Click image to open full size in new tab

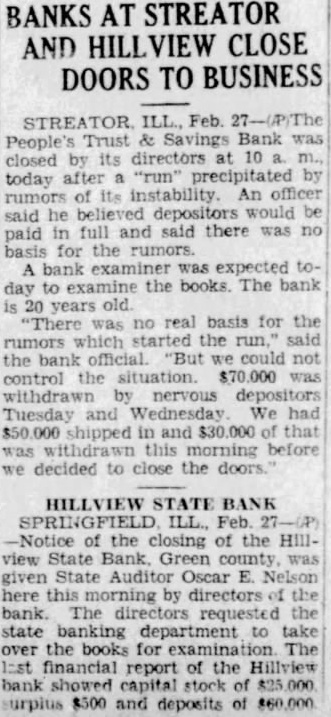

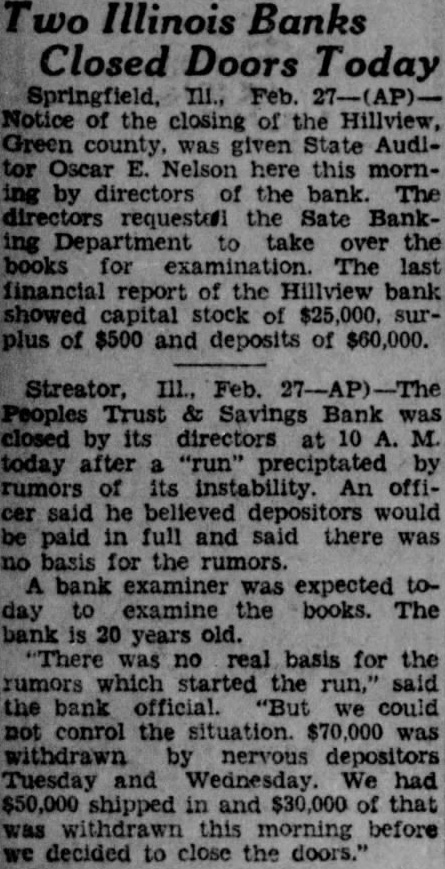

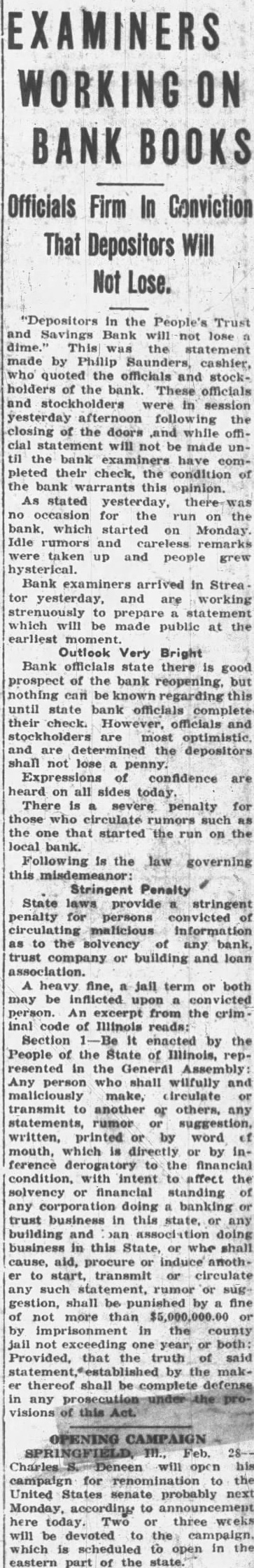

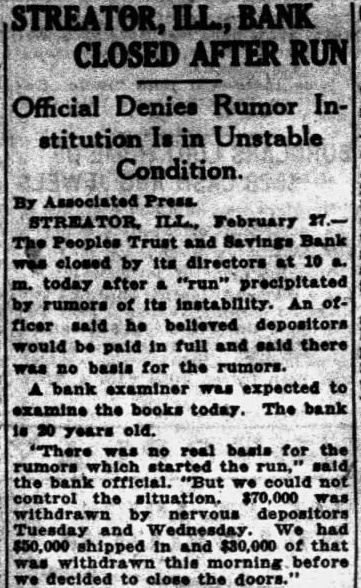

Article Text

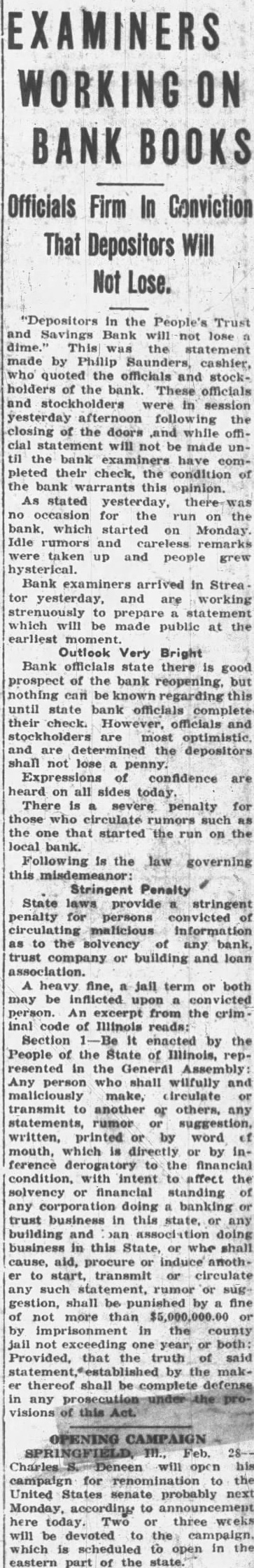

WORKING

Firm In Conviction That Depositors Will Lose.

"Depositors the People's Trust Savings Bank will not This statement made by Philip Saunders, cashier, quoted the officials and stockholders of the bank. These officials and stockholders in were yesterday afternoon the closing of the doors and while official statement will not be made the bank examiners have completed their check, the condition the bank warrants this opinion. As stated yesterday, no occasion the run the which started on Monday. Idle rumors and remarks taken up and people grew hysterical. Bank examiners in Streator yesterday, and are working strenuously prepare statement which will be made public at earliest Outlook Very Bright Bank officials state there good prospect of the bank reopening, but nothing can be known regarding this until state bank officials their check. are most optimistic and determined the depositors shall not lose penny. Expressions confidence are heard on all sides today. There severe penalty those who circulate rumors such the that started the run on local bank. Following the law governing Stringent Penalty State laws provide stringent penalty convicted circulating malicious to the solvency any bank, trust company or building and loan association. heavy fine, jail term both may be inflicted upon convicted person. An excerpt from the crim. inal code of Illinois reads: Section enacted by the People of the State of Illinois, represented In the General Assembly: Any person who shall wilfully and maliciously make, circulate transmit to another others, any statements, rumor suggestion, written, printed by word mouth, which directly by inference derogatory to the financial condition, with intent affect the solvency or financial standing of any corporation doing banking trust business this state, or any building and doing business in this State, whe shall cause, aid, procure induce anothto start, transmit circulate any such statement, rumor suggestion, shall be punished fine not more than imprisonment in the county exceeding or both: Provided, that the truth said by the makthereof shall complete any this

OPENING will campaign renomination United States senate probably next Monday, according to announcement today. Two or three will be devoted the which scheduled to open in eastern part of the state.