Article Text

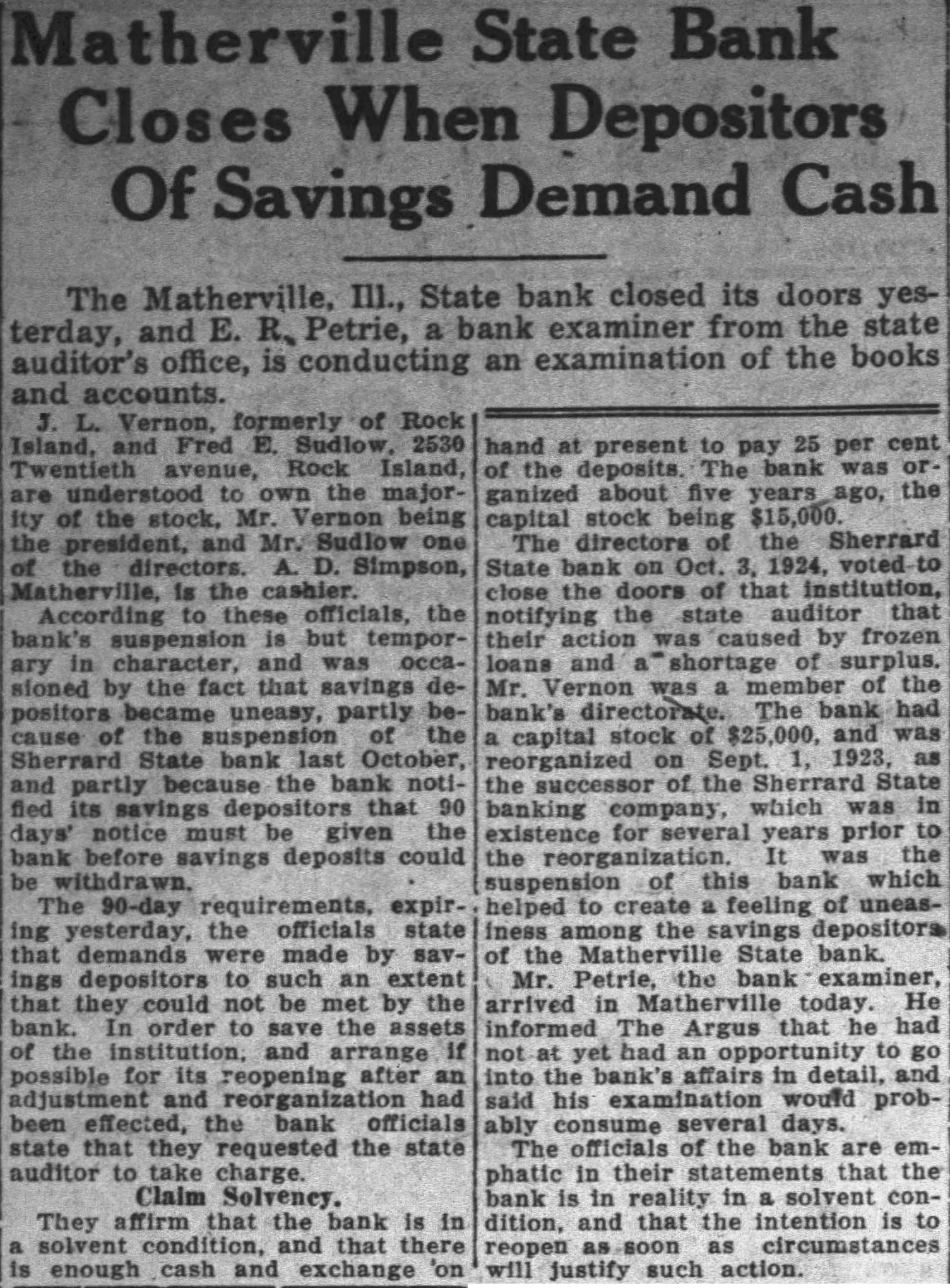

State Bank Closes When Depositors Of Savings Demand Cash The Matherville, III., State bank closed its doors yesPetrie, bank examiner from the state terday, and examination of the books auditor's office, is conducting an Vernon, formerly of Rock Island, and Fred Sudlow, 2530 Twentieth avenue, Rock Island, understood to the majorthe stock, Mr. being Simpson, the cashier. According to officials, the suspension but character, and was occasioned by the fact that savings uneasy, partly the State bank last October, partly the bank notified that days' notice must be given the bank before savings deposits could expiryesterday, the officials state that demands made by savings depositors to such an extent that they could not be met by the bank order the assets institution, and arrange if possible its reopening after adjustment been effected, the bank officials state that they requested the state auditor to take charge. Claim Solvency. They affirm that the bank is in solvent condition, and that there enough cash and exchange hand present to 25 per cent pay of the deposits. ganized about five the capital stock being $15,000. The directors the Sherrard State bank on 1924, close doors that state that their was by frozen loans and of Mr. the was The bank had capital stock of and Sept. 1923, the of the State banking which was existence for several years prior the of this bank which helped to create feeling of uneasiness the savings depositors of Matherville State bank. Petrie, bank examiner, arrived Matherville today. He informed Argus had opportunity into the affairs in detail, said examination would probably consume several days. The officials the are emphatic their statements that the bank is in reality solvent condition, and that the intention reopen justify such action.