Article Text

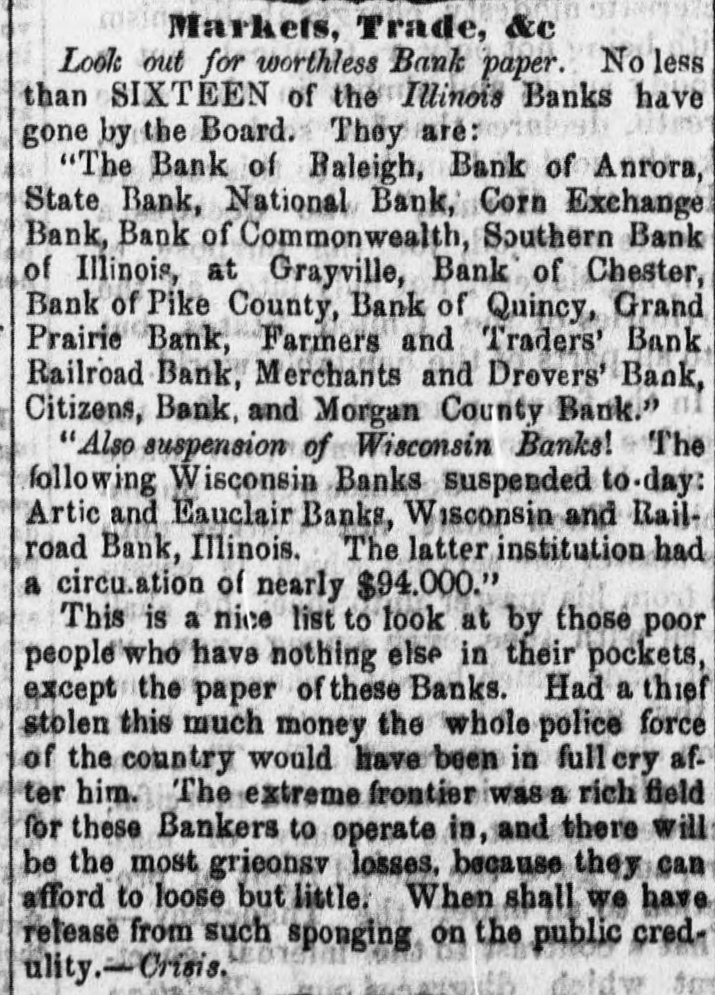

Markets, Trade, &c Look out for worthless Bank paper. No less than SIXTEEN of the Illinois Banks have gone by the Board. They are: "The Bank of Baleigh, Bank of Anrora, State Bank, National Bank, Corn Exchange Bank, Bank of Commonwealth, Southern Bank of Illinois, at Grayville, Bank` of Chester, Bank of Pike County, Bank of Quincy, Grand Prairie Bank, Farmers and Traders' Bank Railroad Bank, Merchants and Drovers' Bank, Citizens, Bank, and Morgan County Bank." "Also suspension of Wisconsin Banks! The following Wisconsin Banks suspended to. day: Artic and Eauclair Banks, Wisconsin and Rail road Bank, Illinois. The latter institution had a circu.ation of nearly $94.000." This is a nice list to look at by those poor people who have nothing else in their pockets, except the paper of these Banks. Had a thief stolen this much money the whole police force of the country would have been in full cry after him. The extreme frontier was a rich field for these Bankers to operate in, and there will be the most grieonsv losses, because they can afford to loose but little. When shall we have release from such sponging on the public credulity. / Crisis.