Article Text

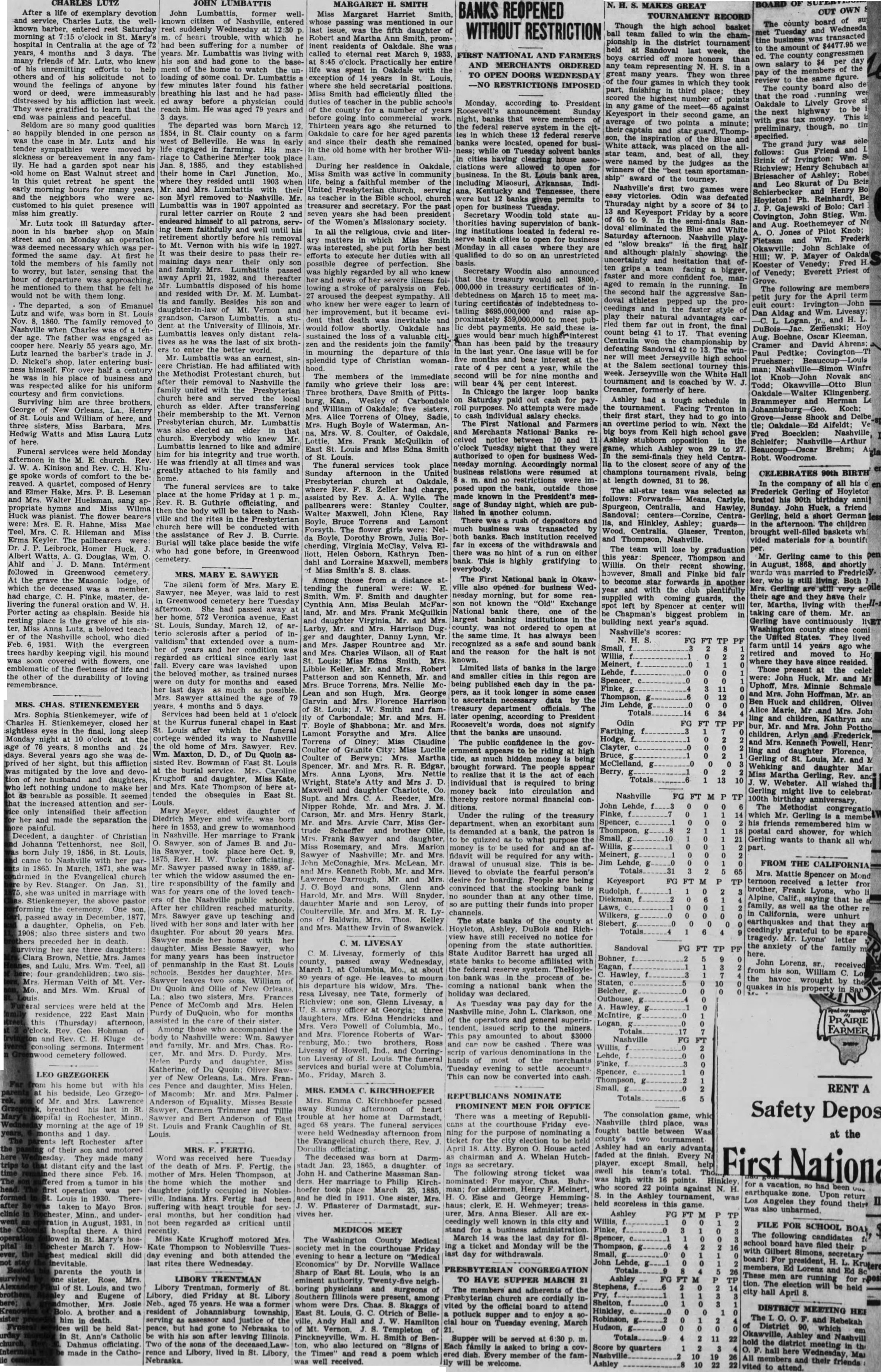

CHARLES LUTZ After life exemplary devotion Lutz, the wellknown entered rest Saturday morning at 7:15 o'clock in St. Mary's hospital Centralia at the age years, months and days. The many friends who knew his unremitting efforts to help others and of his solicitude not wound the feelings of by anyone word deed, were immeasurably distressed by his affliction last week. They were gratified to learn that the painless and peaceful. Seldom good qualities happily one person in Mr. Lutz and his tender by sickness in any ily. He had garden his street and this quiet retreat he spent the early for the neighbors who customed his quiet presence him greatly. Mr. Lutz took Saturday afterin barber Main street and on Monday operation which was performed the same first told the members his family not worry, but later, sensing that the hour approaching, mentioned them that he felt would with them long. The son of Emanuel Lutz and born in St. Louis Nov. 1860. family removed Nashville when Charles was tender The father was engaged cooper here. Nearly 55 years ago, Mr. learned the barber's trade Nickel's later entering busihimself. For over half century he was in his place of was alike for his uniform and firm three brothers, George New Orleans, Henry St. Louis William here, and three sisters, Miss Barbara, Mrs. Hedwig Watts Miss Laura Lutz here. Funeral services were held Monday the M. church. Kinison and Rev. H. Kluge spoke words comfort the bereaved quartet, composed Henry and Elmer Hake, Mrs. Leseman Mrs. Walter sang appropriate hymns Miss Wilma Huck was pianist. The flower bearers were: Mrs. Hahne, Miss Mae Teel, Mrs. Hileman and Miss Erma Keyler. The pallbearers were: Leibrock, Homer Huck, Albert Watts. Douglas, Wm. Ahlf D. Interment in Greenwood At the grave the Masonic lodge, which was member, had Finke, master, livering the oration and Porter acting chaplain. Beside his resting place the grave of his ter, Anna Lutz, teachthe school, who died Feb. With the evergreen hardby keeping vigil, his mound soon one the fleetness of life and the other of the durability of loving remembrance. MRS. CHAS. STIENKEMEYER Mrs. Sophia Stienkemeyer, wife Charles H. her sightless eyes in the final, long sleep Monday night at 10 o'clock age years, months and days. years ago she was deprived her sight, this affliction mitigated by the love and devoof her husband daughters, left nothing undone make her bearable possible. seemed the attention and seronly intensified their affection her and made the separation the painful. Decedent, daughter of Christian Johanna Tettenhorst, Soll, born July 19, 1856. St. Louis, came Nashville with her parin 1865. March, 1871, she Evangelical church by Rev. Stanger. On 31 united marriage with the pastor forming the One daughter. Ophelia, on Feb. and two her in death her are daughters: Clara James Lulu, Teel, all two sisVeith Mt. VerMrs. Wm. Krual of services were held the residence, 222 East Main this (Thursday) afternoon, Hohman and Rev H. Kluge consoling Interment cemetery followed. LEO GRZEGOREK his home but with his his Leo GrzegoMr. and Mrs. Lawrence breathed last St. ospital Rochester, Minn. the age of 19 left Rochester after their and motored They made many distant city and the last there since Feb. 16. from tumor in his operation Louis in 1930. Theretaken to Mayo Bros underAugust, hospital there. third St. Mary's hoschester March Howmedical skill did parents the youth Rose, Mrs. Louis, two and Eugene Josie brother and in will be held SatSt. Catholic Dahmus made in the Catho- JOHN LUMBATTIS John Lumbattis, former wellcitizen rest suddenly Wednesday at heart trouble, which had been suffering for number of years. was living with his and had gone the basement of the home watch the unloading of some coal. Dr. minutes later found his father breathing his last and he had passed away before physician could reach him. He was aged 79 years and days. was born March 12, 1854, in St. Clair farm He early life in His marriage Merker took place Jan. they established their home Carl Mo. where 1903 when Mr. and Lumbattis their son Myrl to Nashville. Mr. Lumbattis in 1907 appointed rural letter carrier on Route and himself to all patrons, them faithfully and well until shortly before his removal Mt. Vernon with his wife in 1927 was desire pass their maining days near their only son and family. Lumbattis passed April 1932, and thereafter Mr his resided with Dr. M. Lumbat tis and family. Besides his son Mt. Vernon Illinois, Mr. only he the last of six broththe Mr Lumbattis earnest, sinChristian had affiliated the Methodist church, their removal Nashville family united with the Presbyterian church here and served church elder. After transferring their membership the Mt. Vernon Presbyterian church, Mr. Lumbattis also elected an elder that church. Everybody knew Mr Lumbattis learned like and admire for his integrity true worth. He friendly all was greatly attached to his family and The funeral services are to take place the home Friday Rev. Guthrie and then the body will be taken Nashville the rites the be conducted with the Rev Currie. Burial will take place beside the wife who had gone before, in Greenwood cemetery. MRS. MARY E. SAWYER The silent form of Mrs. Mary nee Meyer, laid Tuesday afternoon. She had passed away her home, 572 Veronica avenue, East St. Louis, Sunday, March 12, arterio sclerosis after period of invalidism that extended over number of condition regarded critical since early last fall. Every care lavished upon the beloved trained nurses on duty for months and eased possible. Mrs. attained the of and days had been held o'clock the funeral in East Louis after which the funeral cortege wended its Nashville the home Mrs. Rev Maxton, of Du Quoin assisted East the burial service. Caroline Krughoff and daughter, Miss Kate, and Kate Thompson here tended the obsequies East Louis. Mary Meyer, eldest daughter Diedrich Meyer and wife, born here 1853 and grew womanhood Nashville marriage Frank Sawyer son James and place Tucker Mr Sawyer away in 1889, which the widow the of the family and one the ers of the Nashville public schools After her children Mrs. up and lived her her daughter about 20 years Mrs. Sawyer with her daughter, Bessie for many has instructor the East St. Louis schools. Besides her Mrs. Sawver leaves William of Du Quoin and Ollie of New also two sisters, Mrs. Frances Pence of McComb and Mrs. Helen Purdy DuQuoin, for months assisted the of their Among those the body to were: Wm. Sawyer and family, Mr. Chas Ro. Mr. Purdy. Mrs Katherine Du Sawyer La., Mrs FranPence and Miss Helen, Mr Mrs. Palmer Misses Bessie Sawyer, Trimmer and Tillie and Anderson East Louis and Frank Caughlin of St. MRS. FERTIG. Word was received Tuesday the death of Mrs. the mother of Mrs. Helen Thompson, the which the mother and daughter jointly occupied NoblesIndiana. Mrs. Fertig had been suffering heart trouble for several months, condition had not regarded as critical until Miss Kate Krughoff motored Mrs. Kate Thompson Noblesville Tuesevening both the last rites there Wednesday. LIBORY TRENTMAN Libory formerly of St. Libory, Friday at St. Libory years. He former resident of Johannisburg township, serving assessor and justice of the but had gone to Nebraska with his after leaving Illinois the of the rence and lived in St. Libory, Nebraska. MARGARET H. SMITH Miss Margaret Harriet Smith, whose our last the fifth Robert and Martha Ann Smith, prominent residents Oakdale. She called eternal March 1933, o'clock. Practically entire life spent in Oakdale with the exception years St. Louis, where held secretarial positions. Miss Smith had efficiently filled the duties teacher the public schools of the county for number of years before going into commercial work. Thirteen years she returned Oakdale her aged parents and their death she in the old home with her brother WilDuring her residence in Oakdale, Smith active in life, being faithful of the church, serving teacher the Bible school, church treasurer and For the past seven had the society. In all the religious, and litermatters which Miss Smith interested, she put forth her best efforts execute her duties with all possible degree perfection. She highly regarded all who knew and news severe illness following stroke paralysis Feb. aroused the deepest sympathy. All knew eager to learn her improvement, but became dent that death inevitable and would follow shortly Oakdale has valuable citiand the residents join the family the departure of this splendid type of Christian womanThe members of the immediate family who loss are: Three brothers Smith Pittsburg, Kan., Wesley Carbondale and William sisters, Mrs. Alice Torrens Olney, Sadie, Mrs. Hugh Boyle Waterman, AnMrs. Coulter, Oakdale, Lottie, Mrs. Frank McQuilkin East St. Louis and Miss Edna Smith of St. Louis. The funeral services took place Sunday afternoon in the United Presbyterian church Oakdale, where Rev. Zeller had charge, assisted by Rev. The pallbearers Stanley Coulter, Walter Maxwell, Klene, Ray Boyle, Bruce Torrens Lamont Forsyth. Nelda Boyle, Dorothy Brown, Julia Virginia McClay Velva Elliott, Osborn. Kathryn Ibendahl and Maxwell, members Miss Smith's class. Among those from distance tending the funeral E. Smith, Smith and daughter Cynthia Ann. Miss Beulah McFarland, and Mrs. Frank McQuilkin Virginia, and Mrs. Larby, and Harrison Dugdaughter, Danny Lynn, Mrs. Jasper Rountree and Mr and Mrs. Charles Wilson. all of East Louis; Miss Edna Smith, Mrs. Libbie Keller. Mr. and Mrs. Robert Kenneth, Mrs. Bruce Torrens, Mrs. Nellie McLean son Hugh, George Garvin Mrs. Florence Harrison St Louis; Smith and famof Carbondale; Mr. Mrs. H. Boyle Shabbona: Mr. and Mrs. Lamont Forsythe Alice Torrens Olney Miss Claudine Coulter of Granite Miss Lucille Coulter Mrs. Martha Spencer, Mr. R. Edgar, Lyons, Mrs. Nettie Wright, State's Mrs Maxwell and Charlotte, Co. Reeder, Nipper Mr. Mrs. Carson, Mrs. Stark, Miss GerSchaeffer and Ollie, Frank Sawyer daughter, Marion and Mrs. Mr Kenneth Mr. and Mrs. Darrough Mr. Mrs. sons, Glenn and and Mrs. no daughter Marie and son Coulterville, and Lyons Kelley and Mrs Matthew Irvin of Swanwick. C. LIVESAY M. Livesay, formerly of this county, passed Wednesday, March at Columbia, Mo., at about 80 years of He mourn departure his Mrs. TheLivesay, nee Tate, formerly of son, Glenn Livesay, army officer three Edna Hendricks and Mrs. Vera Powell Columbia, and Mrs Florence Warrenburg, two Ross Livesay Ind., Corrington of Louis The funeral burial at Columbia, Mo., Friday, March MRS. EMMA C. KIRCHHOEFER Mrs. Emma Kirchhoefer passed away Sunday of heart trouble aged 68 The funeral services Wednesday from the Evangelical church there, Rev. officiating. The deceased born at Darmstadt Jan 1865, daughter John H. and Catherine Massman SanHer marriage Philip Kirchhoefer place March 25, 1885, and died in One Mrs. Pflasterer of Darmstadt. survives MEDICOS MEET The Washington County Medical society in the courthouse Friday evening to on "Medical by Dr. Norville Wallace Sharp of St. Louis, is authority. neighboring physicians and surgeons of Illinois among whom Drs. Chas Skaggs East Belleville, Hall and Hamilton Mt. Vernon. of H. Smith of ton. who lectured on "Signs the Times' and read which poem well received. BANKS REOPENED WITHOUT RESTRICTION Monday, according President Sunday night, banks that were members the federal reserve system in the cities which these federal reserve banks were located, opened for business; while Tuesday solvent banks cities clearing house associations open for business. the St. Louis bank area, including Arkansas, Indiana, and Tennessee, there were but given permits to for Tuesday. Secretary told state authorities of banking institutions located in federal serve bank cities open for business Monday all cases where they are qualified to do on an unrestricted Secretary Woodin announced that the treasury would $800,treasury certificates of in debtedness on March 15 to meet maturing certificates indebtedness totalling $695,000,000 raise proximately to meet pubdebt payments. He these ishas paid by the treasury the last year will be five bear the rate while the second will for months and will bear cent interest. Chicago larger banks Saturday paid for paypurposes. attempts were made to salary checks. The First National Farmers and Merchants National Banks ceived notice between 'clock Tuesday night that they were authorized to open for business Wednesday morning. Accordingly normal business relations resumed and no restrictions were imposed upon outside those made known the President's sage Sunday night, which are published in There rush of depositors and business transacted by both banks. institution far of the hint on either bank. highly gratifying to everybody. The First National bank in Okawville also opened for morning, but for some reanot known "Old" Exchange National bank there, of largest banking institutions in the county, ordered open the same time. has always been recognized safe and sound bank and the reason halt is not known. Limited lists of banks in the large and smaller cities this regon are being published each day papers, took longer some cases ascertain necessary data by the treasury department officials. The later opening, according to President words, signify that the banks The public confidence in the ernment appears to be riding high tide, much hidden money being brought forward. The people appear realize that of each individual required to bring money back into and thereby restore normal financial conditions. Under the ruling of the treasury demanded the be quizzed purpose the money used for and an fidavit will required for withdrawal of This is believed obviate the fearful person's desire for People are being bank sounder any other time, are putting their funds into proper The state banks of the county Hoyleton, Ashley, DuBois and Richhave still received no notice for opening from state authorities. State Auditor Barrett urged all state banks become affiliated with the federal system. TheHoyleton bank in the becoming national bank when the holiday was declared. As Tuesday pay day for the mine, John Clarkson, of the operators and general superinissued to the miners. This pay to about $3000 and can be cashed There was scrip in the hands of most of the merchants Tuesday evening to settle acocunts This can now be converted into cash. REPUBLICANS NOMINATE PROMINENT MEN FOR OFFICE There was meeting of Republicans the courthouse Friday ning for the purpose ticket for the city election to be held April 18. Atty. Byron House acted chairman Whelan Hutchings as secretary. following strong ticket was For mayor, Chas. Buhrman; for aldermen, Henry Meinert, and George Hemminghaus; clerk, E. Wehmeyer; treasurer. Anna Bieser are ceedingly known in this city and stand March 14 was the day for ticket and Monday will be the day for withdrawals. BOARD OF N. S. MAKES GREAT OUT OWN TOURNAMENT RECORD board of The county Though the high school basket and ball Tuesday team failed the chamtransacted tine business was pionship the district tournament the amount of Sandoval to week, the FIRST NATIONAL AND FARMERS congressmen ed. The county boys carried off more honors than $4 per day AND MERCHANTS ORDERED any team representing the of the members TO OPEN DOORS great many pay WEDNESDAY years. They three same figure. review to the four games which they took RESTRICTIONS IMPOSED board also The county part, third place; they the running that scored the number points Grove Oakdale to Lively any game the against be the next highway Keyesport their second game, an This with tax money. average gas points minute; tin though, no their preliminary, captain star Thompthe specified. inspiration the was The grand White attack, placed on the follows: Gus Friend star team, and, all, they Wm. Brink of Irvington; were named the judges as winners Richview; Henry the Rober Briesacher of Ashley; ship" award of the tourney. Skurat Du and Leo Nashville's first games Henry easy victories. Odin was defeated Ph. Reinhardt, Hoyleton! Thursday night by score 34 Carl and Friday score John Stieg, Wm 65 the Sanand doval eliminated the Blue and White Jones of Pilot Saturday Nashville play- Frederk Fietsam ed in the first half John Schlake and although plainly showing the of Oakda W Mayer uncertainty hesitation Venedy; Fred Koester of ten grips team facing bigger, Priest Venedy; Everett and foe, Grove. aged the running following are members The half the aggressive San- April term for doval athletes pepped up the cuit court: style of Wm. Dan Aldag and their car- H. Logan, them far out front, the final Zemenski Hoy count being to That Aug. Boehne, Oscar Kleeman, Centralia by David Ahrens: Cramer defeating 42 13. The Paul Covingtonner will meet Jerseyville high school the Salem tourney this Winfre Jerseyville won White Hall lot Novak coached by Blun Creamer, formerly of here. Ashley had tough schedule Brammeyer Herman the Facing Trenton Johannisburg Koch: their first start, they to Shook go into overtime period Next the Oakdale- Alfeldt: tle; big boys from high school Nashville gave Fred Ashley stubborn opposition the Schleifer; game, which Ashley 29 to Brehm; the semi-finals they held Centra- Robt. Woodrome. to the closest score of any champions tournament rivals, being CELEBRATES 90th BIRTH at length downed, 31 26. In the company of all his The all-star team was selected Frederick Hoyletor Gerling follows: Forwards- Means, Carlyle, brated his 90th birthday annil Spurgeon, Centralia, Hawley, Sunday. John Huck, friend Sandoval; Centra- Gerling, held short German lia, and Hinkley, Ashley; in the afternoon. The children Wood, Centralia. Glaeser, Trenton, brought baskets wh! and Thompson, Nashville. vided materials for bountift The team lose by graduation Spencer, Mr. Gerling came to this Willis. their recent showing, in August, 1868, and shortly however, Small and Finke bid fair to to become forwards ker, still living. Both another and Mrs. year the plentifully supplied with coming guards, their age and have their ter, Martha, living with spot by Spencer center will biggest problem taking care of them. Mr. an building next year's squad. Gerling county since Nashville's scores: the United States. They lived FG FT TP PF farm until years ago whe Small, retired and moved Ho: Willis, where they have since resided. Meinert, Those present at the celeb Lehde, were: Huck, Mr. and Mr Spencer, Uphoff, Mrs. Minnie Schmale Finke, and Mrs. John Hoffman, Mr. an Thompson, Ben Huck and children, Jim Lehde, Alice Marie, Mr Mrs. John Totals 14 ling and children, Kathryn Odin FG Mr. and Mrs. John children, Arlyn and Frederick Hodge, and Kenneth Powell, Henr Clayter, daughter Florence, Bruce, Gerling St. Louis, Mr. and McClelland, Wehking and daughter Mar Berry, Miss Martha Gerling, Rev. Totals wished Gerling might live to Nashville FG TP 100th birthday anniversary. John Lehde, The Methodist Finke, which Mr. Gerling Spencer, his him Thompson, postal card for which Small, Gerling wants to thank all who Willis, part. Jim Lehde, FROM THE CALIFORNIA Totals Mrs. Mattie Spencer on Mond Keyesport TP ternoon received letter Rudolph, Frank who Diekman, Alpine, Calif., saying that he Laws, in family, well as the other Wilkers, California, unhurt earthquakes that they Totals ceedingly grateful be spare tragedy. Mr. Lyons' letter the anxiety of the Sandoval FG PF family here. Bohner, John Eagan, from his William Hawley, havoc wrought by Staten, quakes in his property Outhouse, Hawley, Logan, Nashville Willis, Lehde, Finke, Spencer, Thompson, Small, RENT Totals Safety Depos The consolation which game, Nashville third place, was fought battle between the county's two tournament Ashley advanta faded the Every player, except Small, swell his total. high points. Hinkley for who scored 22 had points against N. earthquake the Ashley tournament, return Los Angeles they held in found their* game. unharmed. Ashley FG TP Willis, FILE FOR SCHOOL Finke, The following candidates Spencer, board have filed Thompson, Small, board: with Gilbert Simons, their John Lehde, H. PRESBYTERIAN CONGREGATION Totals These members, Lorenz and Ed men running TO HAVE SUPPER MARCH 21 Ashley FG TP for election Stephens, will held The members and adherents of the city hall April Fry, church are cordially invited by the official board to attend Hinkley, DISTRICT MEETING HEI potluck to enjoy Robinson, and Rebekah cial hour on Tuesday evening, March Hudson, District Okawville, Totals Ashley and Supper will be served at m. 11 the district meeting in the family asked Score by quarters hall here dish. of the All members and their will be welcome. friends Ashley to attend. ily