Article Text

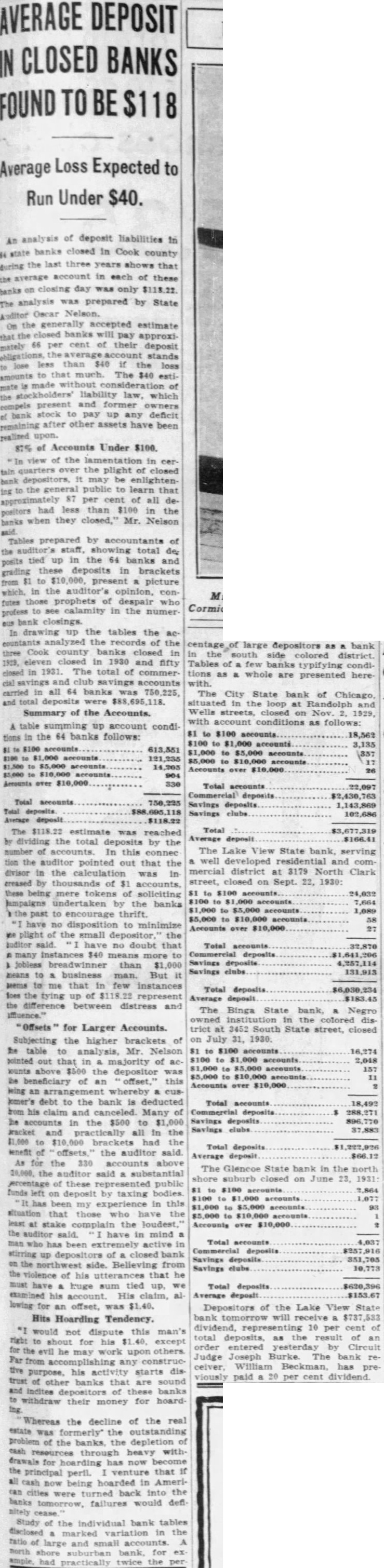

AVERAGE DEPOSIT IN CLOSED BANKS FOUND TO BE $118 Average Loss Expected to Run Under $40. in county the three years shows that average account in of only On the banks will of stands to that The $40 amounts made without of present former any other of Accounts Under $100. of in the of closed be the general to that had than the when they Mr. Nelson by accountants in the 64 banks and these deposits in brackets present picture in the auditor's of despair who to see calamity in the closings. In up the tables the the of the Cook county banks closed closed in and fifty in total of accounts in all banks was were $88,695,118. Summary of the Accounts. A table up account in the 64 banks follows: 904 Accounts over $10,000 330 Total accounts Total deposits. $118.22 The $118.22 estimate was reached dividing the total by the number of In this connec tion the auditor pointed out that the in the calculation was in creased by of $1 accounts, these being mere of soliciting undertaken by the banks past to encourage thrift. have no disposition to minimize of the small the no doubt that many $40 than $1,000 means to & business man. But it to me that in few instances foes the up of represent distress and for Larger Accounts. Subjecting the higher brackets of the table to analysis, Mr. Nelson $1 to pointed out that in majority of ac. ounts above $500 the depositor was the beneficiary of an this debt to the bank is deducted his claim Many of in the to $1,000 and all in the $1,000 to had the of the Average for the 330 accounts above The the said shore of these public $1 left on deposit by taxing $100 has been my in that those who have the $5,000 at stake complain the the auditor said. have in mind man who has extremely active in stirring up of closed bank Savings on the side. Believing from violence of his utterances that he have ruge sum tied up, examined his account. His claim, alfor an offset, was $1.40. Hits Hoarding Tendency. "I would not dispute this man's total right to shout for his except order for the evil he may work upon Judge Far from any purpose, his activity starts trust other banks are sound indites depositors of these banks to withdraw their money for Whereas the decline of the real estate was formerly* the outstanding of the banks. the depletion of cash resources through heavy for now the that if peril. all cash being hoarded in American cities back into the were banks tomorrow, failures would of the individual tables disclosed the of large and small accounts. shore suburban for had twice the centage of large depositors as bank in the south side colored Tables few banks typifying conditions as whole are presented with. The City State bank of in the and closed on Nov. 1929, with account conditions as follows: $1 to $100 accounts 3,135 to $5,000 accounts $5,000 to $10,000 accounts accounts 22,097 deposits Savings Savings clubs. 102,686 Total $166.41 The Lake View State serving well and commercial district at 3179 North Clark street, closed on Sept. 1930: $1 24,032 accounts 7,664 to $5,000 1,089 $5,000 to $10,000 accounts Total accounts. 32,870 deposits $1 Savings Savings elubs 131,913 Total deposits $183.45 The Binga State bank, the trict at South State street, on July 31, $100 16,274 2,048 to $5,000 to $10,000 accounts over $10,000 Total accounts. 18,492 770 Total deposits deposit. $66 Glencoe State in the suburb closed on 23, 1931 $100 accounts 2,864 1,077 accounts 93 to Total accounts 4,037 10,773 Total deposits $620,396 deposit $153.67 Depositors of the Lake View State bank will receive representing per cent of deposits, as the result of an entered yesterday by Circuit Joseph Burke. The bank ceiver, William has pre viously paid a per cent dividend.