Article Text

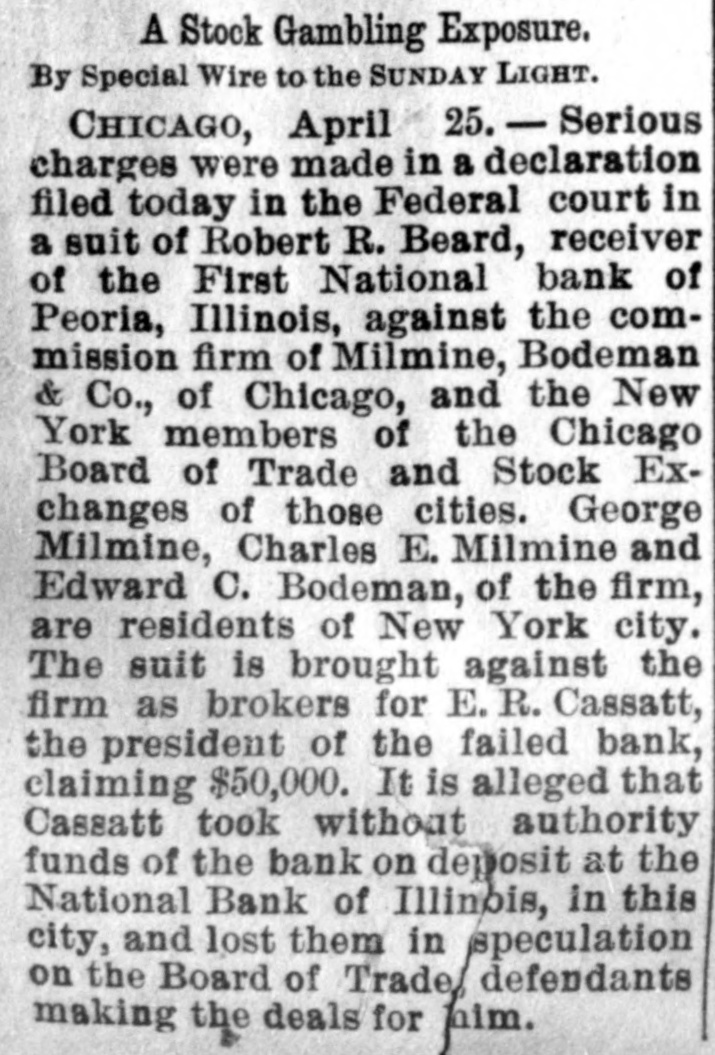

A Stock Gambling Exposure. By Special Wire to the SUNDAY LIGHT. CHICAGO, April 25. - Serious charges were made in a declaration filed today in the Federal court in a suit of Robert R. Beard, receiver of the First National bank of Peoria, Illinois, against the commission firm of Milmine, Bodeman & Co., of Chicago, and the New York members of the Chicago Board of Trade and Stock Exchanges of those cities. George Milmine, Charles E. Milmine and Edward C. Bodeman, of the firm, are residents of New York city. The suit is brought against the firm as brokers for E. R. Cassatt, the president of the failed bank, claiming $50,000. It is alleged that Cassatt took without authority funds of the bank on deposit at the National Bank of Illinois, in this city, and lost them in speculation on the Board of Trade/ defendants making the deals for him.