Click image to open full size in new tab

Article Text

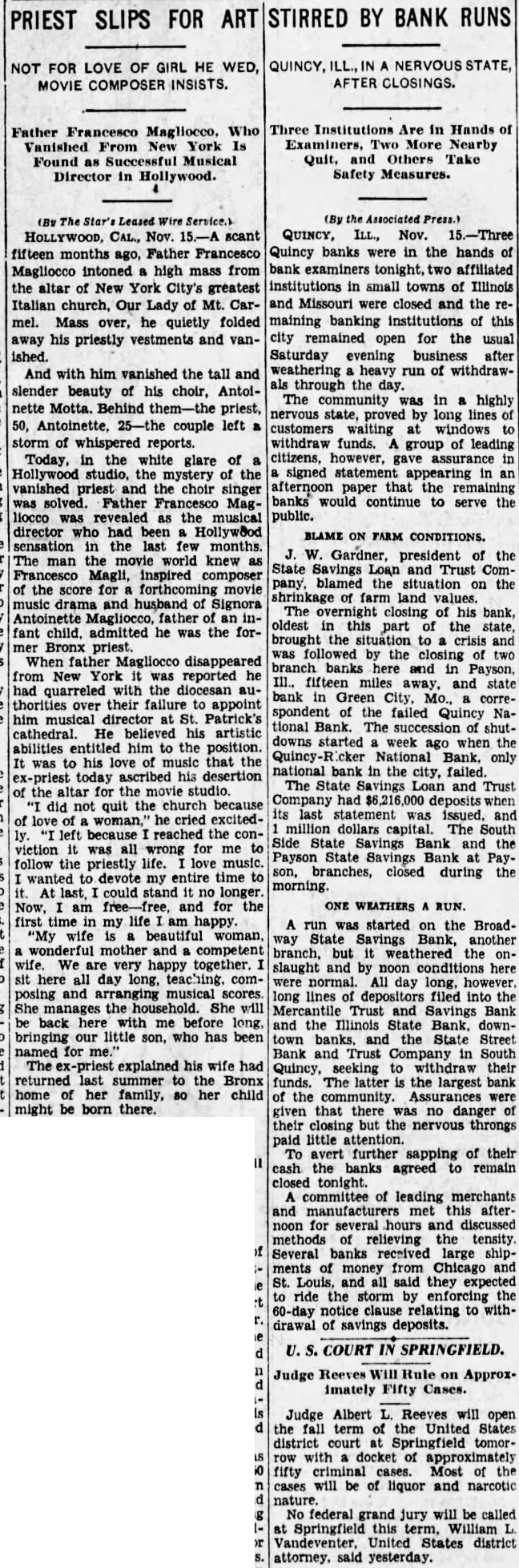

PRIEST SLIPS FOR ART STIRRED BY BANK RUNS

NOT FOR LOVE OF GIRL HE WED, MOVIE COMPOSER INSISTS.

Father Francesco Magliocco, Who Vanished From New York Is Found as Successful Musical Director in Hollywood.

(B# The Star's Leased Wire Service.) HOLLYWOOD, CAL., Nov. 15.-A scant fifteen months ago, Father Francesco Magliocco intoned a high mass from the altar of New York City's greatest Italian church, Our Lady of Mt. Carmel. Mass over, he quietly folded away his priestly vestments and vanished.

And with him vanished the tall and slender beauty of his choir, Antoinette Motta. Behind them-the priest, 50, Antoinette, 25-the couple left a storm of whispered reports. Today, in the white glare of Hollywood studio, the mystery of the vanished priest and the choir singer was solved. Father Francesco Magliocco was revealed as the musical director who had been Hollywood sensation in the last few months. The man the movie world knew as Francesco Magli, inspired composer of the score for forthcoming movie music drama and husband of Signora Antoinette Magliocco, father of an infant child. admitted he was the for- mer Bronx priest.

When father Magliocco disappeared from New York was reported he had quarreled with the diocesan authorities over their failure to appoint him musical director at St. Patrick's cathedral. He believed his artistic abilities entitled him to the position. It was to his love of music that the priest today ascribed his desertion of the altar for the movie studio. "I did not quit the church because of love of woman," he cried excitedly. left because reached the conviction it was all wrong for me to follow the priestly life. love music. wanted to devote my entire time to it. At last, could stand it no longer. Now, am free-free, and for the first time in my life am happy. "My wife is beautiful woman, wonderful mother and competent wife. We are very happy together. sit here all day long teaching. composing and arranging musical scores She manages the household. She will be back here with me before long, bringing our little son, who has been named for me. The ex-priest explained his wife had returned last summer to the Bronx home of her family, so her child might be born there.

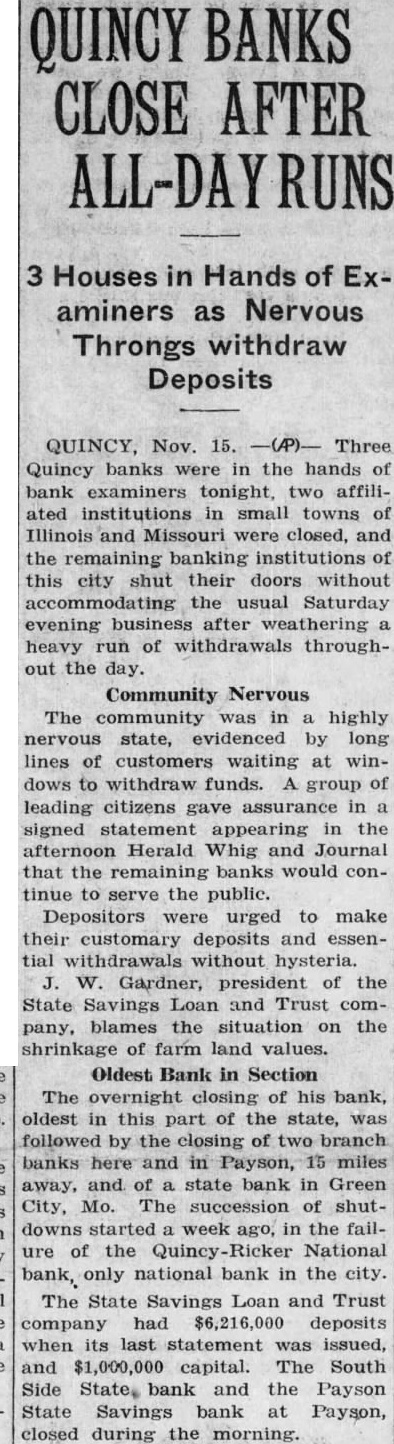

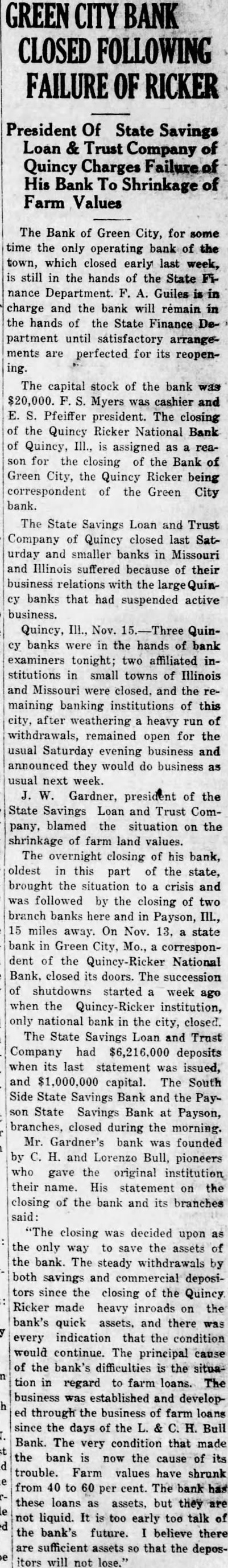

(By the Associated Press.) QUINCY, ILL., Nov. 15.-Three Quincy banks were in the hands of bank examiners tonight, two affiliated institutions in small towns of Illinois and Missouri were closed and the remaining banking institutions of this city remained open for the usual Saturday evening business after weathering heavy run of withdrawals through the day. The community was in a highly nervous state, proved by long lines of customers waiting at windows to withdraw funds. A group of leading citizens, however, gave assurance in signed statement appearing in an afternoon paper that the remaining banks would continue to serve the public.

BLAME ON FARM CONDITIONS. J. W. Gardner, president of the State Savings Loan and Trust Company, blamed the situation on the shrinkage farm land values. The overnight closing of his bank, oldest in this part of the state, brought the situation to crisis and was followed by the closing of two branch banks here and in Payson, III., fifteen miles away. and state bank in Green City, Mo., correspondent of the failed Quincy National Bank. The succession of shutdowns started week ago when the Quincy-R National Bank. only national bank in the city, failed. The State Savings Loan and Trust Company had $6,216,000 deposits when its last statement was issued, and million dollars capital. The South Side State Savings Bank and the Payson State Savings Bank at Payson, branches, closed during the morning.

ONE WEATHERS RUN.

Three Institutions Are in Hands of Examiners, Two More Nearby Quit, and Others Take Safety Measures.

A run was started on the Broadway State Savings Bank, another branch, but it weathered the onslaught and by noon conditions here were normal. All day long, however. long lines of depositors filed into the Mercantile Trust and Savings Bank and the Illinois State Bank, downtown banks. and the State Street Bank and Trust Company in South Quincy, seeking to withdraw their funds. The latter is the largest bank of the community Assurances were given that there was no danger of their closing but the nervous throngs paid little attention. To avert further sapping of their cash the banks agreed to remain closed A committee of leading merchants and manufacturers met this afternoon for several hours and discussed methods of relieving the tensity Several banks received large shipments of money from Chicago and St. Louis, and all said they expected to ride the storm by the 60-day notice clause relating to withdrawal of savings deposits. U. S. COURT IN SPRINGFIELD. Judge Reeves Will Rule on Approximately Fifty Cases.

Judge Albert L. Reeves will open the fall term of the United States district court at Springfield tomorrow with docket of approximately fifty criminal cases. Most of the cases will be of liquor and narcotic nature. No federal grand jury will be called at Springfield this term, William L. Vandeventer, United States district attorney. said yesterday.

QUINCY, ILL.,IN A NERVOUS STATE, AFTER CLOSINGS.