Article Text

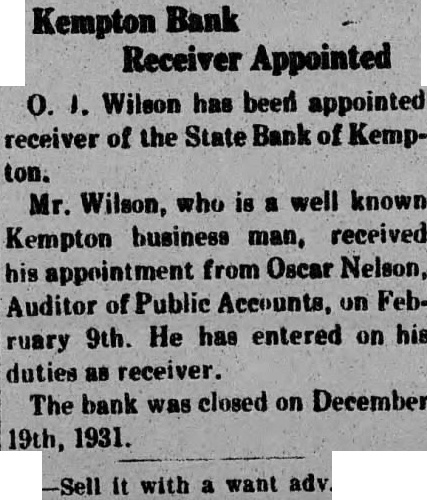

Kempton Bank Receiver Appointed 0. 1. Wilson has been appointed receiver of the State Bank of Kemp- ton. Mr. Wilson, who is a well known Kempton business man, received his appointment from Oscar Nelson, Auditor of Public Accounts, on February 9th. He has entered on his duties as receiver. The bank was closed on December 19th, 1931. -Sell it with a want adv.