Article Text

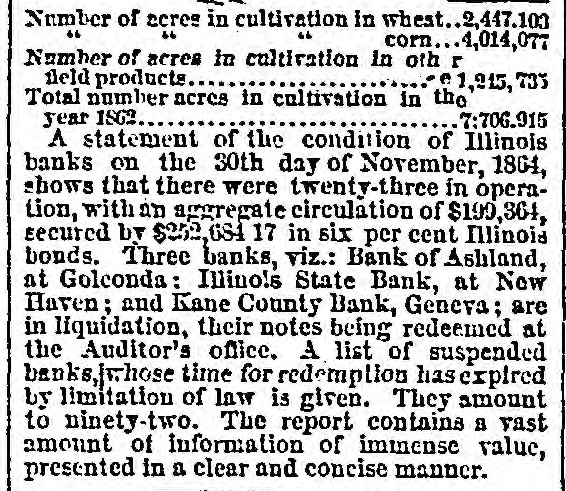

Number of acres in cultivation in whest..2,447.103 46 corn 4,014,077 Number of acres in cultivation In oth r field products $1,215,733 Total number ncres in cultivation in the year ISG2 7:706.915 A statement of the condition of Illinois banks on the 30th day of November, 1864, shows that there were twenty-three in operation, with an aggregate circulation of $199,364, secured by $252,684 17 in six per cent Illinois bonds. Three banks, viz.: Bank of Ashland, at Golconda: Illinois State Bank, at New Haven; and Kane County Bank, Geneva; are in liquidation, their notes being redeemed at the Auditor's office. A list of suspended banks/whose time for redemption has expired by limitation of law is given. They amount to ninety-two. The report contains a vast amount of information of immense value, presented in a clear and concise manner.