Article Text

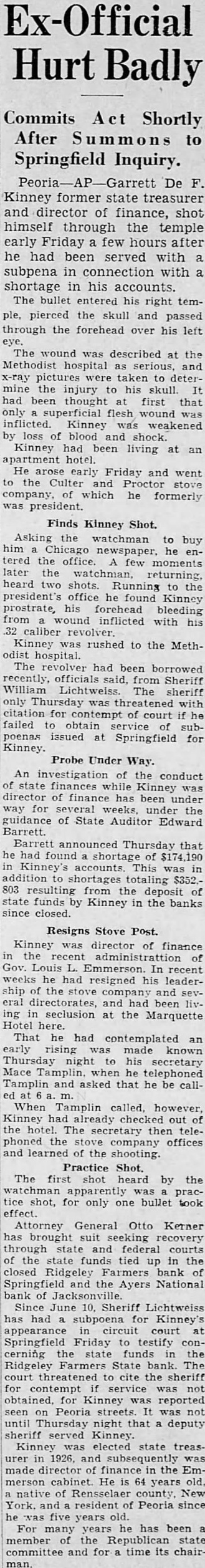

Ex-Official Commits Act Shortly After to Springfield Inquiry. De former state treasurer and director of finance, shot himself through the temple early Friday a few hours after he had been served with a subpena in connection with shortage in his accounts The bullet entered his right temple, pierced the skull and passed through the forehead over his left The wound was described at the Methodist hospital serious, and pictures were taken to determine the injury his skull. had been thought first that only superficial flesh wound inflicted. Kinney weakened by loss of blood and shock. Kinney had been living at an apartment hotel. He arose early Friday and went Culter stove which he formerly president. Finds Kinney Shot. Asking the watchman to buy him Chicago newspaper, he tered the office. few moments later the watchman, returning, heard shots. Running to the president's office he found Kinney prostrate, forehead bleeding from wound inflicted with his caliber revolver. Kinney rushed to the Methodist hospital. The revolver had been borrowed recently, officials said, from Sheriff William Lichtweiss. The sheriff only Thursday was with contempt of court he obtain subissued Springfield for Probe Under Way. investigation of the conduct state finances while Kinney of finance has been under way for several weeks, under the guidance of State Auditor Edward Barrett announced Thursday that had found shortage of $174,190 This addition shortages totaling $352.803 resulting from the deposit of state funds by Kinney in the banks closed. Resigns Stove Post. Kinney director of finance the recent Gov. Louis In recent weeks he resigned his leaderthe stove and company directorates, and had been in seclusion the Marquette here. That he had contemplated an early rising made known Thursday night to his secretary Mace Tamplin, when he telephoned Tamplin and asked that he be callWhen Tamplin called, however Kinney had already checked out of the hotel secretary then telephoned the company offices and learned the shooting. Practice Shot. The first shot heard by the shot, for only one bullet took effect. General Otto Ketner brought suit seeking recovery through state federal courts the state funds tied in the closed Ridgeley Farmers bank Springfield Ayers National Jacksonville Since June 10. Sheriff Lichtweiss had subpoena for Kinney's circuit court Springfield Friday testify concerning state funds the Ridgeley Farmers State bank. The threatened to cite the sheriff contempt service not obtained. for Kinney reported Peoria not Thursday night that deputy served Kinney. Kinney elected state treasurer 1926, and subsequently made director finance in the Emmerson cabinet. He years old. of Rensselaer county, New York. resident Peoria since five years For he has been the Republican state and for time its chair-