Article Text

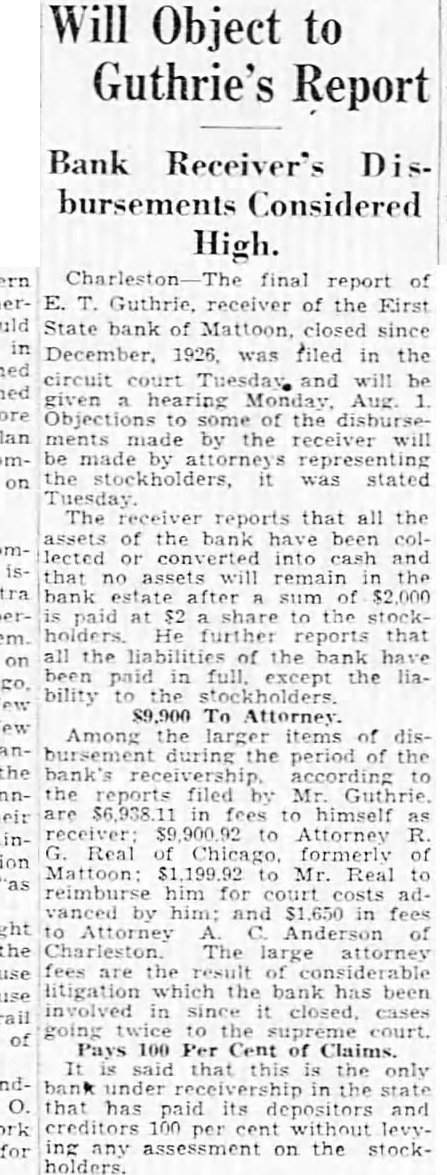

Will Object to Guthrie's Report Bank Receiver's Disbursements Considered High. Charleston- final report of E. T. Guthrie, receiver of the First State bank of Mattoon, closed since December, 1926, was filed in the circuit court and will be given hearing Monday, Aug. Objections the disburse ments made by the receiver will be made by representing the stockholders, it was stated The receiver reports that all the assets of the bank have been collected or converted into cash and that no will remain bank sum of $2,000 paid at $2 the stockholders He reports that all the liabilities of the bank have been paid in full. except the liability the stockholders. $9,900 To Attorney. Among the larger items of disbursement during the period of the bank's receivership according to the reports filed by Mr. Guthrie are $6,938.11 in fees to himself as Attorney R Real of Chicago, formerly of Mattoon: $1,199.92 to Mr. Real to reimburse him for court advanced by him: and $1,650 in fees to Attorney Anderson of Charleston The large attorney fees are the result of considerable litigation which the bank has been involved in since it closed, cases going to court. Pays 100 Per Cent of Claims. It said that is the only bank under in the state that has paid its depositors and creditors 100 per without levying any assessment on the stockholders.