Article Text

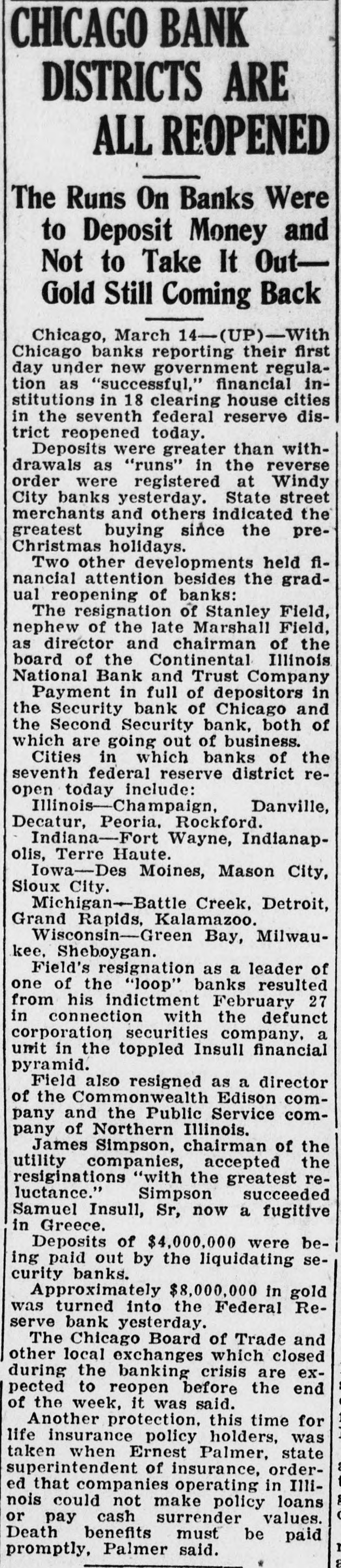

CHICAGO BANK DISTRICTS ARE ALL REOPENED The Runs On Banks Were to Deposit Money and Not to Take It OutGold Still Coming Back Chicago, March 14-(UP)-With Chicago banks reporting their first day under new government regulation as "successful," financial institutions in 18 clearing house cities in the seventh federal reserve district reopened today. Deposits were greater than withdrawals as "runs" in the reverse order were registered at Windy City banks yesterday. State street merchants and others indicated the greatest buying since the preChristmas holidays. Two other developments held financial attention besides the gradual reopening of banks: The resignation of Stanley Field, nephew of the late Marshall Field, as director and chairman of the board of the Continental Illinois National Bank and Trust Company Payment in full of depositors in the Security bank of Chicago and the Second Security bank, both of which are going out of business. Cities in which banks of the seventh federal reserve district reopen today include: Illinois-Champaign, Danville, Decatur, Peoria. Rockford. Indiana-Fort Wayne, Indianapolis, Terre Haute. Iowa-Des Moines, Mason City, Sioux City. Michigan-Battle Creek, Detroit, Grand Rapids, Kalamazoo. Wisconsin-Green Bay, Milwaukee, Sheboygan. Field's resignation as a leader of one of the "loop" banks resulted from his indictment February 27 in connection with the defunct corporation securities company, a unit in the toppled Insull financial pyramid. Field also resigned as a director of the Commonwealth Edison company and the Public Service company of Northern Illinois. James Simpson, chairman of the utility companies, accepted the resiginations "with the greatest reluctance." Simpson succeeded Samuel Insull, Sr, now a fugitive in Greece. Deposits of $4,000,000 were being paid out by the liquidating security banks. Approximately $8,000,000 in gold was turned into the Federal Reserve bank yesterday. The Chicago Board of Trade and other local exchanges which closed during the banking crisis are expected to reopen before the end of the week, it was said. Another protection, this time for life insurance policy holders, was taken when Ernest Palmer, state superintendent of insurance, ordered that companies operating in Illinois could not make policy loans or pay cash surrender values. Death benefits must be paid promptly, Palmer said.