Click image to open full size in new tab

Article Text

COIN IS STACKED OF CUSTOMERS

Douglass National Bank Weathers Storm which Closed 24 Others.

400 IN LINE

Savings Clause is Invoked.

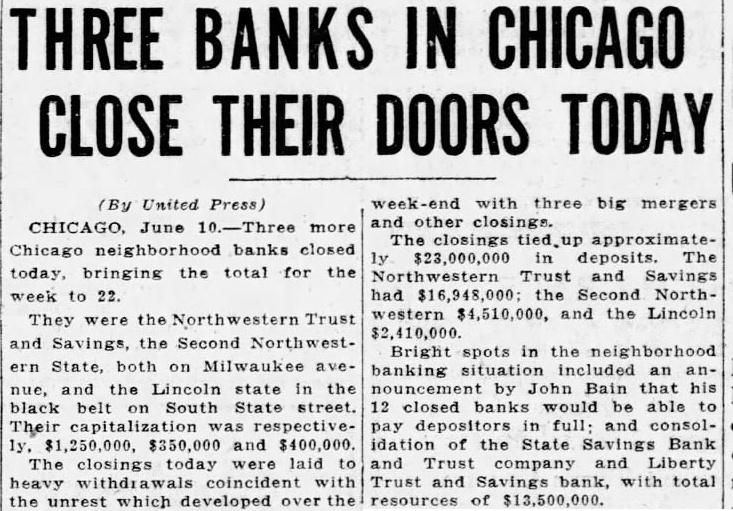

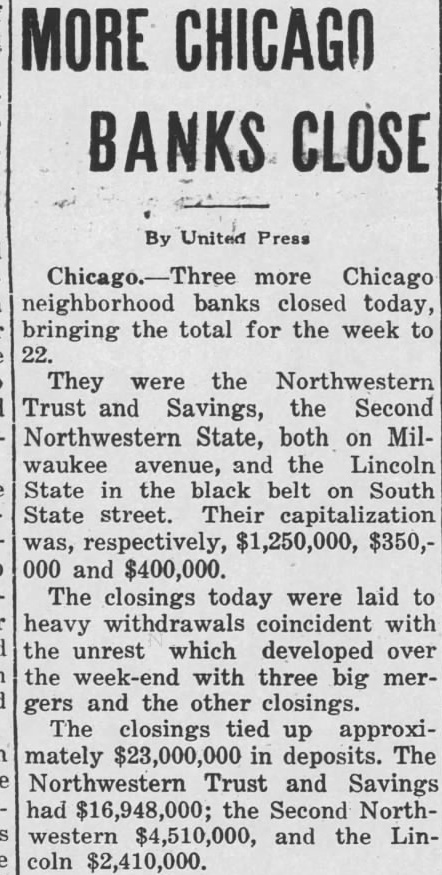

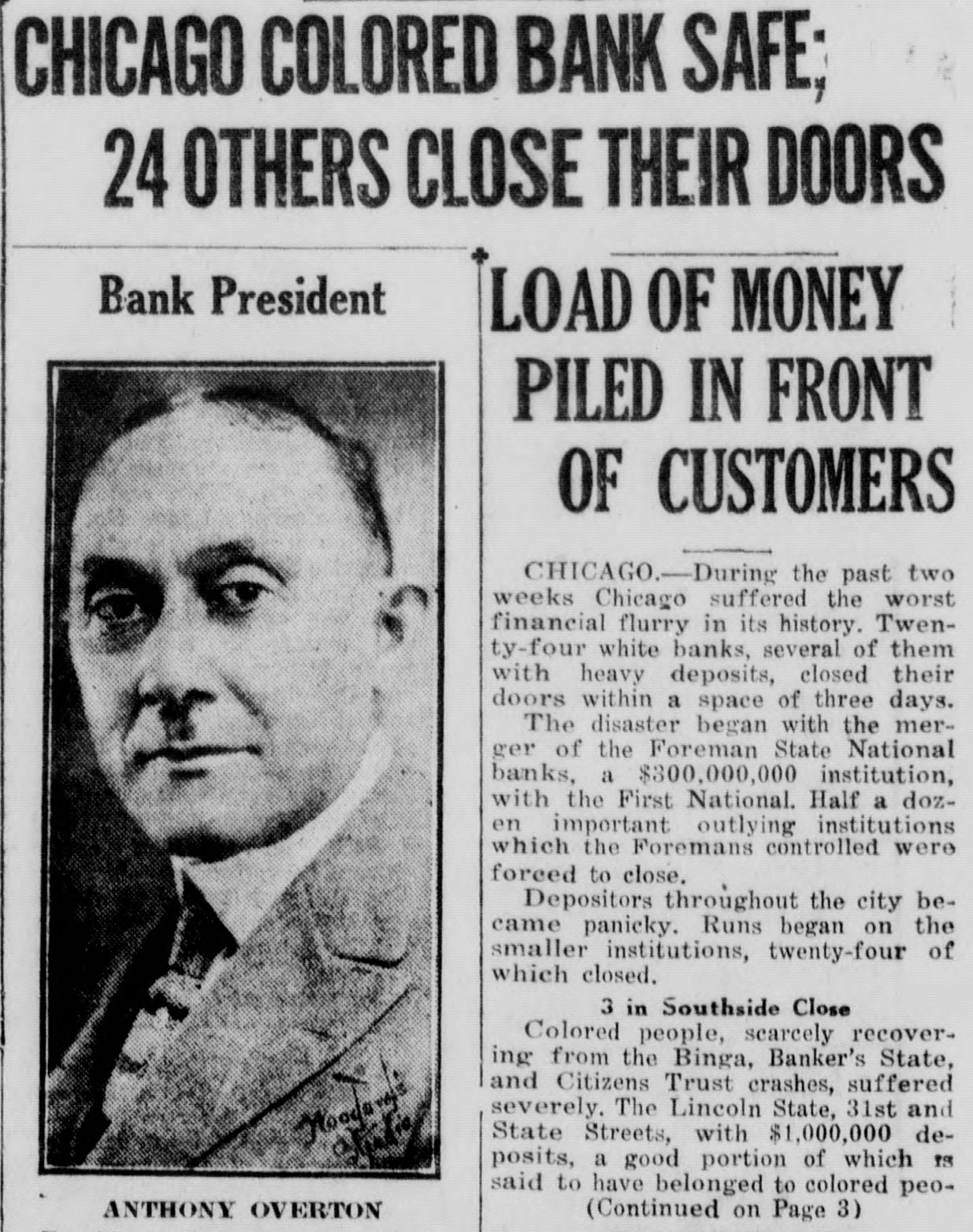

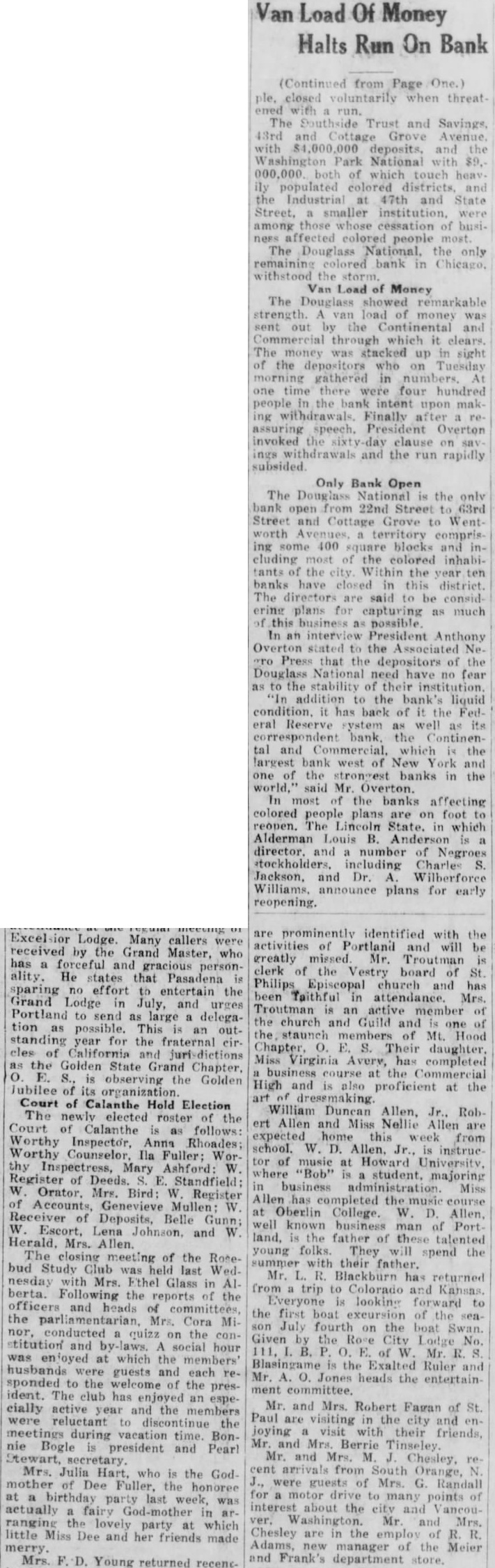

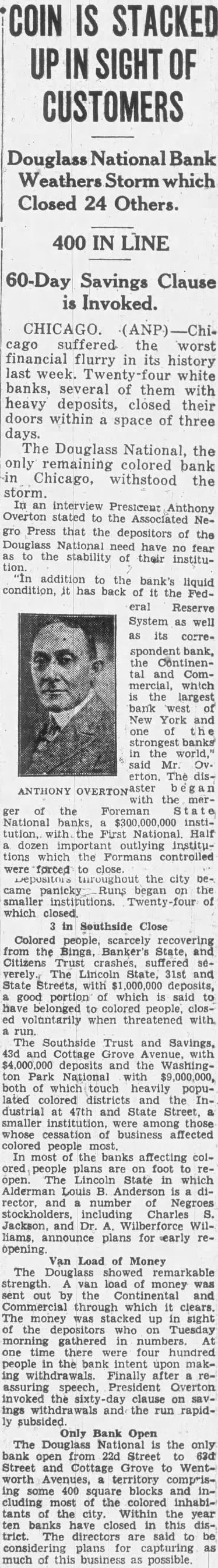

CHICAGO. cago suffered the worst financial flurry in its history last week. white banks, several of them with heavy deposits, closed their doors within a space of three days. The Douglass National, the only remaining colored bank in Chicago, withstood the storm. interview President Anthony Overton stated to the Associated Negro Press that the depositors of the Douglass National need have no fear to the stability of their instituaddition to the bank's liquid condition, it has back of it the Federal Reserve System well as its correspondent the Continental and Commercial, which the largest bank west New York and the strongest banks the world,' said erton. The disthe merof the Foreman National banks, $300,000,000 institution, First Half dozen important outlying institutions which the controlled were forced close the city became panicky Runs began the smaller institutions. of which closed in Southside Close

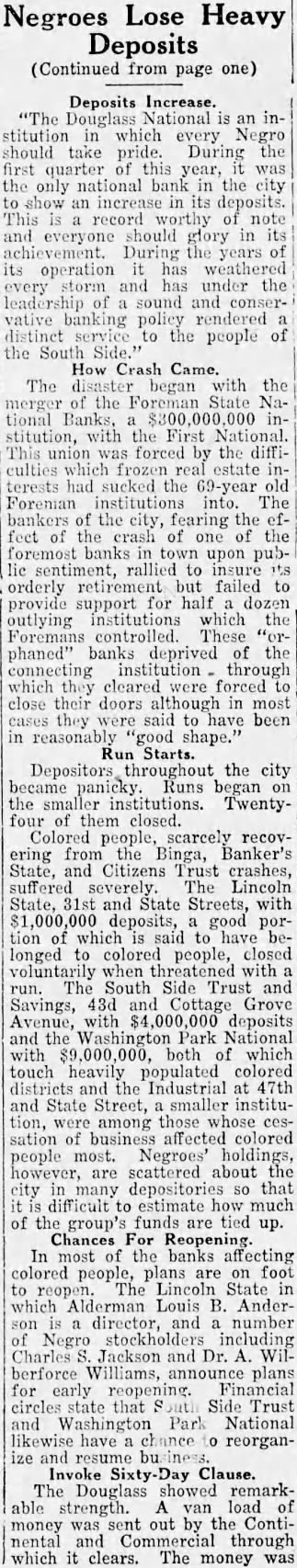

Colored people, scarcely recovering from the Binga, Banker's State, Citizens Trust crashes, suffered verely The Lincoln State, 31st and State Streets. with deposits, good portion which said to belonged colored people, closed voluntarily when threatened with run. The Southside Trust and Savings, 43d and Cottage Grove Avenue, with $4,000,000 deposits and the Washington Park National with $9,000,000, both of which heavily populated districts and the dustrial 47th and State Street, smaller institution. were whose cessation of business affected colored people In most the banks affecting colored people plans foot open. Lincoln State in which Alderman Louis B. Anderson rector, and number Negroes stockholders, including Charles Jackson, and Dr. Williams, announce plans for early reopening

Van Load of Money The Douglass showed remarkable strength. van load of money sent by the Continental and Commercial through which it clears. The money stacked up in sight the depositors on Tuesday gathered in numbers. At one time there four hundred people in the bank intent upon making withdrawals. Finally after assuring speech, President Overton invoked the clause on savings and the run rapidly subsided. Only Bank Open The Douglass National the only bank open from 22d Street 63d Street and Cottage Grove to Wentworth Avenues, territory comprising some 400 square blocks and including most the colored inhabitants of the city Within the year ten banks have closed this trict. The directors are said to be considering plans capturing as much of this business as possible.