Click image to open full size in new tab

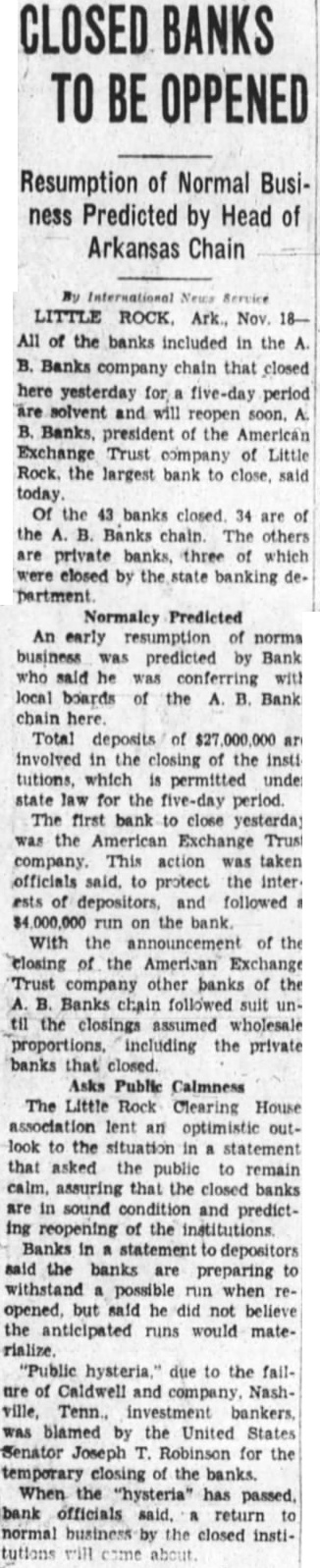

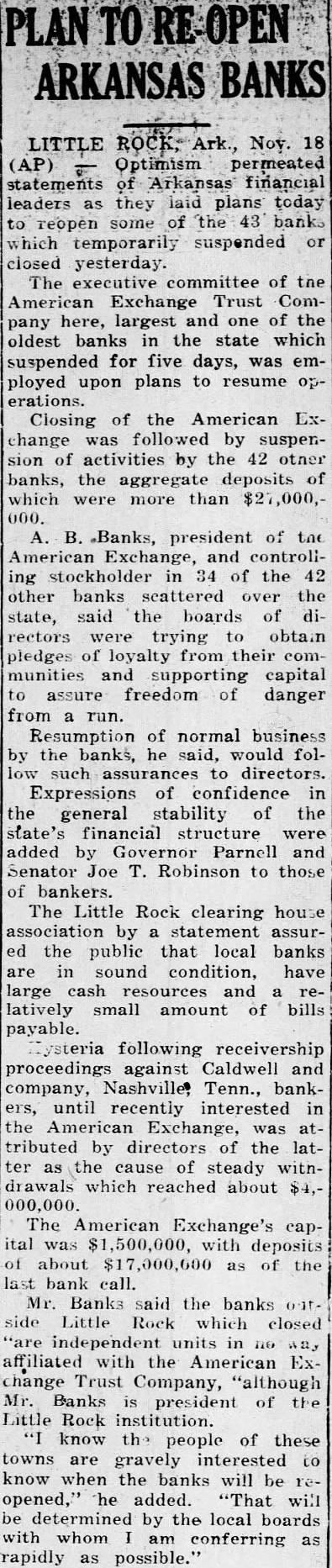

Article Text

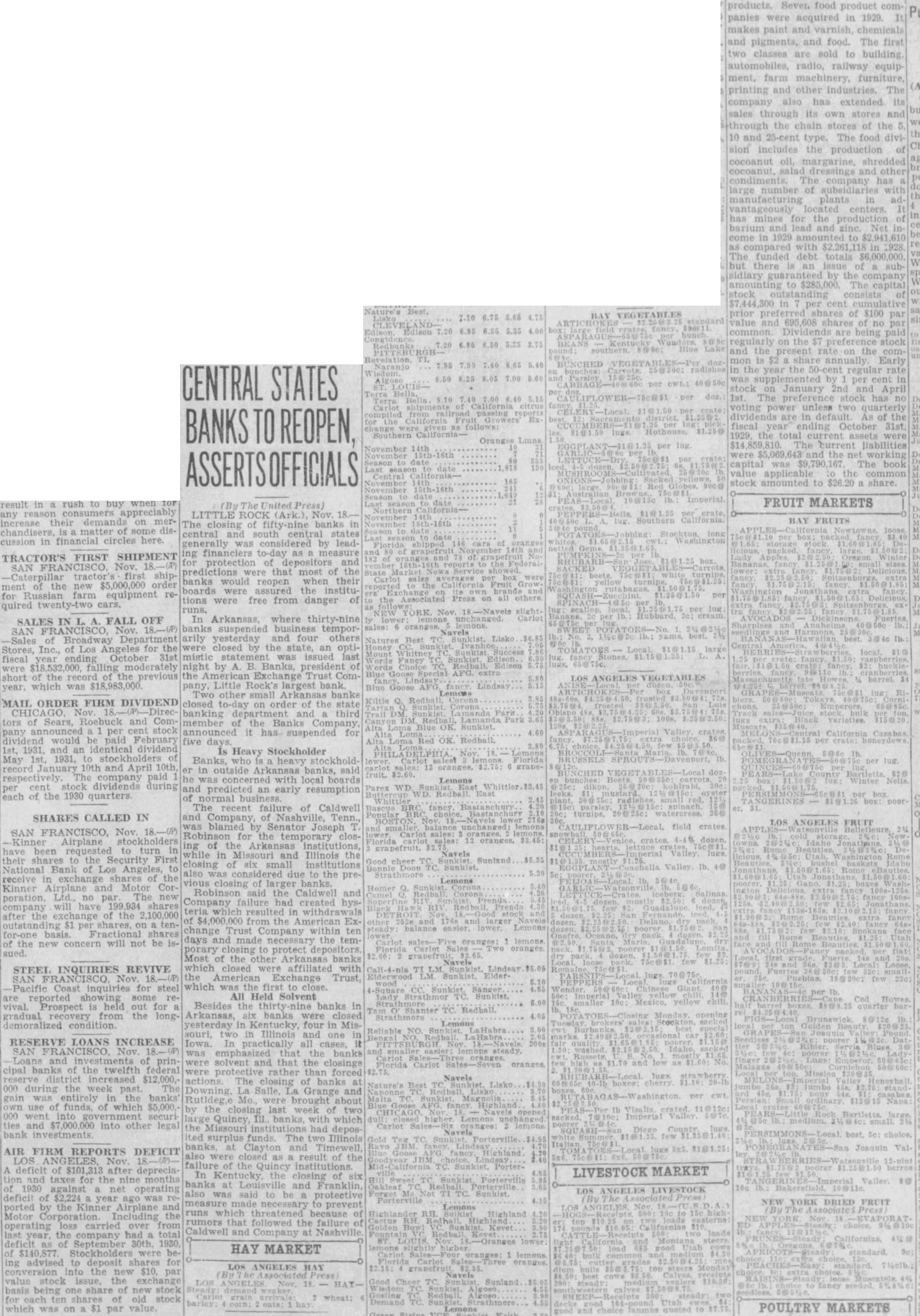

CENTRAL STATES BANKS REOPEN, ASSERTSOFFICIALS products. Seven food product companies were acquired in 1929. It makes paint and varnish, chemicals and pigments, and food. The first two classes are sold to building. automobiles, radio, railway equip and 5.40 in doz 1st. 1929 Oranges lug seasor date value 16th sales Natures ANGELES Lindsay Blue 4.60 fruit. Lemons East 12 Navels Good Lemons

TRACTOR'S FIRST SHIPMENT SAN FRANCISCO, Nov. first shipment of the new $5,000,000 order for Russian farm equipment required twenty-two cars.

SHARES CALLED IN

SAN FRANCISCO, Nov. 18.-(P) Airplane stockholders have been requested to turn in shares to the Security First National Bank of Los Angeles, to receive in exchange shares of the Kinner Airplane and Motor Corporation, Ltd., no par The new company will have 199,934 shares after the of the 100,000 per shares, on tenfor-one basis. Fractional shares of the new concern will not be issued.

STEEL INQUIRIES REVIVE Pacific Coast inquiries for steel are reported showing some revival. Prospect held out for a gradual recovery from the longdemoralized condition

RESERVE LOANS INCREASE Loans and investments of prin cipal banks of the twelfth 000 during the week The gain was entirely in the banks own use of funds of which $5,000. 000 went securi ties and $7,000,000 into other legal bank

AIR FIRM REPORTS DEFICIT LOS Nov. A deficit of $101,313 after deprecia tion and taxes for the nine months of 1930 against net operating deficit of $2,224 year ago was re ported by the Kinner Airplane and Motor Corporation. Including the operating loss carried over from last year. the company had deficit as of September 30th 1930 of $140,877 Stockholders were being advised to deposit shares for conversion into the new $10 par value stock issue, the exchange basis being one share of new stock for each ten shares of old stock which was on a $1 par value

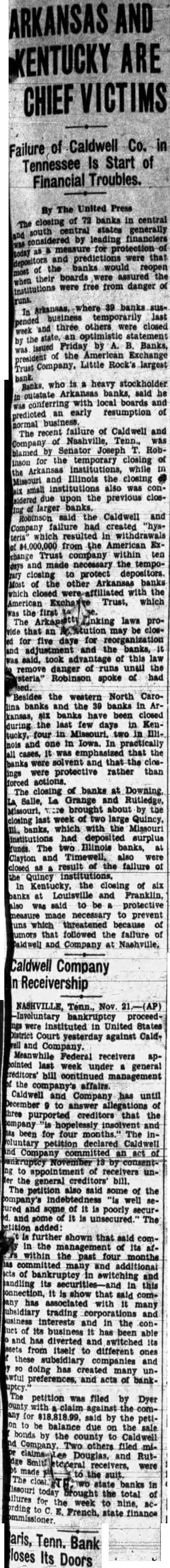

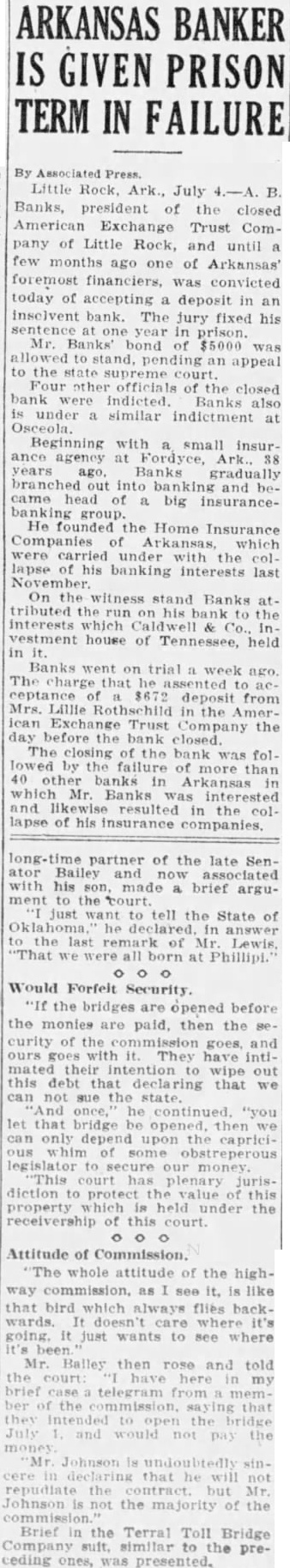

FRUIT MARKETS (B)/ The United Press) LITTLE ROCK (Ark.) Nov. 18 BAY FRUITS The closing of fifty-nine banks in central and south states generally was considered by leading financiers to-day as for protection of depositors and predictions were that most of the banks would reopen when their boards were assured the institutions were free from danger of SALES IN FALL OFF In Arkansas, where thirty-nine SAN FRANCISCO, Nov. 18.-(P) suspended business temporSales of Broadway Department arily yesterday and four others Stores, Inc. of Los Angeles for the were closed by the state, an optifiscal year ending October 31st mistic was issued last were $18,532,000 falling moderately night by A. B. Banks, president of short of the the previous the American Exchange Trust Comyear, which was $18,983,000 pany Little Rock's largest bank Two other Arkansas banks MAIL ORDER FIRM DIVIDEND closed to-day on order of the state banking department and third tors of Sears, and Com- member of the Banks pany a per stock announced it has suspended for dividend would be paid February five days 1st, 1931 and an identical dividend Is Heavy Stockholder May 1st. 1931. to Banks, who is heavy record January 10th and April 10th in outside Arkansas banks, said respectively The company paid he was concerned with local boards stock dividends during per and predicted an early resumption each of the 1930 quarters. of normal The recent failure of Caldwell and Company Nashville, Tenn. ANGELES FRUIT was blamed Senator Joseph T Robinson for the temporary ing of the Arkansas institutions while in Missouri and Illinois the closing of six small institutions also was due to the preclosing larger banks Robinson said the Caldwell and Company had created hysin withdrawals of $4,000,000 from the American Exchange Trust Company within ten days and made necessary the temporary Most of the other Arkansas banks which closed were affiliated with the American Exchange Trust, which was the first close. All Held Solvent Besides the thirty-nine banks in Arkansas, six banks were yesterday in Kentucky four in Missouri two in Illinois and one Iowa. practically all cases it was emphasized the banks were solvent and that the closings were rather than forced Navels actions. The closing of banks Lisko Downing, La Salle La Grange and by the closing last week of two Quincy Ill banks, with which the Missouri had deposIted surplus funds. The two Illinois banks at Clayton and Timewell Val also were closed as result of the the institutions LIVESTOCK MARKET In Kentucky the closing of six banks at Louisv and Franklin LOS ANGELES LIVESTOCK also was said to a protective YORK DRIED FRUIT measure prevent runs which threatened because of rumors followed the failure of Caldwell and at Nashville HAY MARKET LOS ANGELES HAY POULTRY MARKETS