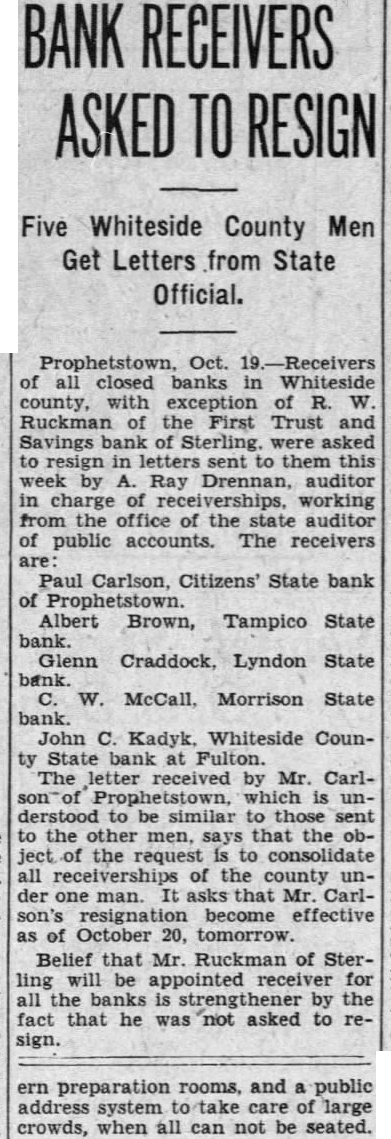

Article Text

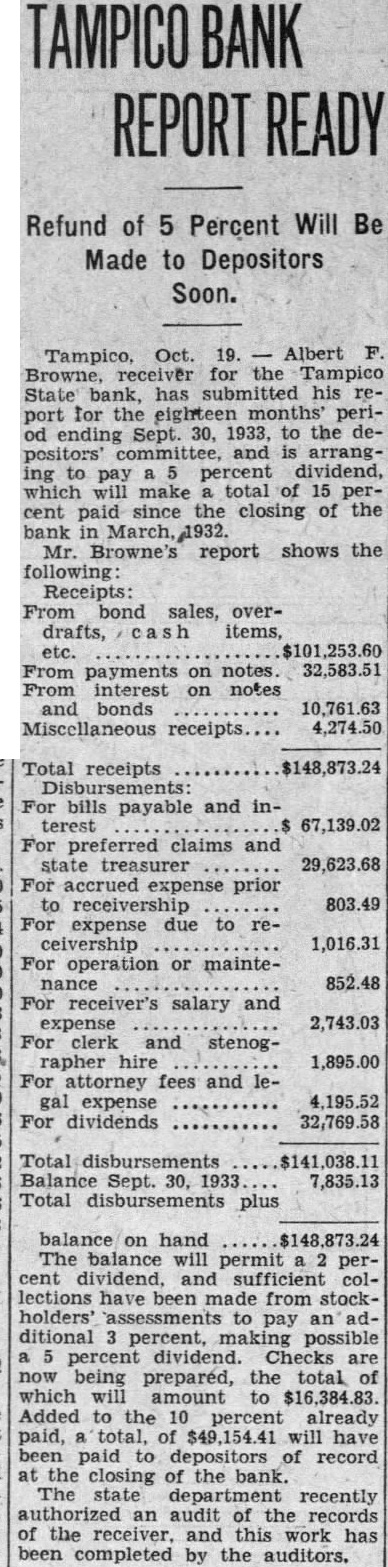

Refund of Percent Will Be Made to Depositors Soon. Oct. Albert Tampico, Browne, receiver for the Tampico State bank, has submitted his port for eighteen months' ending Sept. 1933, to the positors' committee, and to percent dividend, which make total of 15 paid since the closing of the bank Browne's report shows the following: Receipts: From bond sales, overdrafts, items, etc. From payments notes. 32,583.51 From interest on notes and bonds Miscellaneous 4,274.50 Total receipts Disbursements: For bills payable and terest For preferred claims and state treasurer 29,623.68 For accrued expense prior to For expense due to ceivership 1,016.31 For operation mainte852.48 For receiver's salary and expense 2,743.03 For clerk and stenographer hire 1,895.00 For attorney fees and expense 4,195.52 For dividends 32,769.58 disbursements Balance Sept. 30, 7,835.13 Total disbursements plus balance hand The balance will permit dividend, and sufficient lections have from stockholders' to pay ditional percent, possible percent dividend. Checks being prepared, the total which will amount to Added the 10 percent already paid, total, will have been paid depositors of record the closing the bank. The recently authorized an audit of the records of the and this work has been completed by the auditors.