Article Text

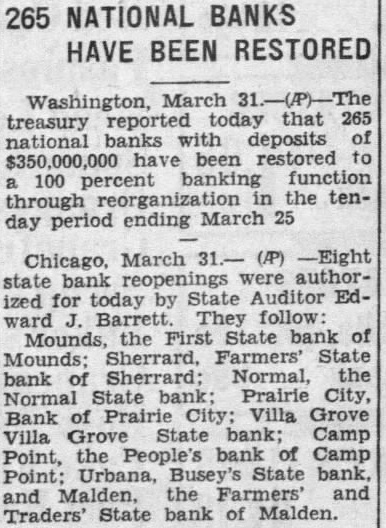

265 NATIONAL BANKS HAVE BEEN RESTORED Washington, March today that treasury reported banks with deposits of national have been restored banking function percent reorganization the tenthrough period ending March day March reopenings were authorbank for today by State Auditor ized Barrett. They follow: the First State bank of Mounds, Farmers' State Mounds; bank of Sherrard; Normal, the Normal State bank; Prairie City, of Prairie Villa Grove Bank Villa Grove State bank; Camp the People's bank of Camp Point, Point: Urbana, Busey's State bank, the Farmers' and and State bank of Malden.