Click image to open full size in new tab

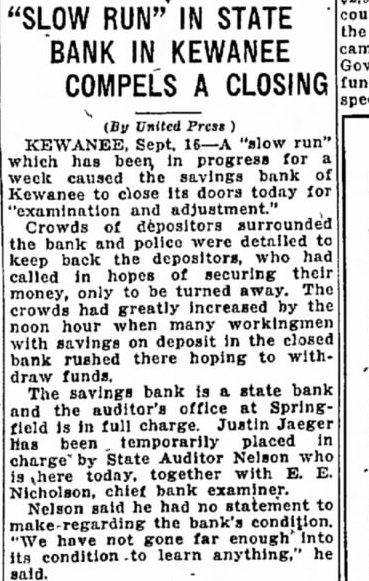

Article Text

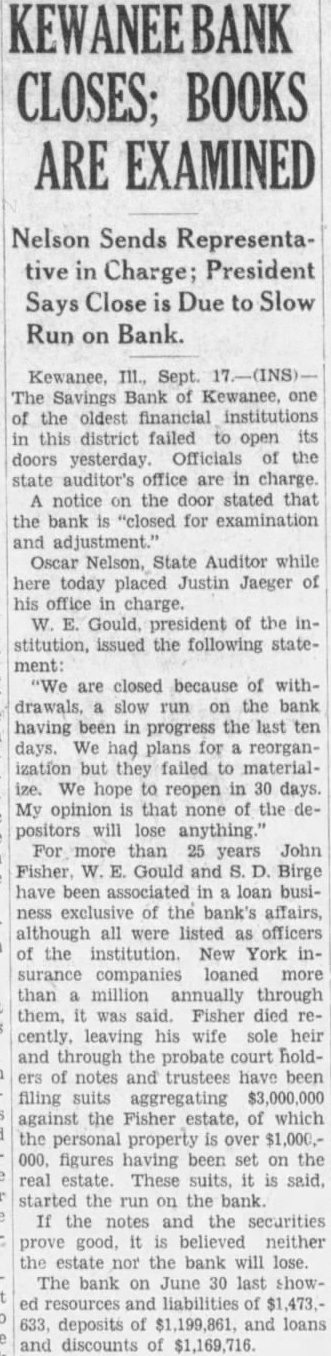

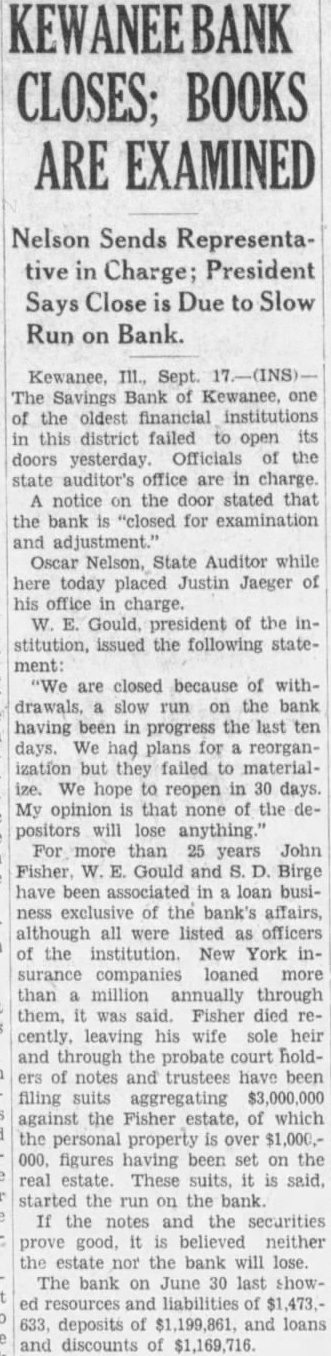

CLOSES; BOOKS ARE EXAMINED

Nelson Sends Representative in Charge; President Says Close is Due to Slow Run on Bank.

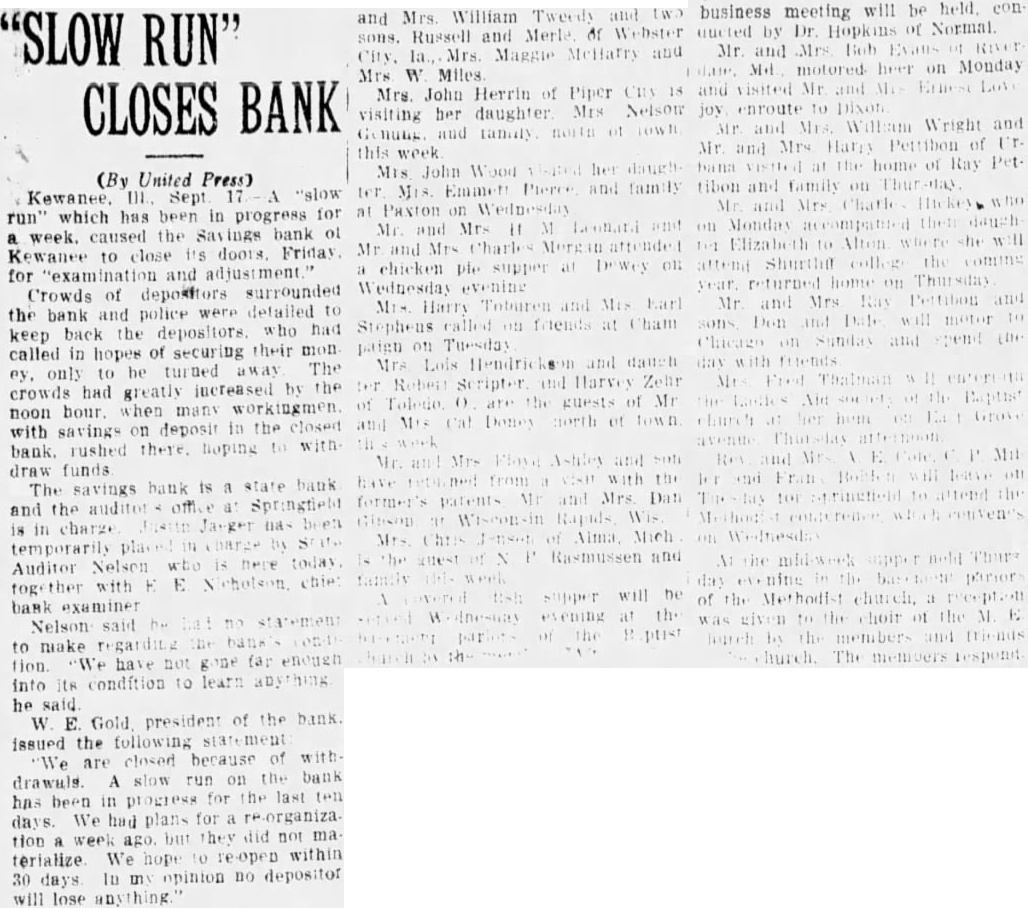

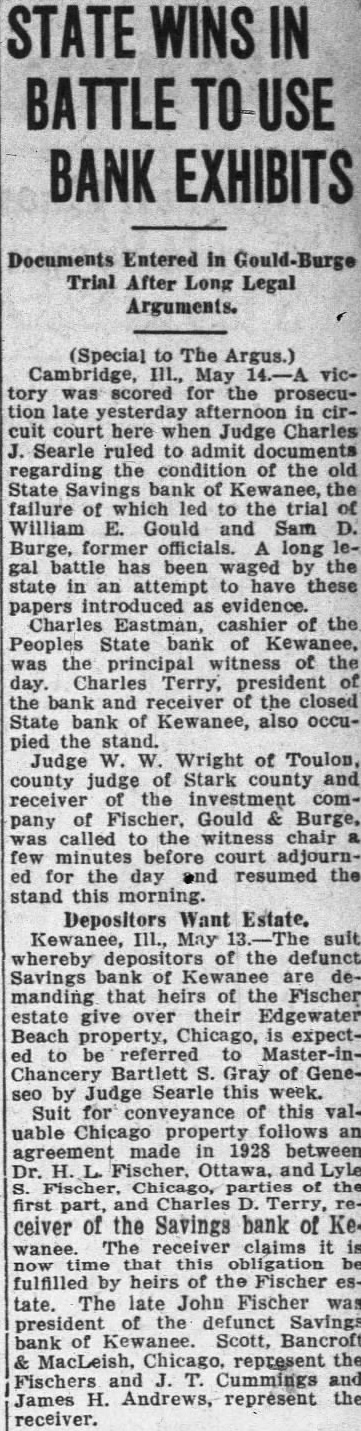

Kewanee, III., Sept. 17.-(INS)The Savings Bank of Kewanee, one of the oldest financial institutions in this district failed to open its doors yesterday. Officials of the state auditor's office are in charge. A notice on the door stated that the bank is "closed for examination and adjustment." Oscar Nelson, State Auditor while here today placed Justin Jaeger of his office in charge. W. E. Gould, president of the institution, issued the following statement: "We are closed because of withdrawals. a slow run on the bank having been in progress the last ten days. We had plans for a reorganization but they failed to materialize. We hope to reopen in 30 days. My opinion is that none of the depositors will lose anything. For more than 25 years John Fisher W. E. Gould and S. D. Birge have been associated in loan business exclusive of the bank's affairs, although all were listed as officers of the institution. New York insurance companies loaned more than a million annually through them, it was said. Fisher died recently, leaving his wife sole heir and through the probate court holders of notes and trustees have been filing suits aggregating $3,000,000 against the Fisher estate, of which the personal property is over $1,000.000, figures having been set on the real estate. These suits, it is said, started the run on the bank. If the notes and the securities prove good, it is believed neither the estate nor the bank will lose. The bank on June 30 last showed resources and liabilities of $1,473.633, deposits of $1,199,861. and loans and discounts of $1,169,716.