Click image to open full size in new tab

Article Text

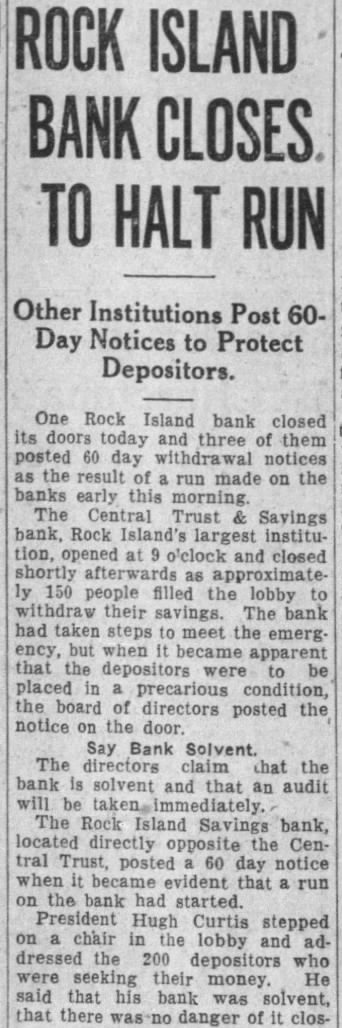

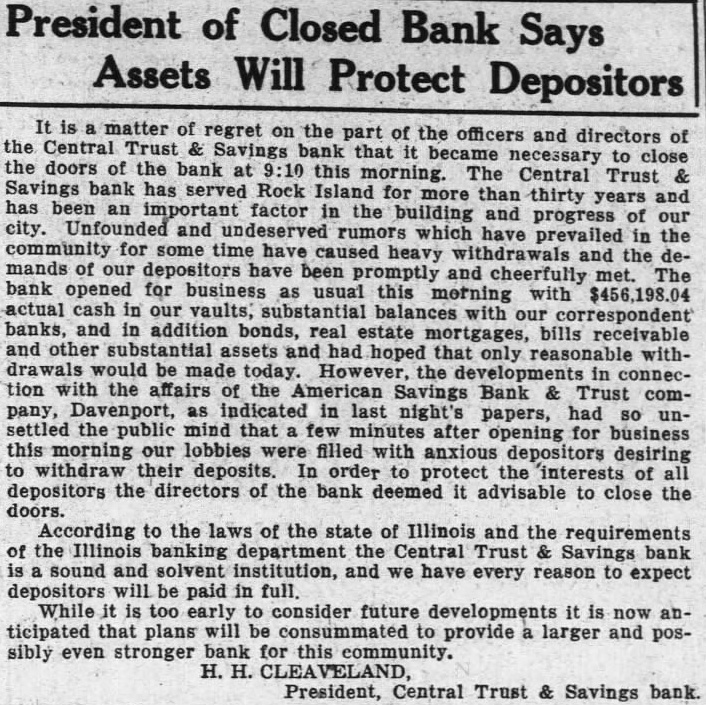

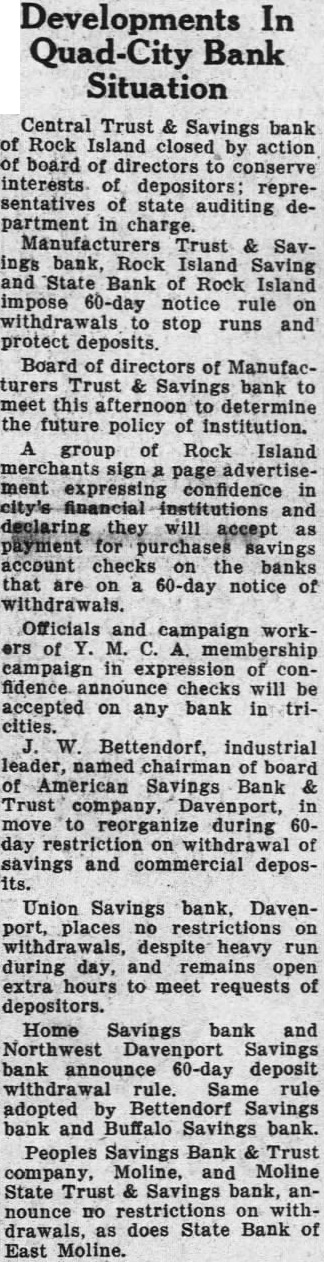

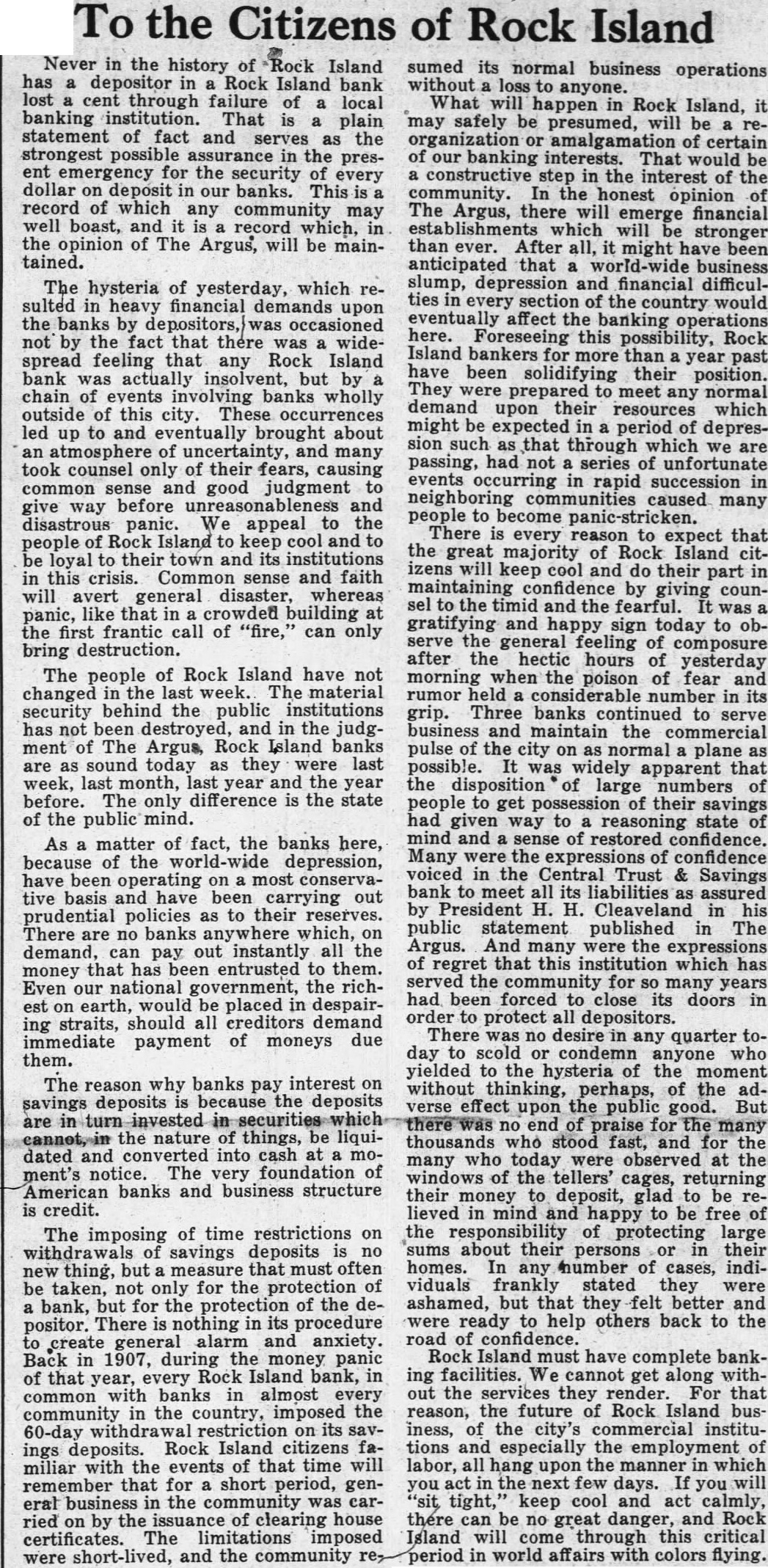

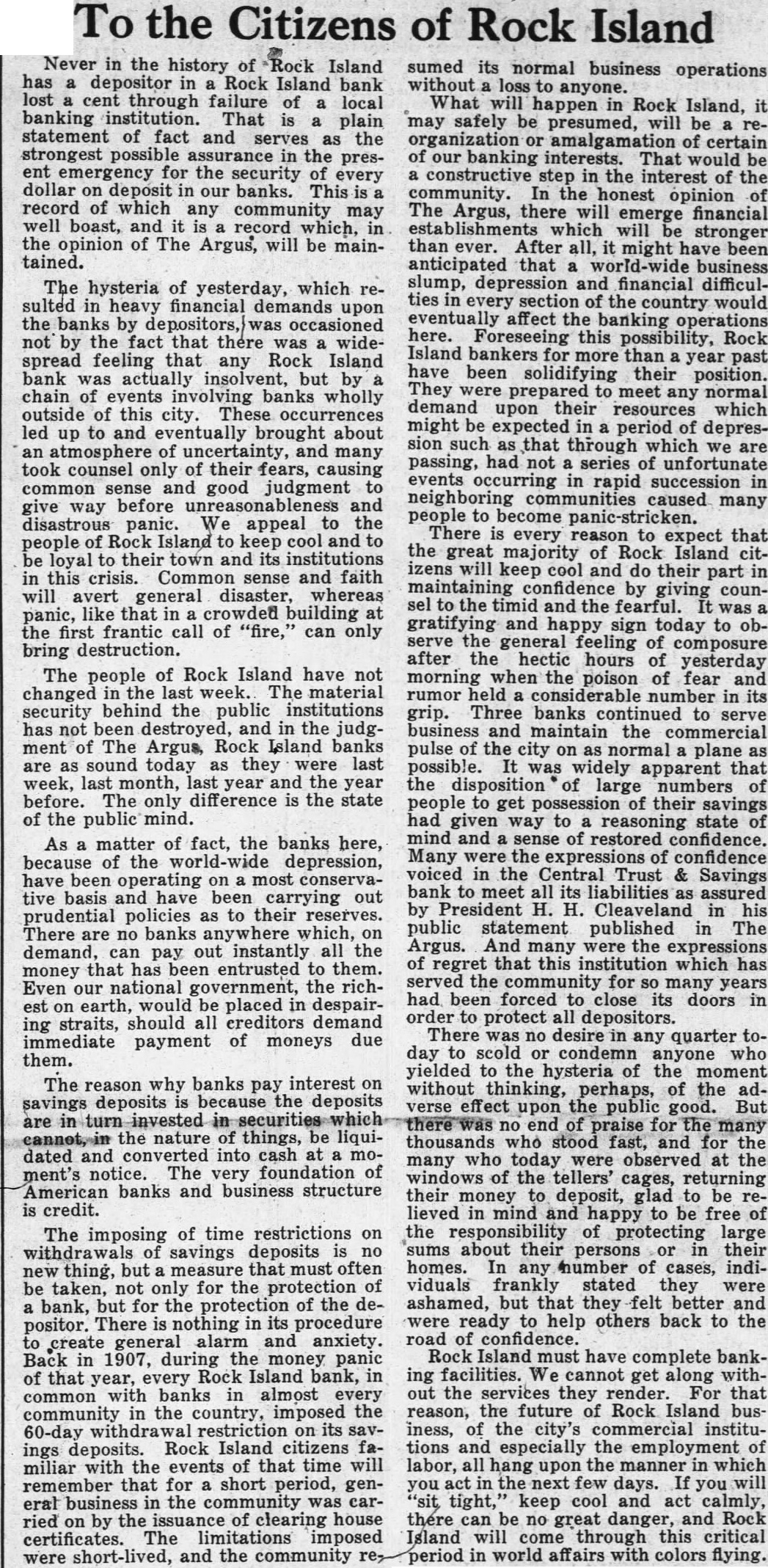

To the Citizens of Rock Island

Never in the history of Island has depositor in Rock Island bank lost cent through failure of local a banking institution. That is plain statement of fact and the serves as strongest assurance in the present emergency for the security of every dollar on deposit in our banks. This is record of which any community may well boast, and it is record which, in the opinion of The Argus, will be maintained.

The hysteria of yesterday, which sulted in heavy financial demands upon the banks by depositors, occasioned not by the fact that there was widespread feeling that Rock Island any bank was actually insolvent, but by chain of events involving banks wholly outside of this city. These occurrences led up to and eventually brought about an atmosphere of uncertainty, and many took counsel only of their fears, causing common sense and good judgment to give way before unreasonableness and disastrous panic. We appeal to the people of Rock Island to keep cool and to be loyal to their town and its institutions in this crisis. Common sense and faith will avert general disaster, whereas panic, like that in crowded building at the first frantic call of "fire," can only bring destruction. The people of Rock Island have not changed in the last week. The material security behind the public institutions has not been destroyed, and in the judgment of The Argus, Rock Island banks are sound today as they were last week, last month, last year and the year before. The only difference is the state of the public mind.

As a matter of fact, the banks here, because of the depression, have been operating on most conservative basis and have been carrying out prudential policies as to their reserves. There are no banks anywhere which, on demand, out instantly all the can pay money that has been entrusted to them. Even our national government, the richest earth, would be placed in despairon ing straits, should all creditors demand immediate of due payment moneys them.

The reason why banks pay interest on deposits is because the deposits savings are the nature of things, be liquidated and converted into cash at monotice. The foundation of ment's very American banks and business structure credit.

The imposing of time restrictions on of savings deposits is no new thing, but measure that must often be for the protection of taken, not only bank, but for the protection of the deThere is nothing in its procedure positor. general alarm and anxiety. create Back in 1907, during the money panic of that year, every Rock Island bank, in with banks in almost every common in the country, imposed the community restriction on its savRock Island citizens ings deposits. with the events of that time will miliar remember that for short period, general business in the community was carried by the issuance of clearing house on certificates. The limitations imposed and the community were sumed its normal business operations without loss to anyone. What will happen in Rock Island, it may safely be will presumed, be reorganization or amalgamation of certain of our banking interests. That would be constructive step in the interest of the community. In the honest opinion of The Argus, there will emerge financial which will be stronger than ever. After all, it might have been anticipated that world-wide business slump, depression and financial difficulties in every section of the country would eventually affect the banking operations here. Foreseeing this possibility, Rock Island bankers for more than year past have been their position. They were prepared to meet any normal demand upon their resources which might be expected in period of depression such as that through which we are passing, had not series of unfortunate events occurring in rapid succession in neighboring communities caused many people to become There is every reason to expect that the great majority of Rock Island citizens will keep cool and do their part in maintaining confidence by giving counto the timid and the fearful. a and happy sign today to observe the general feeling of composure after the hectic hours of yesterday morning when the poison of fear and rumor held considerable number in its grip. Three banks continued to serve business and maintain the commercial pulse of the city on as normal plane as possible. It was widely apparent that the disposition of large numbers of people to get possession of their savings had given way to reasoning state of mind and a sense of restored confidence. Many were the expressions of confidence voiced in the Central Trust & Savings bank to meet all its liabilities assured as by H. H. Cleaveland in his public statement published in The Argus. And many were expressions of regret that this institution which has served the community for so many years had been forced to close its doors in order to protect all depositors. There was no desire in any quarter today to scold or condemn anyone who yielded to the hysteria of the moment without thinking, perhaps, of the adverse effect upon the public good. But no end of praise for thousands who stood fast, and for the many who today were observed at the windows of the tellers' cages, returning their money to deposit, glad to be relieved in mind happy to be free of the responsibility of protecting large sums about their persons in their homes. In any number of cases, individuals frankly stated they were ashamed, but that they felt better and were ready to help others back to the road of confidence. Rock Island must have complete banking facilities. We cannot get along without the services they render. For that reason, the future of Rock Island business, of the city's institutions and especially the of labor, all hang upon the manner in which act in the next few days. If will you you tight," keep cool and act calmly, there can be no great danger, and Rock Island will come through this critical in world affairs with colors flying.