Article Text

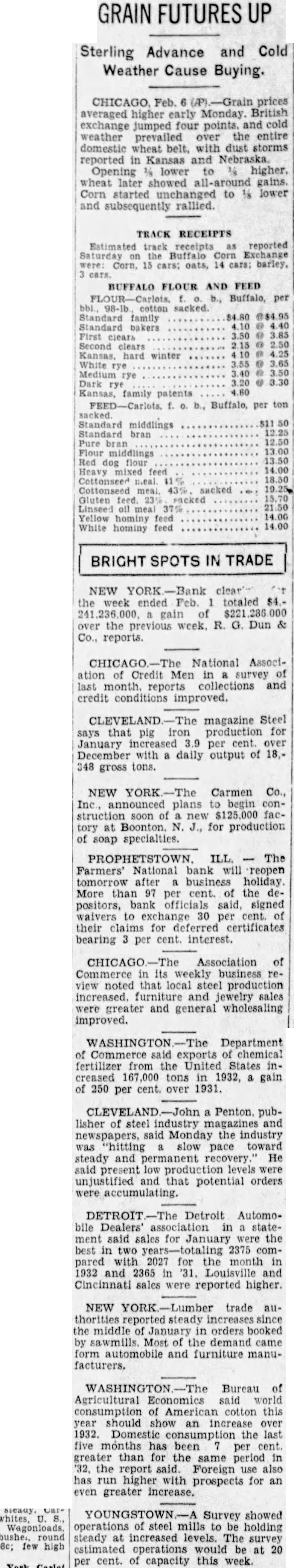

GRAIN FUTURES UP Sterling Advance and Cold Weather Cause Buying. averaged higher early Monday. British exchange jumped four points. and cold weather prevailed over the entire domestic wheat belt, with dust storms reported in Kansas and Nebraska. Opening % lower wheat later showed gains. started unchanged to lower and subsequently rallied. RECEIPTS Estimated receipts reported the Corn Exchange 15 BRIGHT SPOTS IN TRADE NEW YORK the totaled $4.$221 over the week. R. G. Dun & Co., reports. CHICAGO.-The National Association Credit survey last month reports and credit conditions improved. CLEVELAND magazine Steel production for pig January 3.9 per cent. over December with daily output of 18,348 gross tons. NEW YORK-The Carmen Co., begin construction soon of new $125,000 facBoonton. N. J., for production of soap specialties. PROPHETSTOWN. ILL. The Farmers' National bank will reopen tomorrow after business holiday More than 97 per cent. of the positors, bank officials said, signed waivers to exchange 30 per their claims for certificates bearing 3 per cent. interest. CHICAGO-The Association of Commerce its weekly business review noted that local production increased. furniture and jewelry were and general wholesaling improved. WASHINGTON Department of Commerce said chemical fertilizer from the United States increased tons in 1932, a gain of 250 per cent. over 1931. CLEVELAND Penton. publisher of steel magazines newspapers, said the industry was "hitting slow pace toward steady and He said low production unjustified and that potential orders were Detroit Automobile in statement said for were the best in two 2375 comfor in 1932 and 2365 in '31. and Cincinnati sales were reported higher. NEW YORK-Lumber trade authorities the middle January in orders booked by sawmills the demand form and furniture manufacturers. WASHINGTON Bureau of Agricultural Economics consumption of American cotton this should an increase over 1932. Domestic consumption the last five has been per cent. greater than for the same period in 32, the report Foreign also has run higher with prospects for an even YOUNGSTOWN Survey showed operations steel mills to holding steady at increased levels. The survey estimated operations would be at 20 per cent. of capacity this week BUFFALO FLOUR AND FEED per sacked. Standard Standard bakers winter 3.30 patents per ton Standard middlings Standard middlings Red Cottonseed sacked Yellow hominy feed White 14.00