Article Text

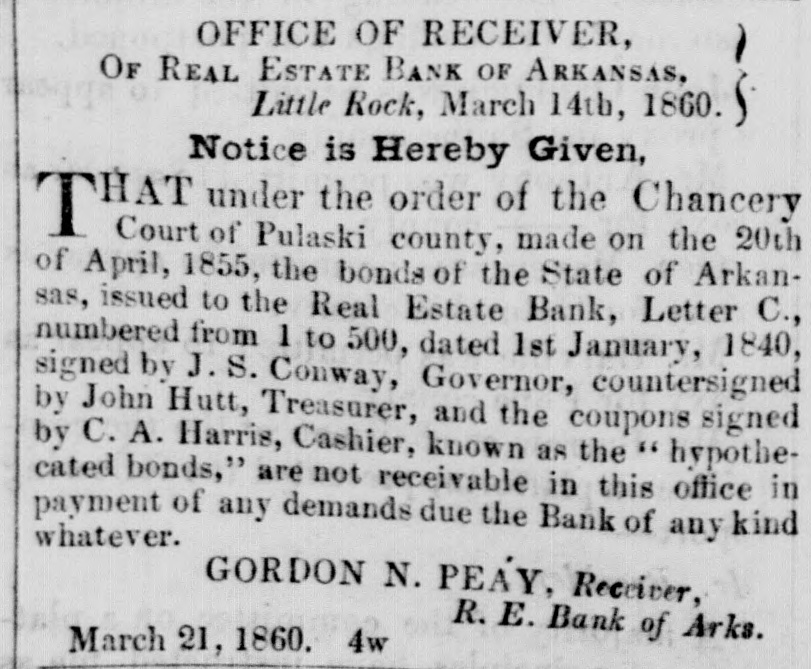

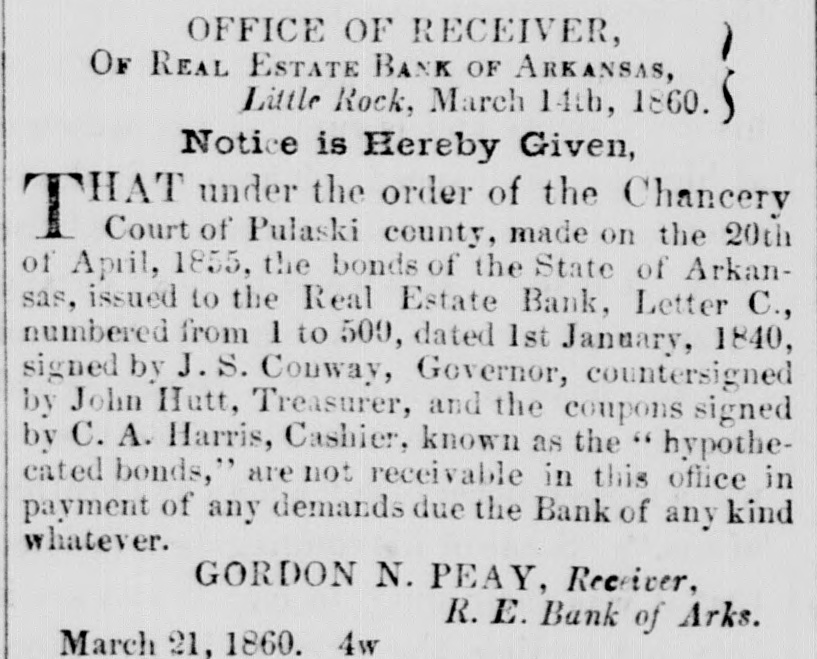

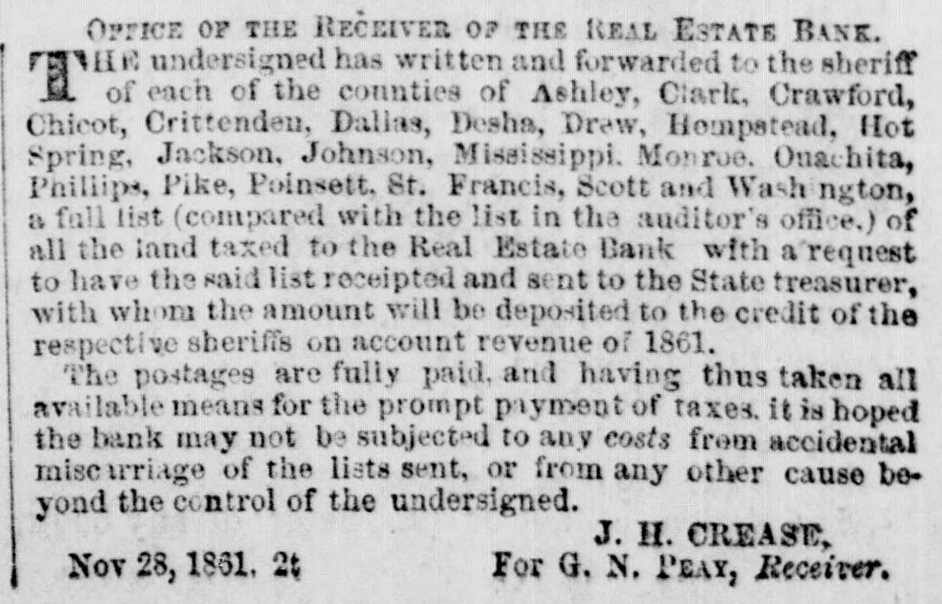

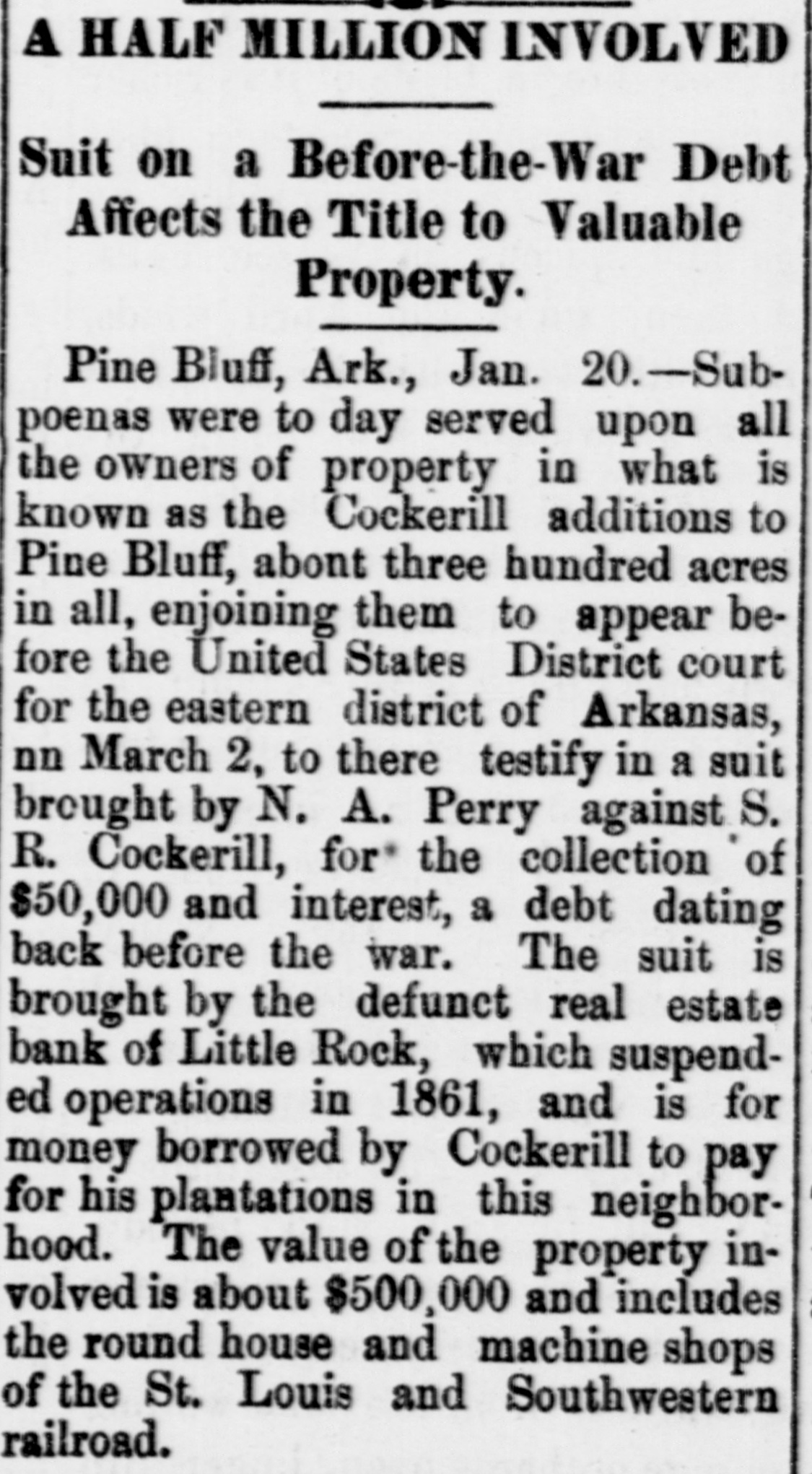

The Napoleon Planter Caught Lying. The Napoleon Planter of the 9th July made the assertion that Benj. Johnson owed the Real Estate Bank the sum of $29,600, Joel Johnson owed it $49,000 and Jas. S. Conway owed it $21,400 This statement of the Planter we denied and asked it, in justice to the three gentlemen thus slandered, all of whom are now dead, to correct the error into which it had fallen. Instead of doing so cheerfully, as any gentleman would have done, it reiterates the slander, and protests that the sums stated are still owing by Benj. Johnson, Joel Johnson and Jas. S. Conway. The Planter goes on the principle that "a lie well stuck to is as good as the truth." For the facts, we refer the Napoleon Planter to the following note from the Receiver in Chancery of the Real Estate Bank who is charged with the collection of all the debts due the bank and has in his possession all the books and papers belonging to it: OFFICE OF RECEIVER OF R. E. BANK, Little Rock, Ark., July 21, 1858. R. H. JOHNSON, ESQ.Sir: In reply to your note of this morning. I have to state that it appears from the books of this office that the debts of Benjamin Johnson, Joel Johnson and James S. Conway to the Real Estate Bank were paid in full to the late trustees prior to their removal from office. Respectfully your ob't serv't, GORDON N. PEAY, Receiver. This shows that these gentlemen owe nothing to the Real Estate Bank-that they have paid up every cent of their debts, and the fol lowing note from the Financial Receiver of the State Bank shows they owe nothing to that institution either: Office of the Bank of the State of Ark., Little Rock, July 22d, 1858. 5 Mr. R. II. JOHNSON-Sir: I have to state in reply to your inquiry that neither Benjamin Johnson, Joel John son or Jas. S. Conway owe any thing whatever to "the Bank of the State of Arkansas." Respectfully, etc., HUGH G. WILSON, Financial Receiver. Thus the statement of the editor of the Planter is shown to be a lie. Neither of the gentlemen mentioned owe any thing to either of the Arkansas Banks. Such lies, we cannot call the editor's lying assertions by a milder term, will do his candidates, Col. Furguson and Judge Patterson no service. If they have no better capital to go before the people upon than slandering the dead, they will live a long while before they will reach the summit of their ambition. As for Tucker, the editor of the Planter himself, he has gone to down-right lying, and is unworthy further notice.