Article Text

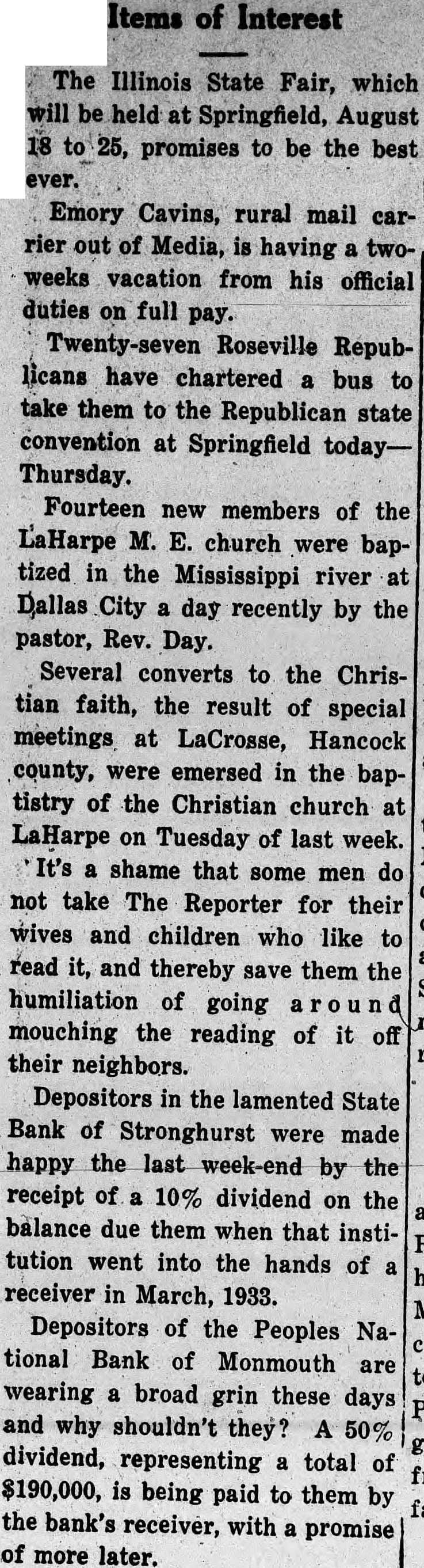

Items of Interest The Illinois State Fair, which will be held at Springfield, August 18 to 25, promises to be the best ever. Emory Cavins, rural mail carrier out of Media, is having a twoweeks vacation from his official duties on full pay. Twenty-seven Roseville Republicans have chartered a bus to take them to the Republican state convention at Springfield todayThursday. Fourteen new members of the LaHarpe M. E. church were baptized in the Mississippi river at Dallas City a day recently by the pastor, Rev. Day. Several converts to the Christian faith, the result of special meetings at LaCrosse, Hancock county, were emersed in the baptistry of the Christian church at LaHarpe on Tuesday of last week. It's a shame that some men do not take The Reporter for their wives and children who like to read it, and thereby save them the humiliation of going a 0 u n d mouching the reading of it off their neighbors. Depositors in the lamented State Bank of Stronghurst were made happy the last week-end by the receipt of a 10% dividend on the balance due them when that institution went into the hands of a receiver in March, 1933. Depositors of the Peoples National Bank of Monmouth are wearing a broad grin these days and why shouldn't they? A 50% dividend, representing a total of $190,000, is being paid to them by the bank's receiver, with a promise of more later.