr. and Mrs. Heiny were married in 1921 and separated in 1928. Mrs. Heiny was not represented by an attorney in court and under the law, the Prosecuting Attorney Fertig filed the legal answer for Mrs. Heiny. Worth Castor represented Mr. Heiny this being his second case in court, representing the firm of Christian & Waltz. Mr. Heiny lives with his father northA former divorce case was filed, but later dismissed and the present case was on a second effort to secure divorce.

P. O. Duncan, doing business as the Federal Loan Company, has brought suit against Dan Crawford to foreclose mortgage.