Click image to open full size in new tab

Article Text

thereof recorded May Sale Document 223331 Book for and fur praying and that thereupon court against the above defendants, returnable the first day of the term said held the Check State Illinois, the Monday 1931. and which suit WILMOT.

Circuit Clerk

Edwards Solicitors for complainants.

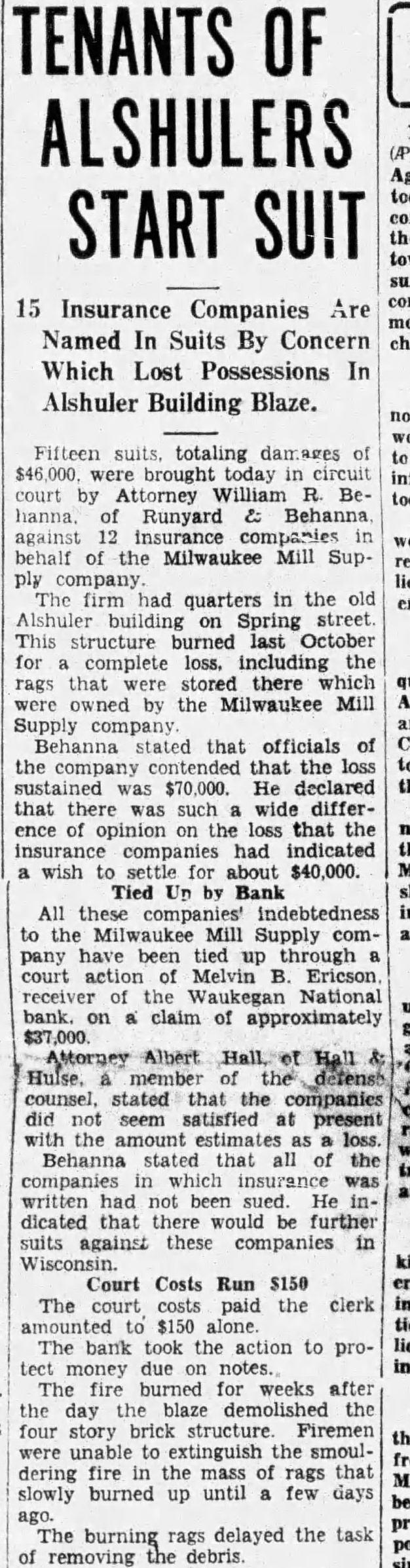

LAKE CIRCUIT COURT OF LAKE COUNTY October Term D. 1931 Marcus Kagy

Leon Jensen Nina Jensen his wife, Title and Trust pany, trustee Bernard Given, Chicago Title and Trust trustee No. 312174. Harold Shiensky, Bert Jones, Waukegan National Bank. receiver, New York Bond and Mortgage corporation, Harry owners. IN CHANCERY 27050 Whereas the requisite affidavit has filed my office. on behalf named complainant, the due that process cannot be served upon Notice therefore hereby given to the said unknown the filed his Com plaint in said Court the Chancery side thereof, and that an alias thereupon issued out said Court against the named first the the Court County the Court House Waukegan said Lake County the First Monday 1931 by and which suit still pend WILMOT Clerk

Waukegan, Illinois, Aug. 28, D. 499-Sept

CIRCUIT COURT OF LAKE COUNTY October Term D. 1931 Georgia Mae Rhodes

Jasper No. 27912 The having been the Office of the Clerk said Court, notice therefore hereby giv. said above defend. Rhodes, that the above filed her Bill Complaint said Court the Chancery and that summons thereupon issued out of said Court against the above the first of the Court Lake be held the Court House Waukegan said Lake the First Monday and which is still pending.

Clerk Waukegan, Illinois, Aug. 25 D.

EARLE H. GRAY SIMMONS, Complainant 26. Sept. 2-9-16

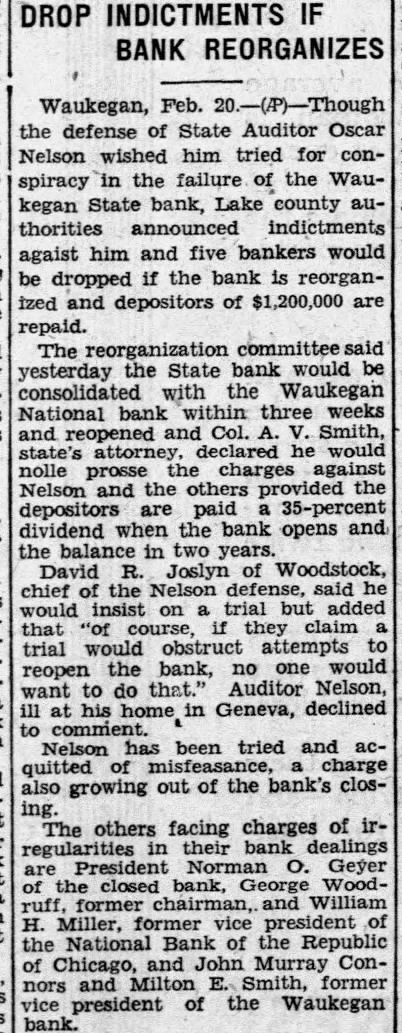

TREASURY of the Comptroller of the Office Currency Washington, August 1931. Notice is hereby given to all perclaims against National Waukegan, Illinois, that the same must presented to Melvin B. ErieReceiver, with the legal proof thereof within three months from this date or they may be disallowed. W. Comptroller the Currency. 31, Sept. Oct. Nov.

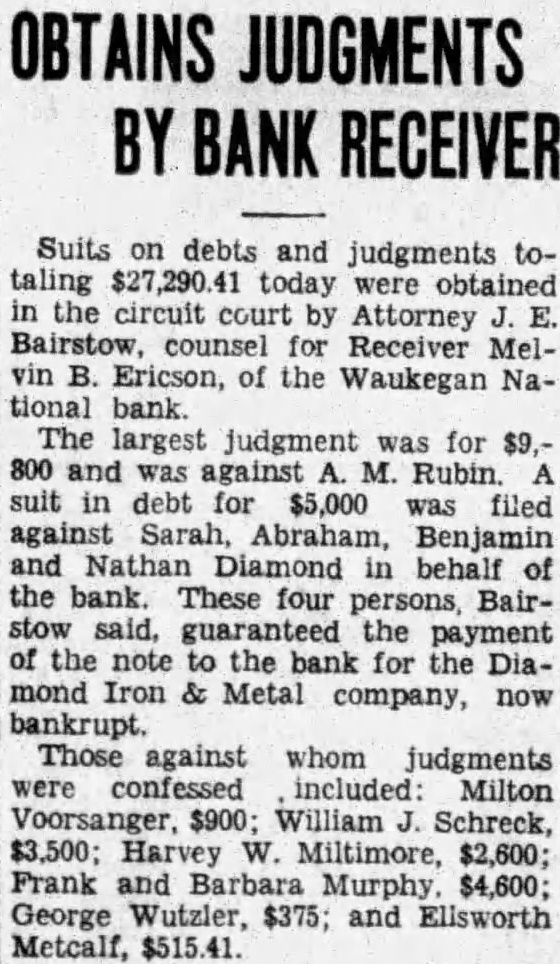

COUNTY LAKE CIRCUIT COURT OF LAKE COUNTY October Term D. 1931 IRENE HARRISON

JOHN HARRISON IN CHANCERY NO. 37909 Requisite affidavit having been heretofore in the entitled cause, Notice therefore hereby given the John Harrison that the above named Complainant heretofore filed her Bill of Complaint the Chancery that upon issued out said Court against above named defendant, returnthe first day the the Circuit Court Lake County, be held Court House in WaukeFirst 1931, and which still pending. Clerk Waukegan, Illinois, Aug. 25th, Complainant's Solicitor 484-Aug. 26, Sept. 2-9-16

COUNTY CIRCUIT COURT OF LAKE COUNTY October Term D. 1931 Marcus Kagy Robert Luke and Miriam Luke. his Chicago Title and Trust trustee, Frank E. Bundy and Della Bundy, his Harold Shlensky and Chicago Title and Trust Company, corporation, as trustee under 313398, James and Dixon, business and Dixon, and Harry Lasaine.

IN CHANCERY Whereas the affidavit duly in my office. on the above the defendants, Robert Luke and Miriam Luke, his Frank Bundy and Della his wife, found Notice therefore hereby given said defendants. Robert Luke Miriam Luke, his wife, and, Frank Bundy and Della his wife, that the filed his Bill Complaint said Court on the Chancery thereof, and alias thereupon issued out said Court against defendants. first day of the term the Circuit Lake County. held the Court House said Lake County, the First Monday of October 1931 as by law required, and which Clerk. Waukegan, Illinois, Aug. 28, D. Campbell, Clithero & Fischer, Complainant's Solicitors 2-9-16

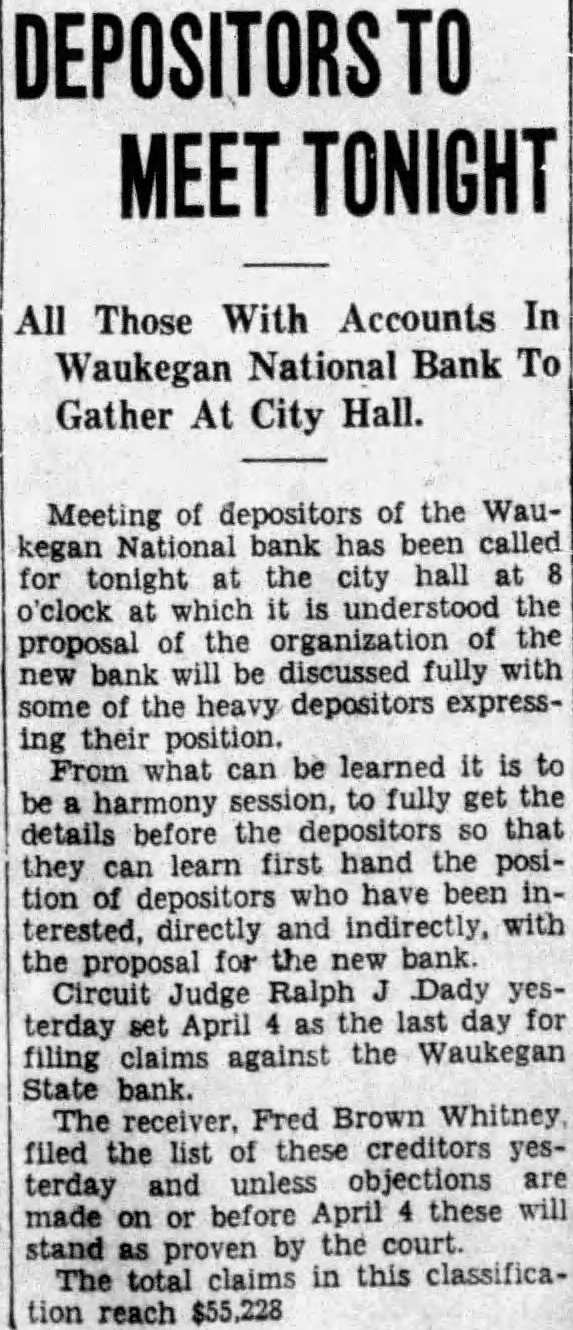

CIRCUIT COURT OF LAKE COUNTY October Term D. 1931 Marcus Kagy

Robert Luke and Miriam Luke, his wife, Chicago Trust pany. trustee, Samuel Sevin Harriet Sevin, his wife, Anton Grobelch, doing business Glen Flora HardCompany, Aigner and Harold IN CHANCERY 27049 Whereas the requisite affidavit has duly filed in my office, on behalf above complainant, the Luke Miriam Luke, and Aigner, on due inquiry cannot found so that process cannot served upon them. Notice therefore hereby given the said Robert Miriam Luke, his and Aigner, Complainant heretofore filed his Bill Complaint Court on the Chancand that an summons against the defendants, returnable on the first term of the Circuit Court County, be held at the Court House Waukegan said the Monday is quired, and which suit is still pending.

Waukegan, Illinois, Aug. 28, Campbell, Clithero Fischer, Complainant's Solicitors. 2-9-16