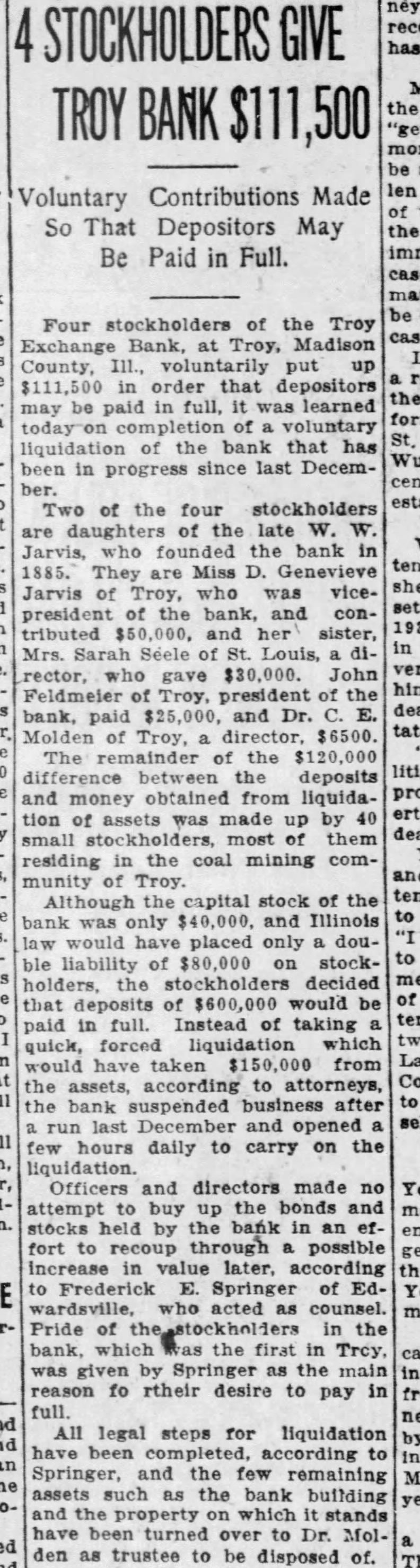

Article Text

Voluntary Contributions Made So That Depositors May Be Paid in Full. Four stockholders of the Troy Exchange Bank, at Troy, Madison County, voluntarily put up $111,500 in order that depositors be paid in full, was learned may of voluntary liquidation the bank that has been in progress since last December. Two of the four stockholders daughters of the late W. W. Jarvis, who founded the bank They Miss Genevieve Jarvis of Troy, who was vicepresident bank, and contributed and her sister, Sarah Louis, rector, who gave $30,000. John Feldmeier Troy, of bank, paid and Dr. Molden of $6500. The remainder of the difference between the deposits money obtained from liquidation of assets was made up by small stockholders, most them residing the coal mining community Although the capital stock of the was only and Illinois would have placed only double liability of on stockthe stockholders decided deposits of $600,000 would be paid in full. Instead of taking quick, forced liquidation which would have taken $150,000 from the assets, according to attorneys, the bank suspended after run last December and opened few hours daily to carry on the liquidation. Officers and directors made no attempt to buy up the bonds and stocks held by the bank in an effort to recoup through possible increase in value later, according Frederick Springer of Edwardsville, who acted counsel. Pride of in the which the first in was given by Springer as the main reason fo rtheir desire to pay in full. All legal steps for liquidation have been according Springer, and the few assets such as the bank building and the stands have been turned over to Dr. Molden as trustee to be disposed of.