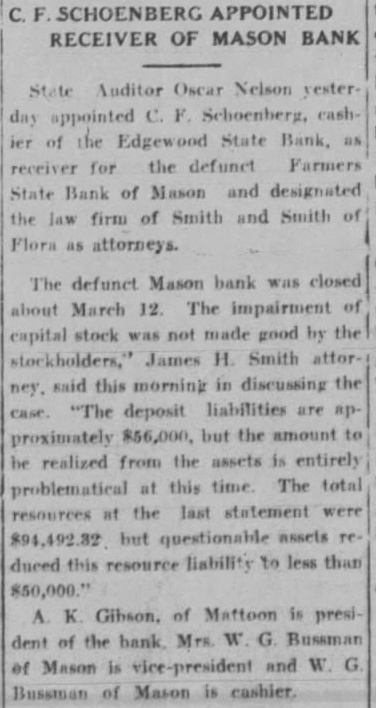

Article Text

SCHOENBERG APPOINTED RECEIVER OF MASON BANK Auditor Oscar Nelson yesterday appointed Schoenberg, the Edgewood State Bank, for the defunct Farmers receiver State Bank of Mason and designated the law firm of Smith and Smith Flora as attorneys. The defunct Mason bank was closed about March 12. The impairment capital stock not made good by the stockholders," James H. Smith ney. said this morning in discussing the "The deposit liabilities proximately $56,000. but the amount realized from assets entirely this time The total problematical resources the last statement but assets duced resource liability to less than $50,000." Gibson. of Mattoon president of the bank Bussman of Mason and Bussman Mason cashier.