Article Text

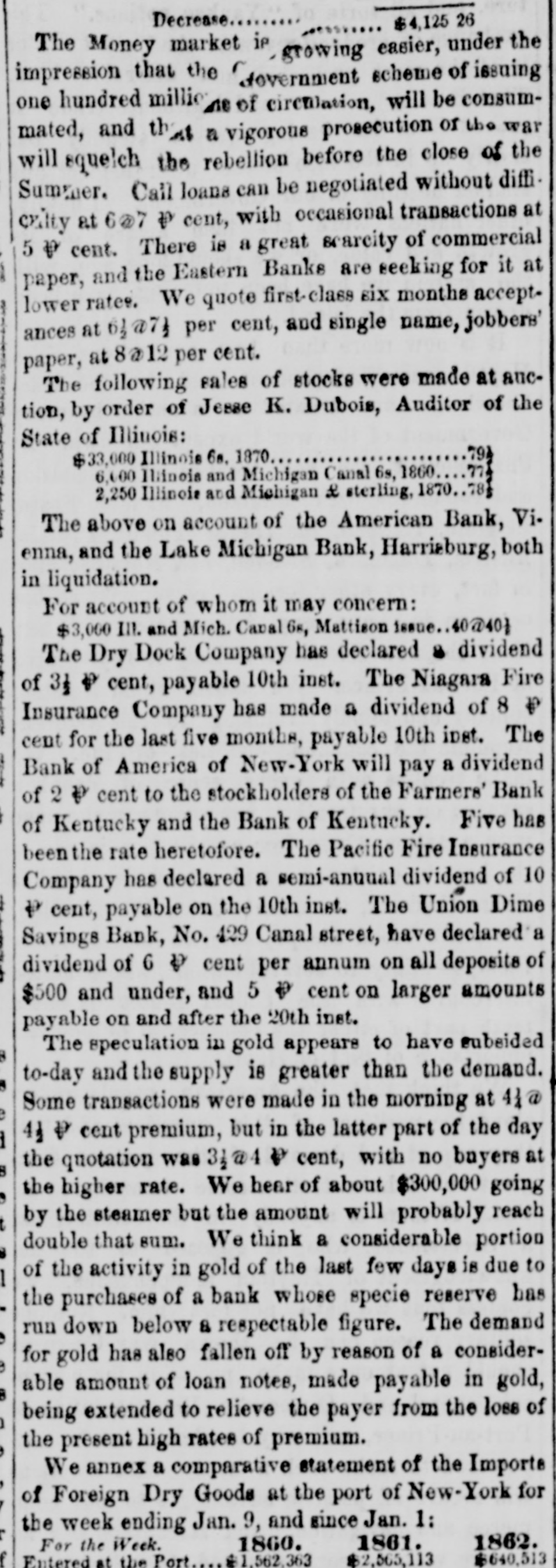

# Decrease.. $4,125 26 The Money market is growing easier, under the impression that the Government scheme of issuing one hundred millio ne of circulation, will be consummated, and that a vigorous prosecution of the war will squelch the rebellion before the close of the Summer. Call loans can be negotiated without diffi-crilty at 6@7 per cent, with occasional transactions at 5 per cent. There is a great scarcity of commercial paper, and the Eastern Banks are seeking for it at lower rates. We quote first-class six months accept-ances at 6@7 per cent, and single name, jobbers' paper, at 8@12 per cent. The following sales of stocks were made at auction, by order of Jesse K. Dubois, Auditor of the State of Illinois: $33,000 Illinois 6s, 1870...79½ 6,000 Illinois and Michigan Canal 6s, 1860....77¼ 2,250 Illinois and Michigan & sterling, 1870..78½ The above on account of the American Bank, Vienna, and the Lake Michigan Bank, Harrisburg, both in liquidation. For account of whom it may concern: $3,000 Ill. and Mich. Canal 6s, Mattison issue..40@40½ The Dry Dock Company has declared a dividend of 3½ per cent, payable 10th inst. The Niagara Fire Insurance Company has made a dividend of 8 per cent for the last five months, payable 10th inst. The Bank of America of New-York will pay a dividend of 2 per cent to the stockholders of the Farmers' Bank of Kentucky and the Bank of Kentucky. Five has been the rate heretofore. The Pacific Fire Insurance Company has declared a semi-anuual dividend of 10 per cent, payable on the 10th inst. The Union Dime Savings Bank, No. 429 Canal street, have declared a dividend of 6 per cent per annum on all deposits of $500 and under, and 5 per cent on larger amounts payable on and after the 20th inst. The speculation in gold appears to have subsided to-day and the supply is greater than the demand. Some transactions were made in the morning at 4¼ @ 4½ per cent premium, but in the latter part of the day the quotation was 3½@ 4 per cent, with no buyers at the higher rate. We hear of about $300,000 going by the steamer but the amount will probably reach double that sum. We think a considerable portion of the activity in gold of the last few days is due to the purchases of a bank whose specie reserve has run down below a respectable figure. The demand for gold has also fallen off by reason of a consider-able amount of loan notes, made payable in gold, being extended to relieve the payer from the loss of the present high rates of premium. We annex a comparative statement of the Imports of Foreign Dry Goods at the port of New-York for the week ending Jan. 9, and since Jan. 1: For the Week. 1860. 1861. 1862. Entered at the Port....$1,562,363 $2,565,113 $640,513