Click image to open full size in new tab

Article Text

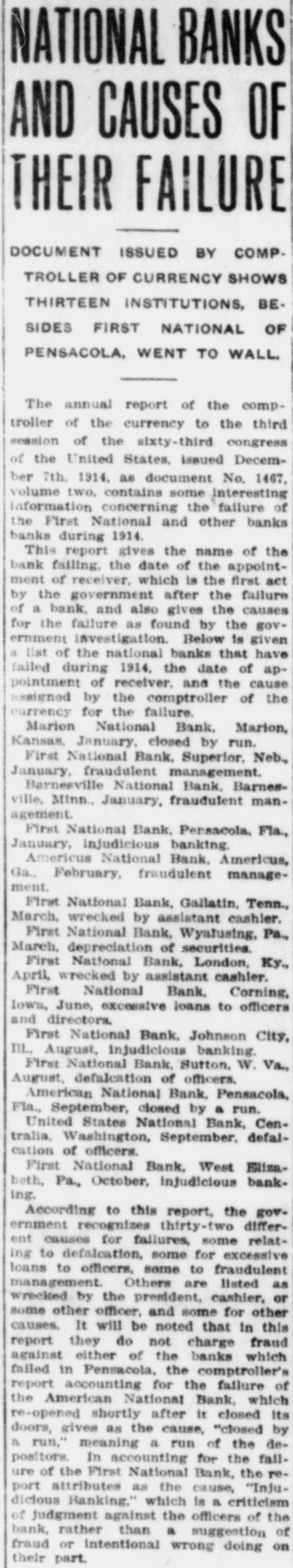

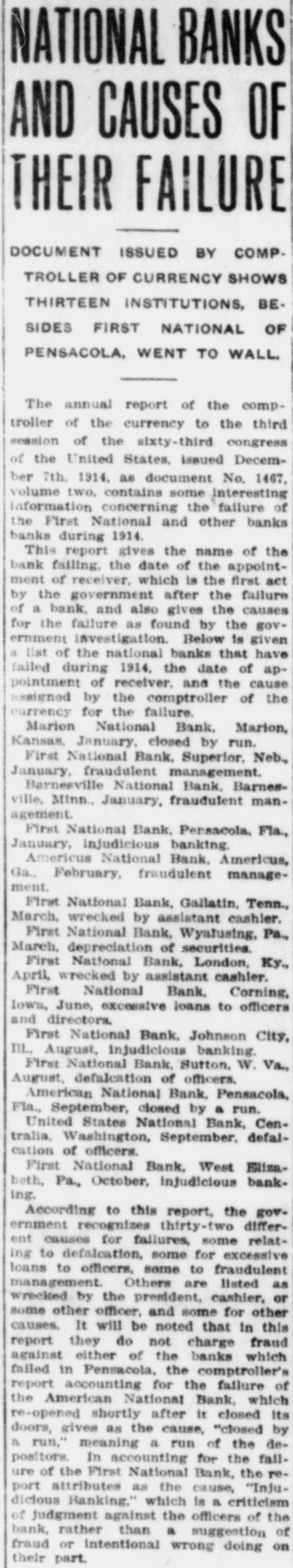

NATIONAL BANKS AND CAUSES OF THEIR FAILURE DOCUMENT ISSUED BY COMP. TROLLER OF CURRENCY SHOWS THIRTEEN INSTITUTIONS, BESIDES FIRST NATIONAL OF PENSACOLA, WENT TO WALL. The annual report of the comptroller of the currency to the third session of the sixty-third congress of the United States, issued December 7th. 1914, as document No. 1467, volume two, contains some interesting information concerning the failure of the First National and other banks banks during 1914. This report gives the name of the bank failing, the date of the appointment of receiver, which is the first act by the government after the failure of a bank, and also gives the causes for the failure as found by the government investigation. Below is given a list of the national banks that have failed during 1914, the date of appointment of receiver. and the cause assigned by the comptroller of the currency for the failure. Marion National Bank, Marion, Kansas, January, closed by run. First National Bank, Superior, Neb., January, fraudulent management. Barnesville National Bank, Barnesville, Minn., January, fraudulent management. First National Bank, Pensacola, Fla, January, injudicious banking. Americus National Bank, Americus, Ga., February, fraudulent management. First National Bank, Gallatin, Tenn., March, wrecked by assistant cashier. First National Bank, Wyatusing, Pa., March, depreciation of securities. First National Bank, London, Ky., April, wrecked by assistant cashier. First National Bank, Corning, Iowa, June, excessive loans to officers and directors. First National Bank, Johnson City, IIL, August, injudicious banking. First National Bank, Sutton, W. Va., August, defalcation of officers. American National Bank, Pensacola, Fla., September, closed by a run. United States National Bank, Centralia, Washington, September, defalcation of officers. First National Bank, West Elizabeth, Pa., October, injudicious banking. According to this report, the government recognizes thirty-two different causes for failures, some relating to defalcation, some for excessive loans to officers, some to fraudulent management. Others are listed as wrecked by the president, cashier, or some other officer, and some for other causes. It will be noted that in this report they do not charge fraud against either of the banks which failed in Pensacola, the comptroller's report accounting for the failure of the American National Bank, which re-opened shortly after it closed its doors, gives as the cause, "closed by a run," meaning a run of the depositors. In accounting for the failure of the First National Bank, the report attributes as the cause, "Injudiclous Banking," which is a criticism of judgment against the officers of the bank, rather than a suggestion of fraud or intentional wrong doing on their part.