Article Text

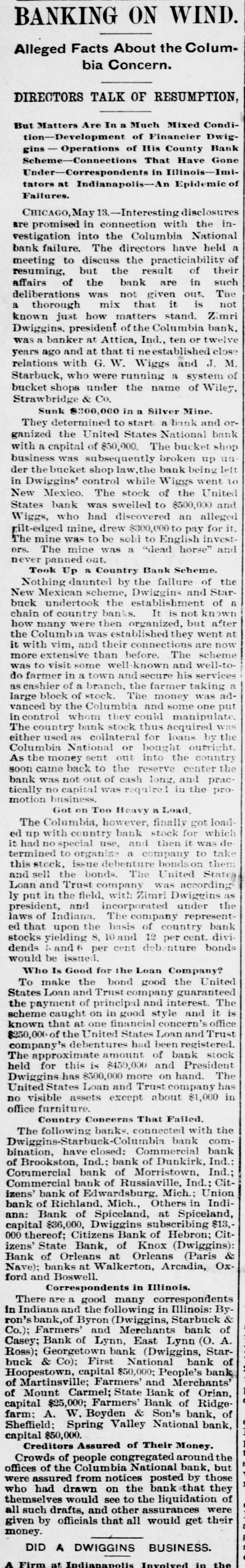

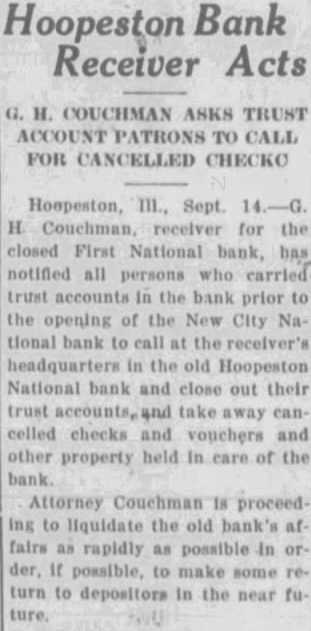

BANKING ON WIND. Alleged Facts About the Columbia Concern. DIRECTORS TALK OF RESUMPTION, But Matters Are In a Much Mixed Condition-Development of Financier Dwig-Operations of His County Bank Scheme-Connections That Have Gone Inder-Correspondents in Illinois-Im tators at Indianapolis-An Epidemic of Failures. CHICAGO,May 3.-Interesting disclosures are promised in connection with the investigation into the Columbia National bank failure. The directors have held a meeting to discuss the practiciability of resuming, but the result of their affairs of the bank are in such deliberations was not given out. The a thorough mix that it is not known just how matters stand. Zimri Dwiggins. president of the Columbia bank, was a banker at Attica, Ind., ten or twelve years ago and at that ti e established close relations with G. W. Wiggs and J. M. Starbuck, who were running a system of bucket shops under the name of Wiley, Strawbridge & Co. Sunk $300,000 in a Silver Mine. They determined to start a bank and organized the United States National bank with a capital of $50,000. The bucket shop business was subsequently broken up un der the bucket shop law, the bank being left in Dwiggins' control while Wiggs went to New Mexico. The stock of the United States bank was swelled to $500,000 and Wiggs, who had discovered an alleged gilt-edged mine, drew $300,000 to pay for it. The mine was to be sold to English investors. The mine was a "dead horse" and never panned out. Took Up a Country Bank Scheme. Nothing daunted by the failure of the New Mexican scheme, Dwiggins and Starbuck undertook the establishment of a chain of country banks. It is not own how many were then organized, but after the Columbia was established they went it with vim, and their connections are now more extensive than before. The scheme was to visit some well-known and well-todo farmer in a town and secure his services s cashier of a branch, the farmer taking a large block of stock. The money was advanced by the Columbia and some one put in control whom they could manipulate The country bank stock thus acquired was either used as collateral for loans by the Columbia National or bought outright. As the money sent out into the country soon came back to the reserve center the bank was not out of cash long, and practically no capital was required in the promotion business, Got on Too Heavy a Load. The Columbia, however, finally got load ed up with country bank stock for which it had no special use, and then it was de termined to organize a company to take stock, issue debenture bondson them and sell the bonds, The United States Loan and Trust company was according ly put in the field, with Zimri Dwiggins as president, and incorporated under the laws of Indiana, The company represented that upon the basis of country bank stocks yielding 8, 10 and 12 per cent. dividends and 6 per cent debenture bonds would be issued. Who Is Good for the Loan Company? To make the bond good the United States Loan and Trust company guaranteed the payment of principal and interest. The scheme caught on in good style and it is known that at one financial concern's office $250,000 of the United States Loan and Trust company's debentures had been registered. The approximate amount of bank stock held for this is 8450,000 and President Dwiggins.ha $500,000 more on hand. The nited States Loan and Trust company has no visible assets except about $1,000 in office furniture. Country Concerns That Failed. The following banks connected with the Dwiggins-Starbuck-Columbia bank combination, have closed: Commercial bank of Brookston, Ind.: bank of Dunkirk, Ind.: Commercial bank of Morristown, Ind.; Commercial bank of Russiaville, Ind.: Citizens' bank of Edwardsburg, Mich.: Union bank of Richland, Mich., Others in Indiana: Bank of Spiceland, at Spiceland, capital $36,000, Dwiggins subscribing $13,000 thereof; Citizens Bank of Hebron; Citizens' State Bank, of Knox (Dwiggins): Bank of Orleans at Orleans (Paris & Nave); banks at Walkerton, Arcadia, Oxford and Boswell. Correspondents in Illinois. There are a good many correspondents in Indiana and the following in Illinois: Byon's bank,of Byron (Dwiggins, Starbuck & Co.); Farmers' and Merchants bank of Casey; Bank of Lynn, East Lynn (O. A. Ross); Georgetown bank (Dwiggins, Starbuck & Co); First National bank of Hoopestown, capital $50,000; People's bank of Martinsville; Farmers' and Merchants' Carmel; State Bank of Farmers' Bank of Boyden & Son's of capital farm; Sheffield; Mount A. $25,000; W. bank, Ridge- Orian, of Spring Valley National bank, capital $50,000. Creditors Assured of Their Money. Crowds of people congregated around the offices of the Columbia National bank, but who were assured from notices posted by those had drawn on the bank that they themselves would see to the liquidation all given such drafts, and other assurances were of by officials that all would get their money. DID A DWIGGINS BUSINESS.