Article Text

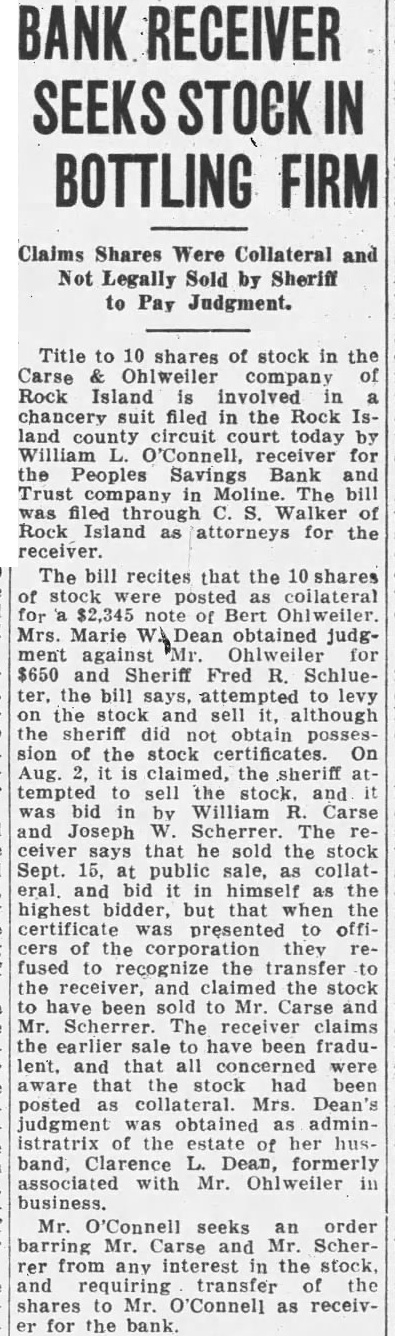

BANK RECEIVER BOTTLING FIRM Claims Shares Were Collateral and Legally Sold Sheriff to Pay Judgment. Title to 10 shares of stock in the Carse Ohlweiler company of Rock Island involved chancery filed the Rock land county circuit today receiver for Peoples Savings Bank and Moline bill filed Walker Rock Island attorneys for the receiver. The bill recites that the stock were posted collateral for $2,345 note of Bert Ohlweiler. Mrs. Marie obtained ment against Ohlweiler $650 and Sheriff Fred Schluethe bill attempted the stock and sell although the sheriff did not obtain possession of the stock certificates. On Aug. claimed, the sheriff tempted sell the stock. William Carse and Joseph Scherrer The says that he sold stock Sept. 15, public sale, as collatand bid in himself highest bidder, but that when the presented the they fused to recognize the and the stock been sold Mr. Carse and Scherrer. The receiver claims the to have been fradulent. and that all concerned aware that stock had been posted Mrs Dean's judgment obtained administratrix of estate her band, Clarence Dean, formerly associated with Mr. business. Mr. O'Connell seeks an order Carse Scherfrom interest the stock, and transfer of the to as receivfor the bank.