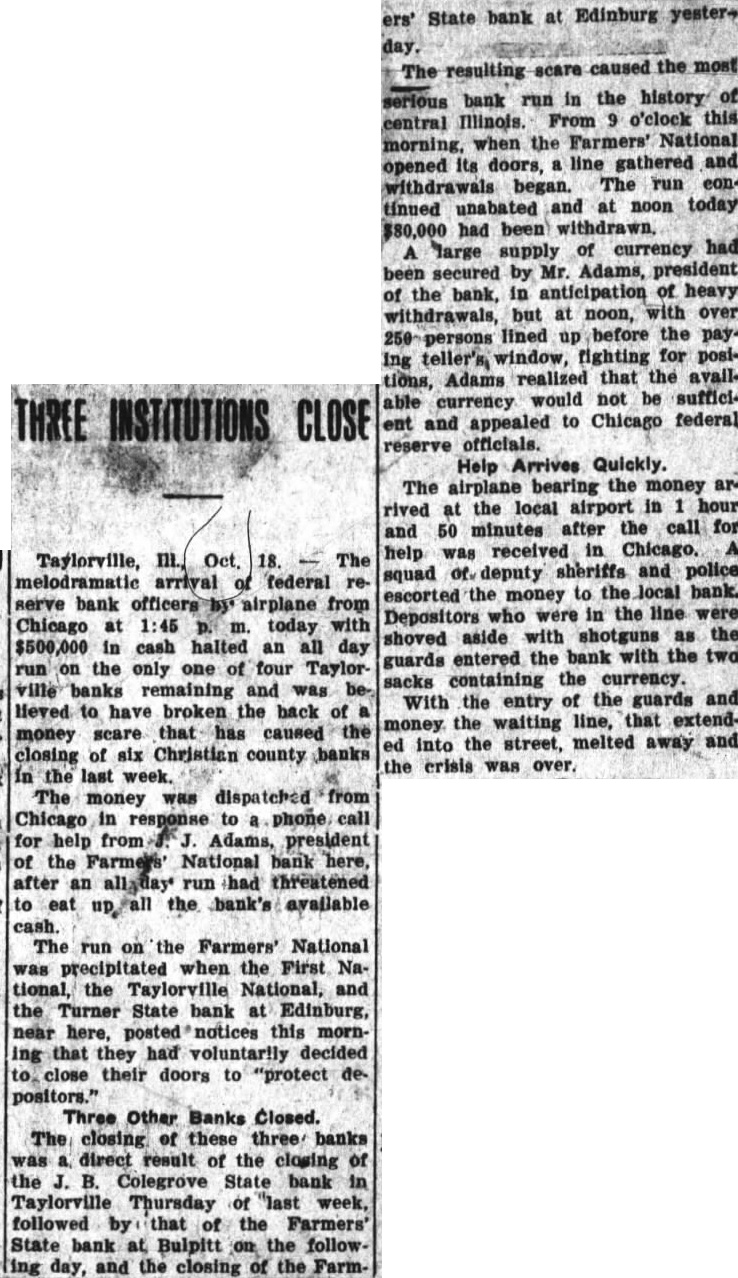

Article Text

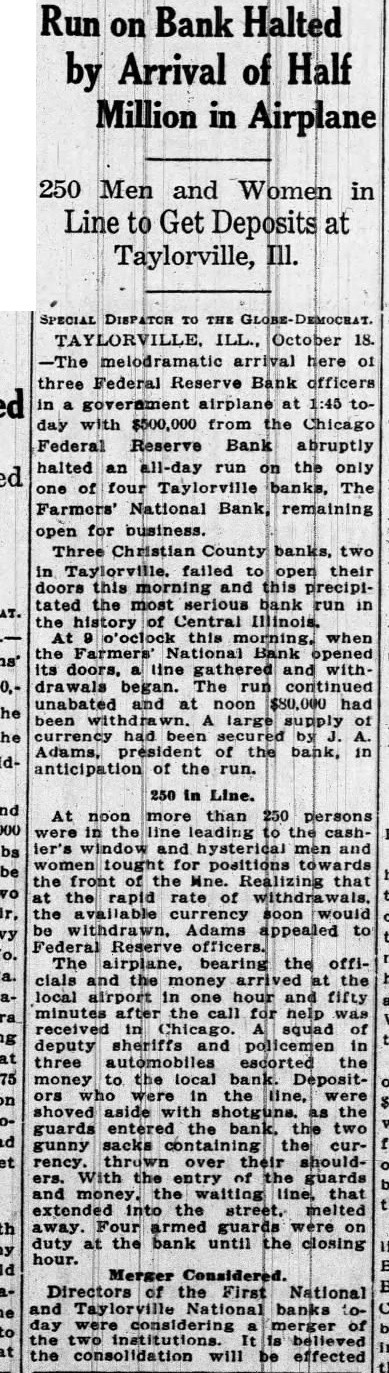

Plane Breaks on Taylorville Bank Farmers' National Remains Open After Two Other Banks in City Close to Protect DepositorsPlans for Reorganization Staff Representative) Oct. financial passed safely early afternoon. THEATERS SOLD An airplane dropped down near Taylorville with supply money for the Farmer's FOX Bank of Taylorville, ample meet demands of depositors. other banks in the town closed. Friday morning The Oct. National Bank of Taylorville and theaters the Frascini chain the Taylorville National Bank closed erating throughout Central Illinois, their doors in an attempt to check the Fox Film Co. was completed run which had developed following Friday morning. The purchase closing of Colegrove State said to have been $700,000. bank in Taylorville week ago. Either directly or indirectly The Turner State Bank of Edin- inick Frascini, burgh also failed to open Friday the following theaters which are morning making total of six banks cluded the sale: Mattoon, Christian county which have clos- leston, within the past Pana, Decision close the two Taylorville banks was reached special meeting the boards directors WATER HITS the two institutions Thursday The condition of the banks believed to be sound. One Bank Operating Friday only one bank in the Farmers' National, operating. Flagship for President HoovAdams, president of the Farmers' National, said that his bank Proposed Visit Is ample reserves of cash on hand would meet all withdrawals Stranded Crisis Brought Closing of the banks Friday brought the financial situation county to crisis. Since of the John B. Colegrove Taylorville week have to open. bank closed Thursday, Oct. The following Bulpitt State bank, the Colegrove bank closed. following day the Citizen's State in Edinburg closed. Friday morning three others closed. Coal Co. Helps turn in the panic which has swept the county evident Friday. Several prominent business in made deposits the offsetting by example the effects of steady withdrawals. The Peabody Coal Co. Friday morning deposited $90,000 the State bank to protect against run from depositors. Plan Reorganization Meanwhile plans for reorganizaand possible merger of the Taylorville banks were being discussed. Little progress can be made until national bank examiners arrive. Two of national banking department expected before night. The decision of the two Taylorville national banks to close taken in Interests of the positors officials said. Many small depositors became terrified at ruand rushed to the bank withdraw their funds. check the the directors decided close the bank. Roy Johnson president of the National bank and Troy Long. president the TaylorNational bank. Dorris Shumpresident of the Turner State bank Edinburg which of Friday. Business Slow The situation attributed present slow conditions the Christian county community. Coal mining has unsteady for period of farming conditions have not the best. factors have (Continued on Page