Click image to open full size in new tab

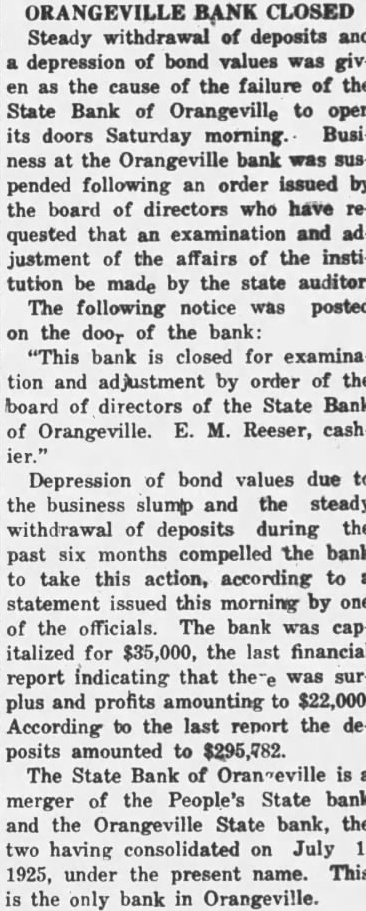

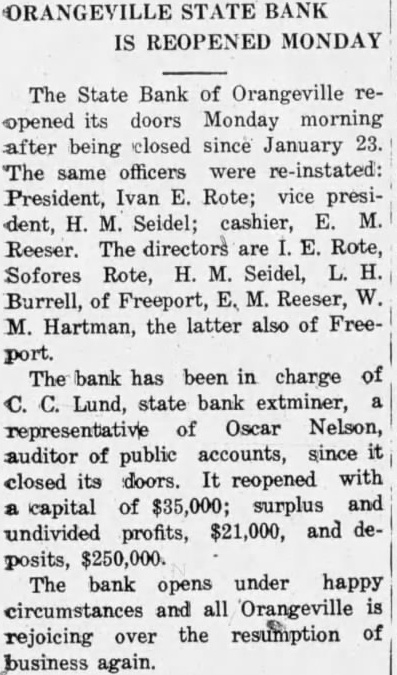

Article Text

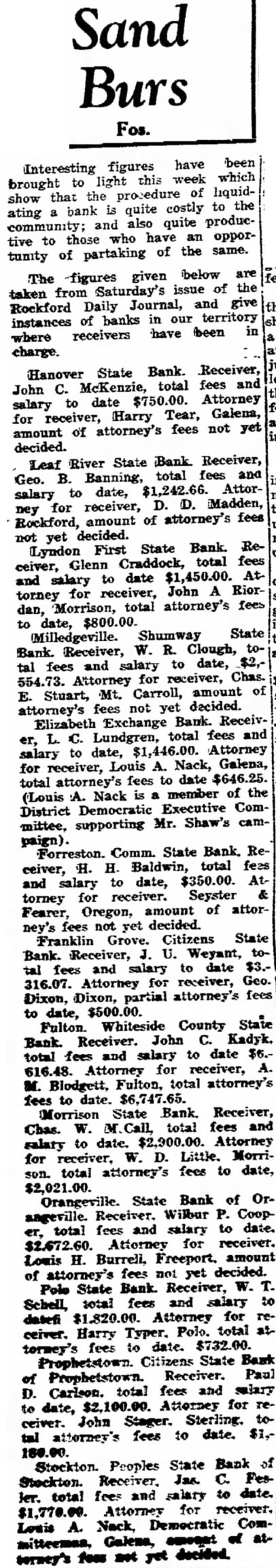

Sand Burs Fos. have been Interesting figures week which light this brought to of liquidthat the procedure show to the is quite costly bank ating community; and also quite producwho have an opportive to those tunity of partaking of the same.

The figures given below are taken from Saturday's issue of the Rockford Daily Journal, and give in our territory instances of banks been in receivers have where charge.

State Bank. Receiver, Hanover John C. McKenzie, total fees and $750.00. Attorney to date salary Tear, Galena, receiver, Harry for fees not yet amount of attorney's decided. Leaf River State Bank Receiver, Geo. B. Banning, total fees and Attorsalary to date, D. D. Madden, for receiver, ney Rockford, amount of attorney's fees not decided. yet Lyndon First State Bank. Receiver, Glenn Craddock, total fees and salary to date $1,450.00. AtJohn A Riorfor receiver, torney dan, Morrison, total attorney's fees date, $800.00. to State Milledgeville. Shumway Bank. Receiver, W. R. Clough, total fees and salary to date, $2,554.73. Attorney for receiver, Chas. E. Stuart, Mt. Carroll, amount of attorney's fees not yet decided. Elizabeth Exchange Bank. Receiver, L. C. Lundgren, total fees and to date, $1,446.00. Attorney salary for receiver, Louis A. Nack, Galena, total attorney's fees to date $646.25. (Louis A. Nack member of the District Democratic Executive Committee, supporting Mr. Shaw's campaign). Forreston. Comm. State Bank. Receiver, H. H. Baldwin, total fees and salary to date, $350.00. Attorney for receiver. Seyster Fearer, Oregon, amount of afterney's fees not yet decided. Franklin Grove. Citizens State Bank. Receiver, U. Weyant, total fees and salary to date $3.316.07. Attorney for receiver, Geo. Dixon, Dixon, partial attorney's fees to date, $500.00. Fulton. Whiteside County State Bank. Receiver. John C. Kadyk. total fees and salary to date $6.616.48. Attorney for receiver, A. M. Blodgett, Fulton, total attorney's fees to date. $6,747.65. Morrison State Bank. Receiver, W. total fees and Chas. salary to date. $2,300.00. Attorney for receiver, W. D. Little. Morrison. total attorney's fees to date, Orangeville. State Bank of Orangeville. Receiver. Wilbur P. Cooper, total fees and salary to date. $2,672.60. Attorney for receiver. Louis H. Burreli, Freeport. amount of attorney's fees not yet decided. Polo State Bank. Receiver, W. T. total fees and salary to Schell, datefi $1,820.00. Attorney for receiver. Harry Typer. Polo. total attorney's fees to date. $732.00. Prophetstown. Citizens State Bank of Prophetstown. Receiver. Paul total fees and D. Carlson. to date, $2,100.00. for receiver. John Stager. Sterling. total attorney's fees to date. $1,180.00. Stockton. Peoples State Bank of Stockton. Receiver. Jas. C. Fesler. total fees and salary to date. for receiver. Attorney Democratic ComLouis A. Nack, of Galena,