Article Text

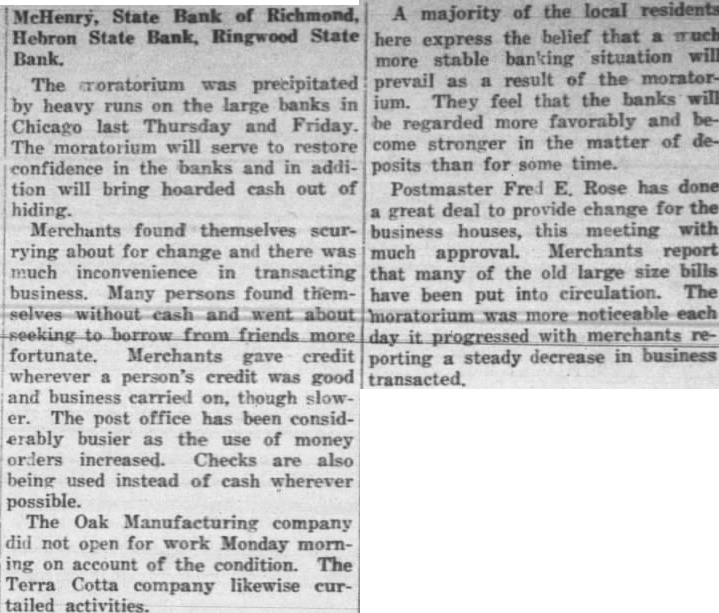

McHenry, State Bank of Richmond, Hebron State Bank, Ringwood State Bank. The moratorium was precipitated by heavy runs on the large banks Chicago last Thursday and Friday. The moratorium will serve to restore confidence in the banks and in addition will bring hoarded cash out of hiding. Merchants found themselves scurabout for change and there was much inconvenience in transacting business. Many persons found themfriends fortunate. Merchants gave credit wherever person's credit was good and business carried on, though slowThe post office has been considerably busier as the use of money orders increased. Checks are also being used instead of cash wherever possible. The Oak Manufacturing company did not open for work Monday morning account of the condition. The Terra Cotta company likewise curtailed activities. majority of the local residents here express the belief that much more stable banking situation prevail as result of the moratorium. They feel that the banks will regarded more favorably and become in the matter of deposits than for some time. Postmaster Fred Rose has done great deal provide change for the business houses, this meeting with much approval. Merchants report that many of the old large size bills have been put into circulation. The noticeable each day progressed with merchants porting steady decrease in business transacted.