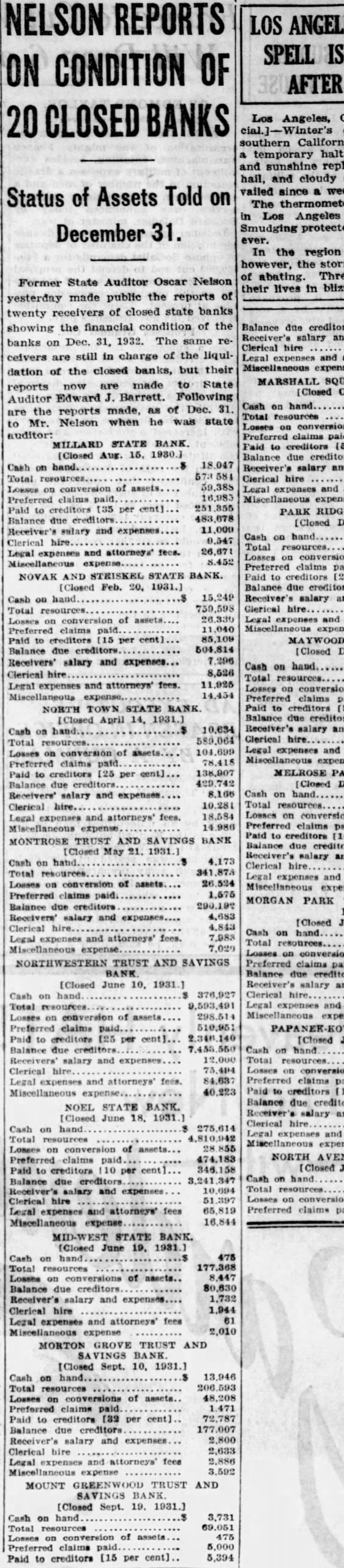

Article Text

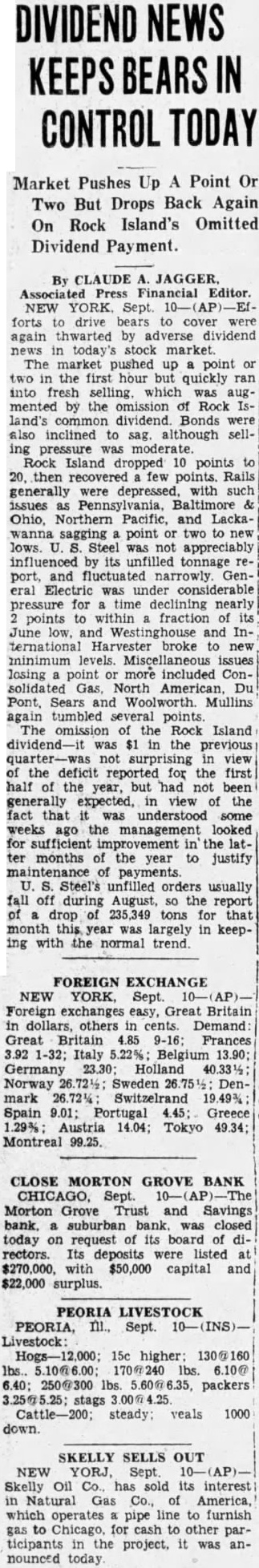

DIVIDEND BEARS IN CONTROL TODAY Market Pushes Up Point Or Two But Drops Back Again On Rock Island's Omitted Dividend By CLAUDE JAGGER. Financial Editor. NEW YORK. Sept. forts drive cover again by adverse dividend today's market The pushed up point two the first hour but quickly ran into fresh selling. which augmented by the omission Rock land's dividend Bonds also inclined to sag. although selling Rock Island dropped points then few points. Rails generally were with such issues Baltimore Ohio, Northern Pacific, and Lackawanna sagging point two to new lows. Steel not appreciably influenced by unfilled tonnage and fluctuated narrowly. GenElectric under considerable pressure for declining nearly points fraction and and broke minimum losing more included Consolidated Gas, North American, Du Pont. Sears and Woolworth. Mullins again tumbled several points. the Rock Island dividend-it was the previous view the deficit reported for the first half of the year, but had not been generally expected, in view the that was understood some weeks ago the management looked for sufficient improvement the lat. months the year to justify maintenance Steel's unfilled usually fall off during August, the report drop 235,349 tons for that month this year largely in keeping the normal trend. FOREIGN EXCHANGE NEW YORK, Sept. Foreign easy, Great Britain dollars, others cents. Demand: Great Britain 4.85 Frances 1-32; Italy Belgium 13.90; Germany 23.30; Holland Norway Sweden Denmark 26.72% Switzelrand Spain 9.01; Portugal Greece 1.29%: Austria 14.04; Tokyo 49.34; Montreal 99.25. CLOSE MORTON GROVE BANK CHICAGO, Morton Grove Trust and Savings bank. closed today on request its board of rectors Its deposits listed $270,000. with $50,000 capital and $22,000 surplus. PEORIA LIVESTOCK PEORIA, Sept. Livestock: 15c higher: 250@300 lbs. packers stags Cattle-200; steady: 1000 down. SKELLY SELLS OUT NEW YORJ, Sept. Skelly Oil Co., has sold its interest Natural Gas Co., America, which operates pipe line to furnish Chicago, for cash other participants the it was announced today.