Click image to open full size in new tab

Article Text

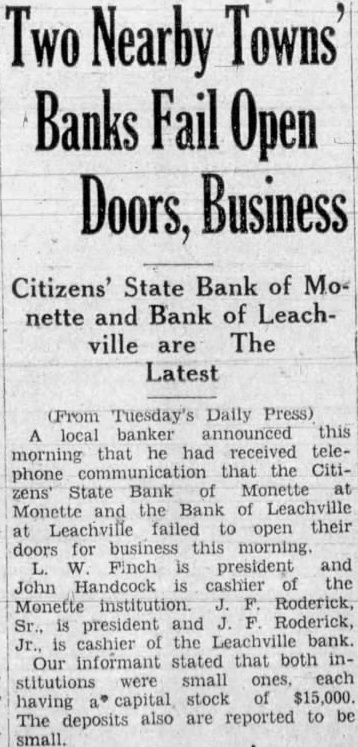

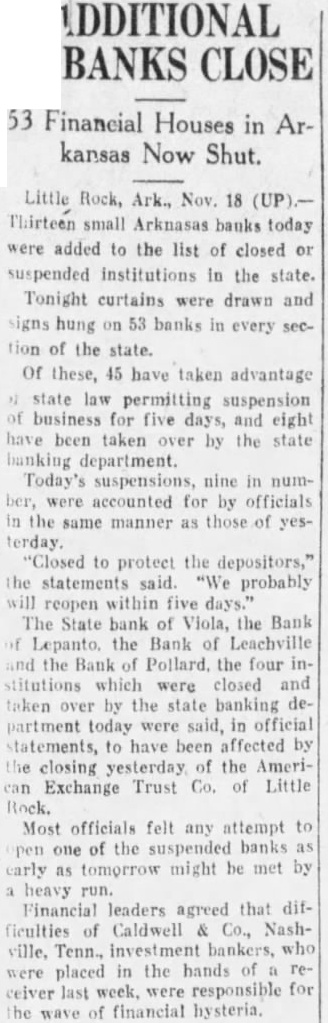

MORE BANKS IN Dearmont Named to Post Vacated Thirteen Small Institutions Are by L. S. U. Prexy Added to Suspended or

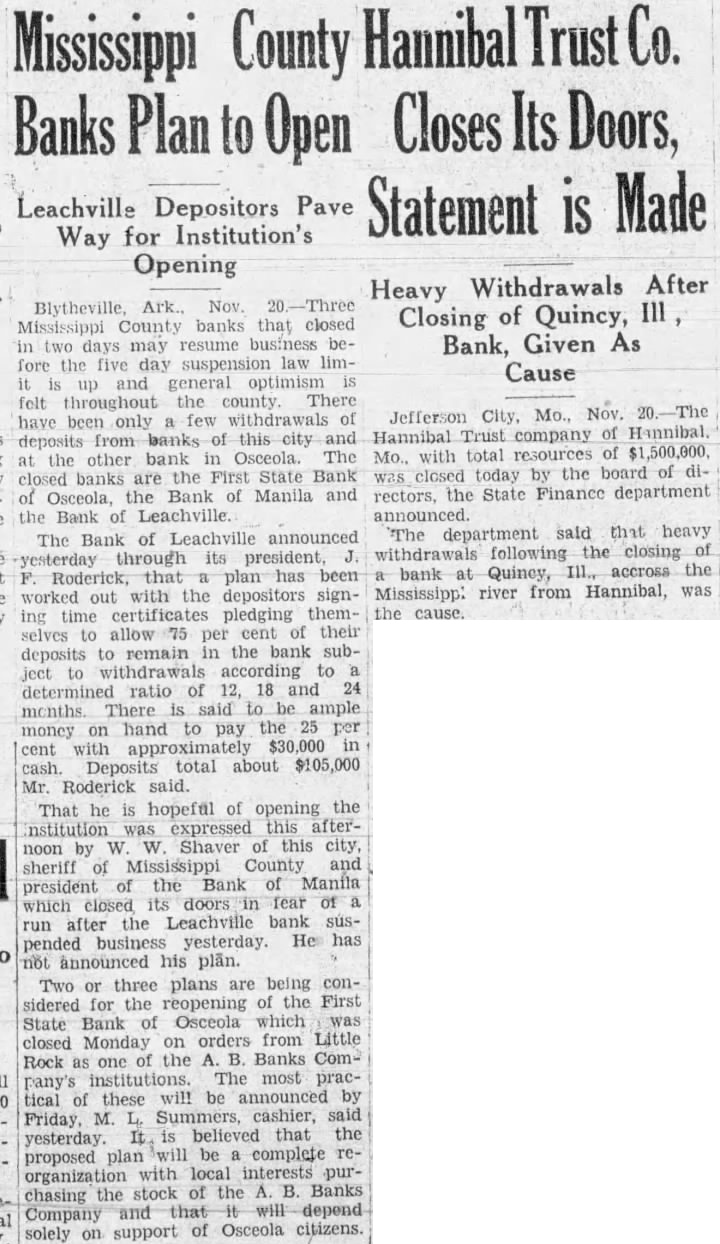

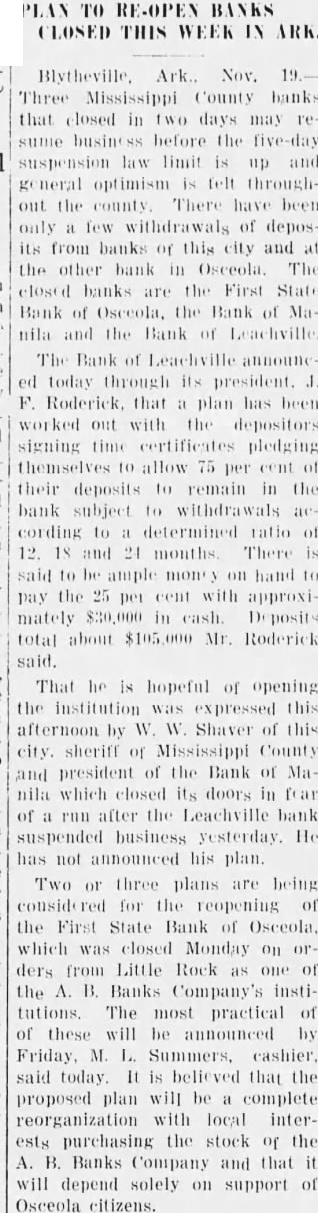

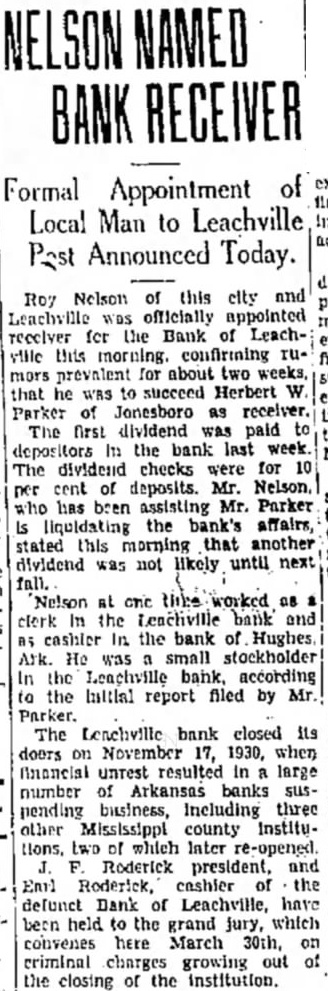

Closed List Tuesday

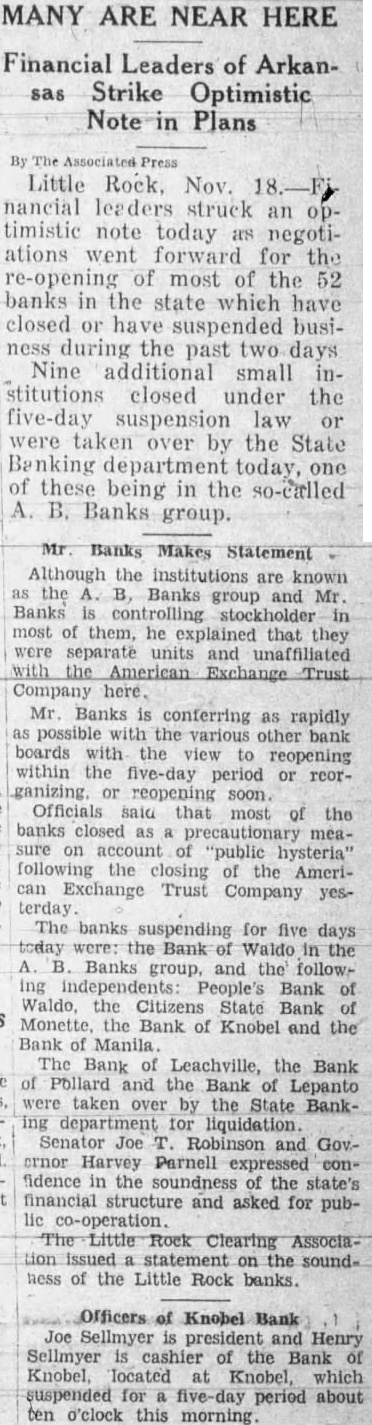

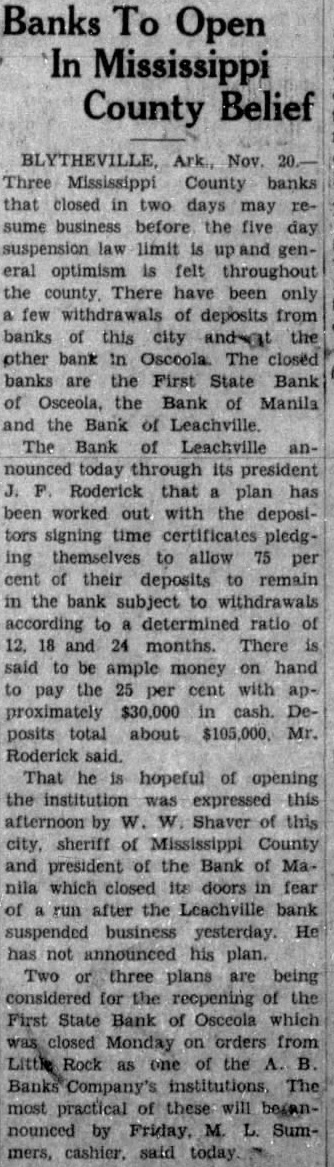

Little Rock, Ark., Nov. 18 (LP).Thirteen small Arkansas banks Tuesday were added to the list of closed suspended institutions in the state Tuesday night curtains were drawn and signs hung on 53 banks in every section of the state Of these. 45 have taken advantage of state law permitting suspension of business for five days. and eight have been taken over by the state banking department. Tuesday's suspensions, nine in number. were accounted for by officials in the same manner as those of "Closed to protect the depositors," the statements said. "We probably will reopen within five days The Viola State bank of Viola, the Bank of Lepanto. the Bank of Leachvile and the Bank of Pollard, the four institutions which were closed and taken over by the state banking department Tuesday were said in official statements. to have been affected by the closing Monday of the American Exchange Trust company of Little Rock. B. Banks. president of the American Exchange Trust company, one of the largest financial institutions in the state, Tuesday continued his conferences with boards of the out-state banks in which he holds large He reiterated his earlier reassuring statements that the small banks would reopen soon as their boards had obtained pledges from the communities. or by outside capital, against run Most officials felt any attempt to open one of the suspended banks as early as Wednesday might be met by heavy run Financial leaders agreed that difficulties of Caldwell and company. Nashville, Tenn., bankers. who were placed in the hands of a receiver last week, were responsible for the wave of financial hysteria. In few days after Caldwell and company receivership. more than $4,000,000 was withdrawn from the American Exchange Trust company. Senator Joseph T. Robinson pointed out.

Lafayette, Nov. 18 (P).-Dr. W. S. Dearmont, professor of psychology and education at Southwestern Louisiana institute here, has been named by Dr. E. L. Stephens, president of Southwestern, as dean of the college of education subject to ratification by the state board of education. Doctor Dearmont succeeds Dean J. M Smith who has been elected president of Louisiana State university Both Doctor Smith and Doctor Dearmont have taken up their new duties. Doctor Dearmont has been connected with Southwestern since 1922.