Article Text

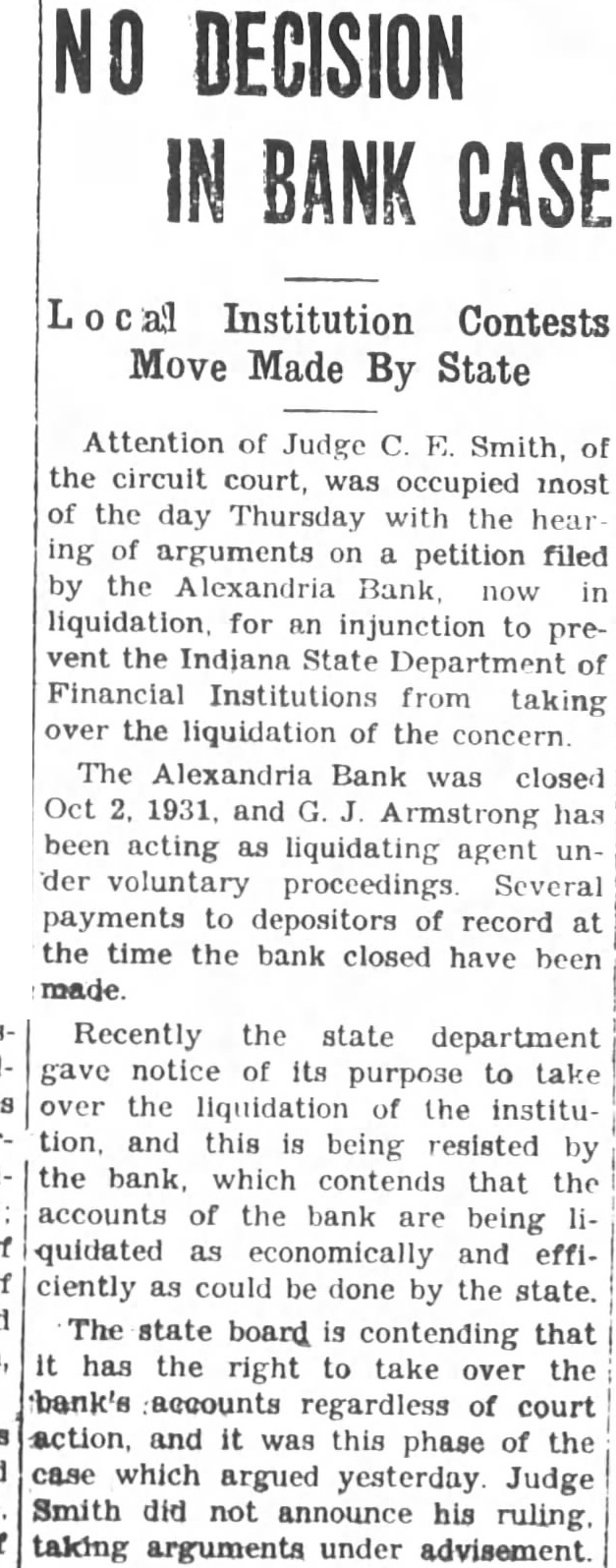

NO DECISION IN BANK CASE Institution Contests Move Made By State Attention of Judge E. Smith, of the circuit court, was occupied inost of the day Thursday with the hear ing of arguments on petition filed by the Alexandria Bank, now in liquidation, for an injunction to prevent the Indiana State Department of Financial Institutions from taking over the liquidation of the concern. The Alexandria Bank was closed Oct 1931. and Armstrong has been acting as liquidating agent under voluntary proceedings Several payments to depositors of record at the time the bank closed have been made. Recently the state department gave notice of its purpose to take over the liquidation of the institution, and this is being resisted by the bank, which contends that the accounts of the bank being quidated as economically and efficiently as could be done by the state. The state board is contending that it has the right to take over the bank's accounts regardless of court action, and it was this phase of the case which argued yesterday Judge Smith did not announce his ruling. taking arguments under advisement.