Article Text

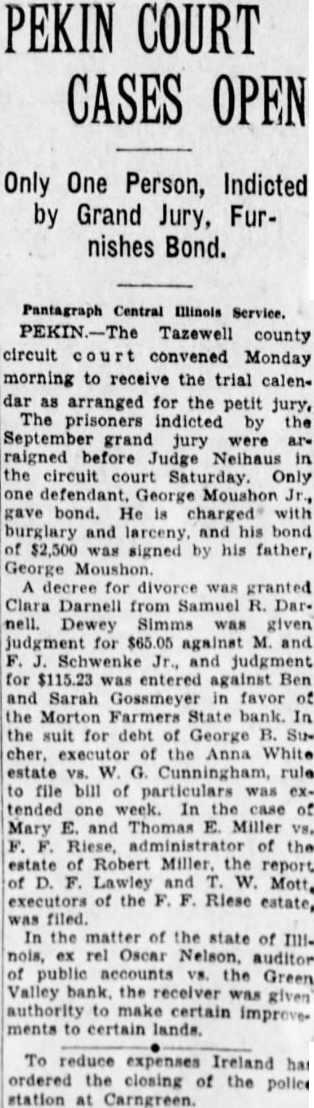

PEKIN COURT CASES OPEN Only One Person, Indicted by Grand Jury, Furnishes Bond. Pantagraph Central Illinois Service. PEKIN-The Tazewell county circuit convened Monday morning to receive the trial calendar as arranged for the petit jury, The prisoners indicted by the September grand jury were are raigned before Judge Neihaus in the circuit court Saturday. Only one defendant. George Moushon Jr., gave bond. He is charged with burglary and larceny. his bond of $2,500 was signed by his father, George Moushon. A decree for divorce was granted Clara Darnell from Samuel R. Dar. nell. Dewey Simms was given judgment for $65.05 against M. and F. J. Schwenke Jr., and judgment for $115.23 was entered against Ben and Sarah Gossmeyer favor of the Morton Farmers State bank. In the suit for debt of George B. Sucher, of the Anna White estate vs. W. G. Cunningham, rule to file bill of particulars was extended week. In the case of Mary E. and Thomas E. Miller vs. F. Riese, administrator of the estate of Robert Miller. the report of D. F. Lawley and T. W. Mott, executors of the F. F. Riese estate, was filed. In the matter of the state of IIIInois, ex rel Oscar Nelson. auditor of public accounts vs. the Green Valley bank. the receiver was given authority to make certain improvements to certain lands. To reduce expenses Ireland has ordered the closing of the police station at Carngreen.