Article Text

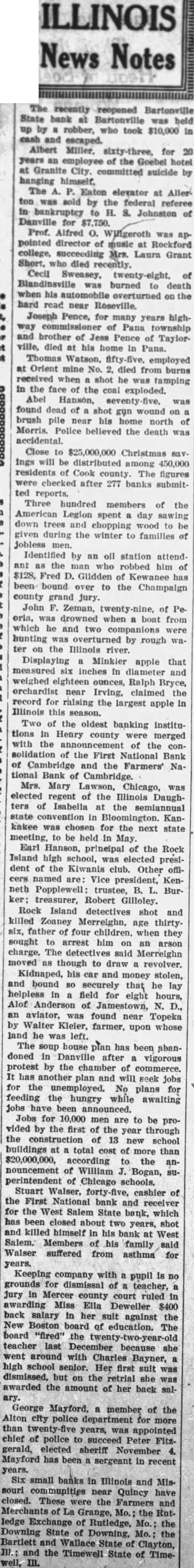

ILLINOIS News Notes The recently reopened Bartonville State bank at Bartonville was held up by a robber, who took $10,000 in cash and escaped. Albert Miller, sixty-three, for 20 years an employee of the Goebel hotel at Granite City. committed suicide by hanging himself, The A. P. Eaton elevator at Allerton was sold by the federal referee in bankruptcy to H. S. Johnston of Danville for $7,750. Prof. Alfred O. Willgeroth was appointed director of music at Rockford college, succeeding Mrs. Laura Grant Short, who died recently. Cecil Sweasey, twenty-eight, of Blandinsville was burned to death when his automobile overturned on the hard read near Roseville. Joseph Pence, for many years highway commissioner of Pana township and brother of Jess Pence of Taylorville, died at his home in Pana. Thomas Watson, fifty-five, employed at Orient mine No. 2, died from burns received when a shot he was tamping in the face of the coal exploded. Abel Hanson, seventy-five was found dead of a shot gun wound on a brush pile near his home north of Morris. Police believed the death was accidental. Close to $25,000,000 Christmas savings will be distributed among 450,000 residents of Cook county. The figures were checked after 277 banks submitted reports. Three hundred members of the American Legion spent a day sawing down trees and chopping wood to be given during the winter to families of jobless men. Identified by an oil station attendant as the man who robbed him of $128, Fred D. Glidden of Kewanee has been bound over to the Champaign county grand jury. John F. Zeman, twenty-nine, of Peoria, was drowned when a boat from which he and two companions were hunting was overturned by rough water on the Illinois river. Displaying a Minkler apple that measured six inches in diameter and weighed eighteen ounces, Ralph Bryce, orchardist near Irving, claimed the record for raising the largest apple in Illinois this season. Two of the oldest banking institutions in Henry county were merged with the announcement of the consolidation of the First National Bank of Cambridge and the Farmers' National Bank of Cambridge. Mrs. Mary Lawson, Chicago, was elected regent of the Illinois Daughters of Isabella at the semiannual state convention in Bloomington. Kankakee was chosen for the next state meeting, to be held in May. Earl Hanson, principal of the Rock Island high school, was elected president of the Kiwanis club. Other officers named are: Vice president, Kenneth Popplewell: trustee, B. L. Burker: treasurer, Robert Gilloley. Rock Island detectives shot and killed Zoaney Merreighn, age thirtysix, father of four children. when they sought to arrest him on an arson charge. The detectives said Merreighn moved as though to draw a revolver. Kidnaped, his car and money stolen, and bound so securely that he lay helpless in a field for eight hours, Alof Anderson of Jamestown, N. D., an aviator, was found near Topeka by Walter Kleier, farmer, upon whose land he was left. The soup house plan has been abandoned in Danville after a vigorous protest by the chamber of commerce. It has another plan and will seek jobs for the unemployed. No plans for feeding the hungry while awaiting Jobs have been announced. Jobs for 10,000 men are to be provided by the first of the year through the construction of 13 new school buildings at a total cost of more than $20,000,000, according to the announcement of William J. Bogan, superintendent of Chicago schools. Stuart Walser, forty-five, cashier of the First National bank and receiver for the West Salem State bank, which has been closed about two years, shot and killed himself in his bank at West Salem. Members of his family said Walser suffered from asthma for years. Keeping company with a pupil is no grounds for dismissal of a teacher, a jury in Mercer county court ruled in awarding Miss Ella Deweiler $400 back salary in her suit against the New Boston board of education. The board "fired" the twenty-two-year-old teacher last December because she went around with Charles Bayner, a high school senior. Her first suit was dismissed, but on the retrial she was awarded the amount of her back salary. George Mayford, a member of the Alton city police department for more than twenty-five years, was appointed chief of police to succeed Peter Fitzgerald, elected sheriff November 4. Mayford has been a sergeant in recent years. Six small banks in Illinois and Missouri communities near Quincy have closed. These were the Farmers and Merchants of La Grange, Mo.; the Rutledge Exchange of Rutledge, Mo.; the Downing State of Downing, Mo.; the Bartlett and Wallace State of Clayton, III. and the Timewell State of Timewell, III.