Click image to open full size in new tab

Article Text

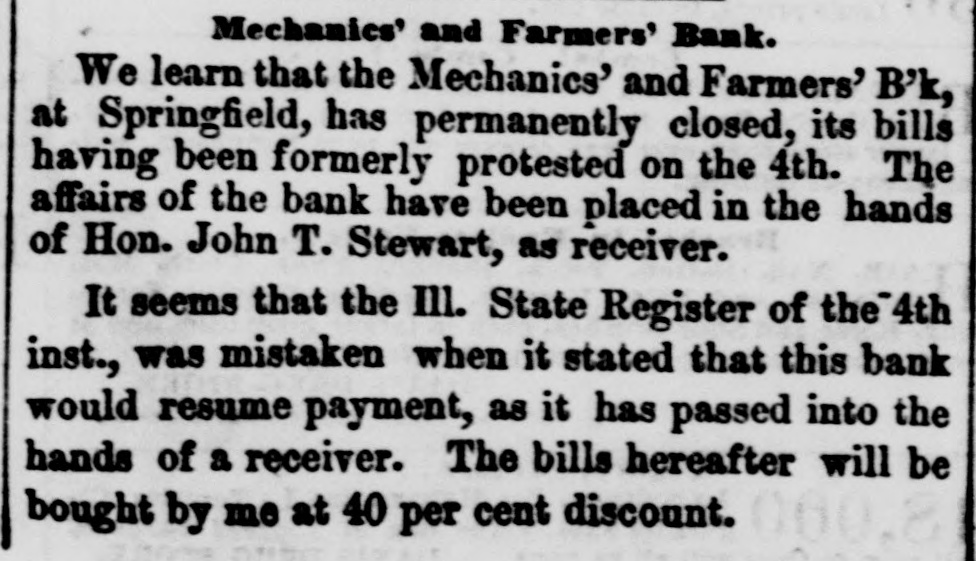

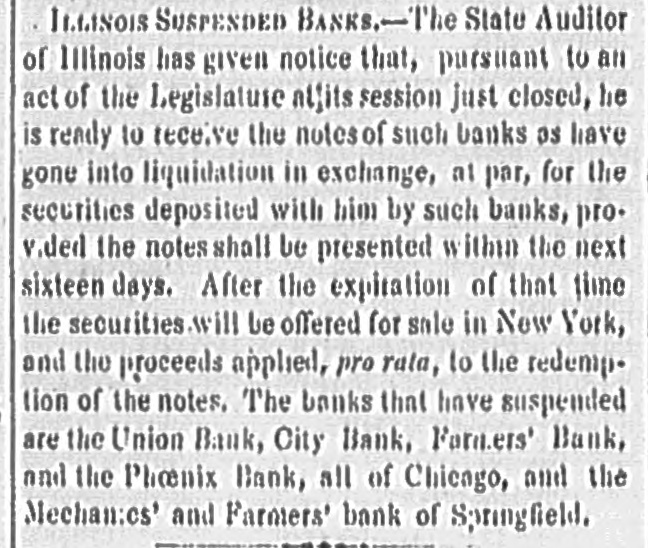

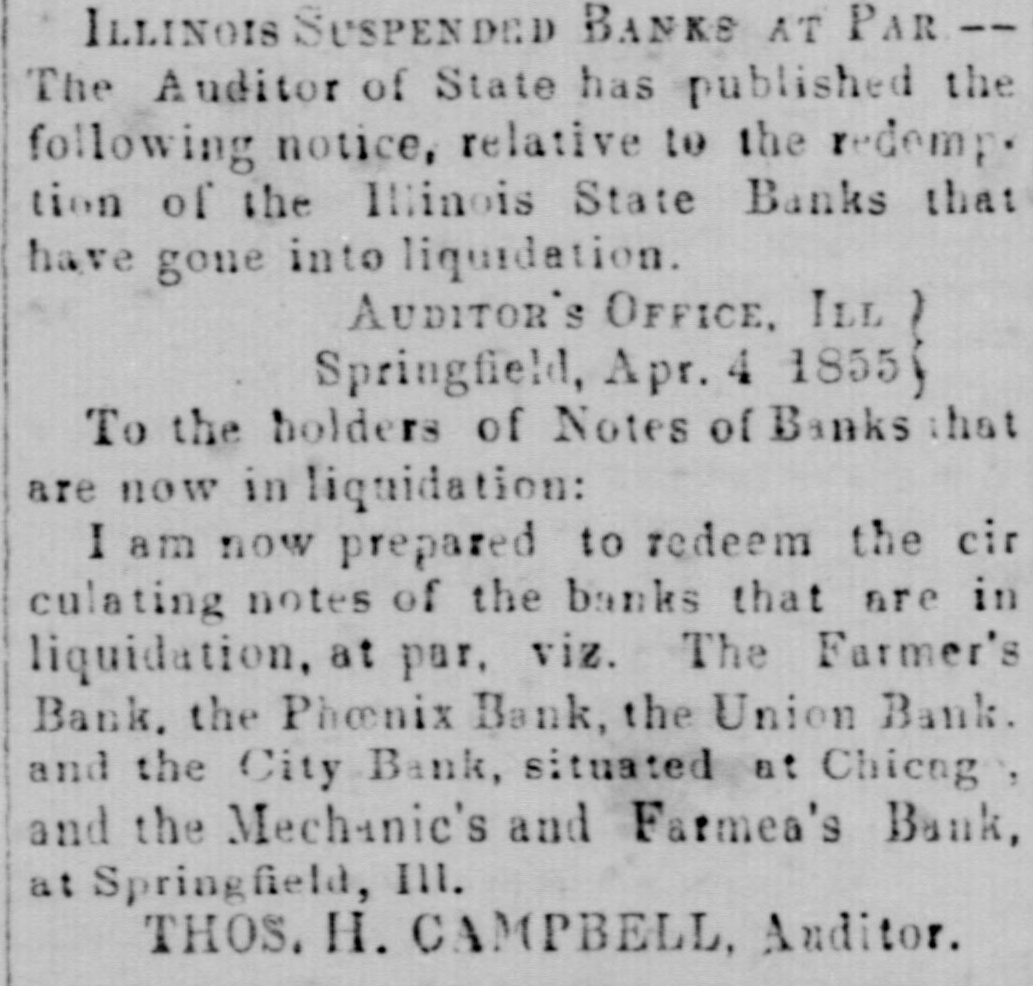

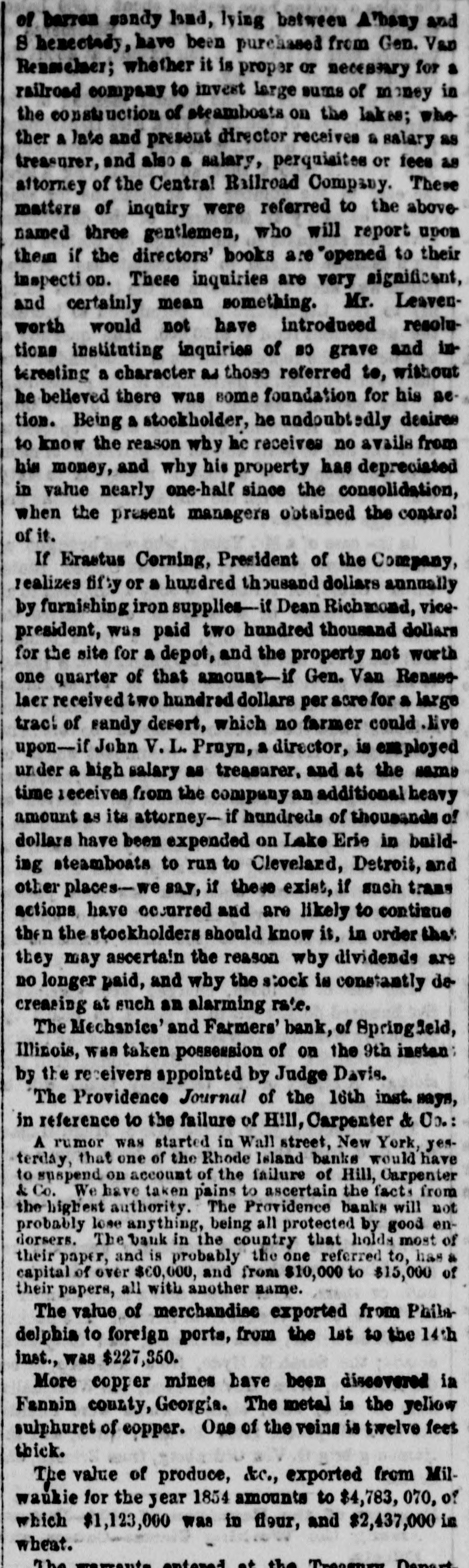

of barren sendy land, lying batween Albany and B henectady, have been purchased from Gen. Van Reaselmer; whether it is proper or necessary for a railroad company to invest large sums of ney in the construction of steamboats on the lakes; who ther a late and present director receives a salary as treasurer, and also a salary, perquisites or fees as attorney of the Central Railroad Company. These matters of inquiry were referred to the abovenamed three gentlemen, who will report upon them if the directors' books are "opened to their inspecti on. These inquiries are very significant, and certainly mean something. Mr. Leavenworth would not have introduced resolutions instituting inquiries of so grave and interesting a character as those referred to, without he believed there was some foundation for his aetion. Being a stockholder, he undoubtedly desires to know the reason why he receives no avails from his money, and why his property has depreciated in value nearly one-half since the consolidation, when the present managers obtained the control of it. If Erastus Corning, President of the Company, realizes fifty or a hundred thousand dollars annually by furnishing iron supplies-it Dean Richmond, vicepresident, was paid two hundred thousand dollars for the site for a depot, and the property not worth one quarter of that amount-if Gen. Van Reaseslaer received two hundred dollars per acre for a large trac! of sandy desert, which no farmer could .live upon-if John V.L. Prayn, a director, is employed under a high salary as treasurer, and at the same time receives from the company an additional heavy amount as its attorney-if hundreds of thousands of dollars have been expended on Lake Erie in building steamboats to run to Clevelard, Detroit, and other places-we say, if these exist, if such trans actions have occurred and are likely to continue then the stockholders should know it, in order that they may ascertain the reason why dividends are no longer paid, and why the stock is constantly decreasing at such an alarming rate. The Mechanics' and Farmers' bank, of Springlel Illinois, was taken possession of on the 9th instan: by the receivers appointed by Judge Davis. The Providence Journal of the 16th inst. says, in reference to the failure of Hill, Carpenter & Co.: A rumor was started in Wall street, New York, yesterday, that one of the Rhode Island banks would have to suspend on account of the failure of Hill, Carpenter & Co. We have taken pains to ascertain the facts from the highest authority. The Providence banks will not probably lose anything, being all protected by good endorsers. The bank in the country that holds most of their paper, and is probably the one referred to, has & capital of over $€0,000, and from $10,000 to $15,000 of their papers, all with another name. The value of merchandise exported from Philadelphia to foreign ports, from the 1st to the 14th inst., was $227,350. More copper mines have been discovered in Fannin county, Georgia. The metal is the yellow sulphuret of copper. One of the veins is twelve feet thick. The value of produce, &c., exported from Milwaukie for the year 1854 amounts to $4,783, 070, of which $1,123,000 was in flour, and $2,437,000 in wheat. The warrante entered at the Treasury Depart