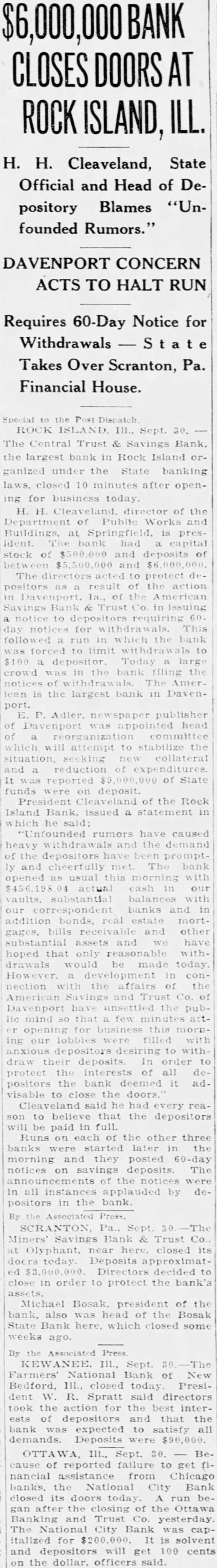

Article Text

ROCK H. H. Cleaveland, State Official and Head of Depository Blames founded Rumors." DAVENPORT CONCERN ACTS TO HALT RUN Requires Notice for Takes Scranton, Pa. Financial House. The Central Trust & Savings Bank. the largest bank in Rock Island ganized under the State laws, closed 10 minutes after ing for business today H. H. director Department of Public Works and Buildings, at ident. bank had capital of and deposits of and protect result Trust in notice to depositors requiring day notices for This followed the bank forced limit to Today large crowd bank filing The the largest bank in Davenport. publisher Davenport appointed head committee attempt to stabilize situation, collateral and reduction reported of State funds were on deposit. President Cleaveland of the Rock Island Bank, issued statement which he rumors caused and the demand of the depositors promptand cheerfully The bank opened usual this morning with actual cash in balances banks and addition bonds, real mortbills receivable and other substantial assets and have hoped that reasonable drawals would be made today. nection the affairs of the Trust the mind that few opening for business this ing our lobbies filled desiring to draw their In order protect of all positors bank deemed it visable close the doors. Cleaveland he had every to that the depositors be paid in full. Runs on of the other three banks later the morning and they posted 60-day notices on savings deposits. The the in all instances applauded by positors in the bank. Sept Miners' Bank & Trust Co. near closed its Deposits approximatDirectors decided to in order to protect the bank's Michael Bosak. president of the also was head of the Bosak Bank here. which closed some the Press Sept. Farmers' National Bank of New Bedford, 111., closed today President R. Spratt said directors the action for the best interof depositors and that the bank expected to satisfy all demands. Deposits $90,000. Sept. Because of reported failure to get nancial assistance from Chicago the National City Bank closed its doors today. run after the closing of the Ottawa Banking and Trust yesterday. The National City Bank capitalized for It is solvent and depositors will get 100 cents on the dollar. officers said.