Article Text

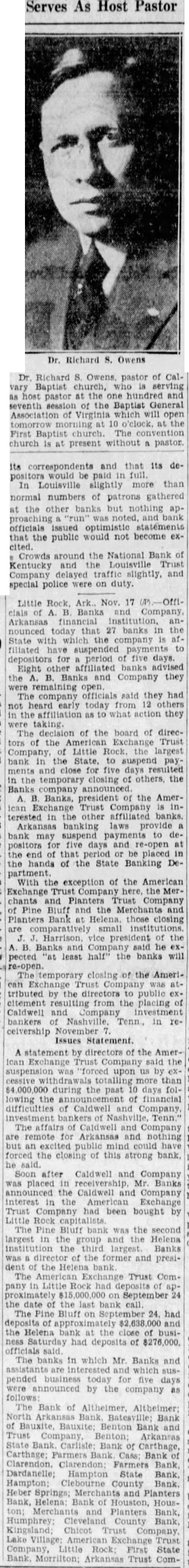

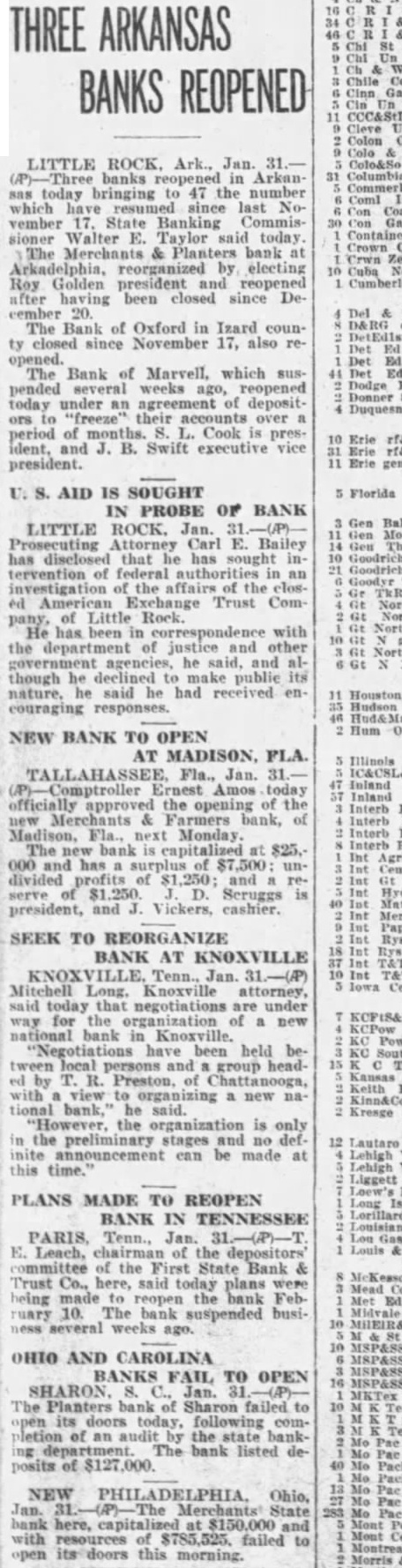

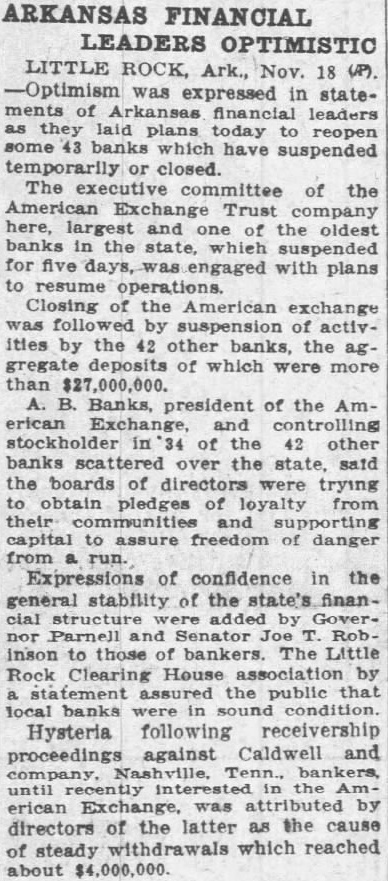

Serves As Host Pastor Richard pastor Baptist church, serving as host pastor at the one hundred and seventh session of the Baptist General Association which will First church present without pastor. its correspondents and that its dewould be In Louisville slightly than numbers of patrons at the other banks but nothing officials that the public would not become excited. Crowds around the National Bank Kentucky and the Louisville Company delayed traffic and special police were on duty. Little Rock, Nov. Banks Arkansas nounced banks in State the company filiated suspended for five days. Eight other affiliated banks advised the Banks and Company they remaining officials said they had heard early from as they taking. The decision of the board of directors of the Exchange Trust Company, Little Rock. the largest bank the to pay ments and five the temporary closing others, the Banks company Banks, president the AmerTrust Company terested the other affiliated banks Arkansas banking laws provide bank suspend to defor five days and re-open hands of the State Banking DeWith exception of the American Exchange Trust here the chants and Planters Trust Company Pine Bluff and the Merchants and Planters Bank Helena, those closing pected least half" the banks will temporary closing of the AmeriExchange Company was tributed by the public citement from the placing Caldwell and bankers in receivership Issues Statement. statement directors the American Exchange the suspension "forced upon by cessive than during the past days following the financial difficulties Caldwell and The Caldwell and Company for Arkansas and nothing the closing of this strong bank, Soon after Caldwell and Company was placed Mr. Banks announced the Caldwell and Company interest Exchange Trust Company been bought The Bluff was the second largest in the group and the Helena third Banks director the former and presithe Helena The Trust Comin Little Rock had September the the last bank call. The Bluff 24. had deposits the Helena the business Saturday had deposits $276,000. officials The banks in which Mr. Banks and which pended business today five by the company follows The Bank of Altheimer Bank Benton and Trust Arkansas Bank Farmers Farmers Dardanelle; Hampton State Hampton: County Heber Springs: and Planters Bank, Helena: Houston, HousMerchants Planters Bank, County Bank Chicot Trust Company Village: Exchange Trust Company, First State Arkansas Trust