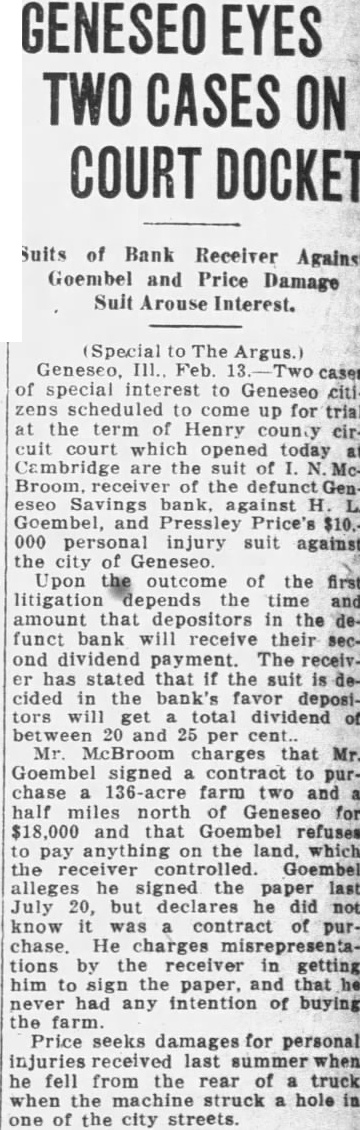

Article Text

ON COURT DOCKET Suits of Bank Receiver Against Goembel and Price Damage Suit Arouse Interest. (Special to The Argus.) Geneseo, Feb. of special interest to Geneseo citizens scheduled come up for trial the term of Henry county circuit court which opened today at Cambridge the suit of Broom, receiver the eseo bank. against Goembel, and Pressley Price's $10.000 personal injury suit against the city of Upon outcome of the litigation depends the time and amount that depositors in the funct bank will receive their second dividend payment. The receivhas stated that the suit cided in the bank's favor depositors get total dividend and 25 per cent. Mr McBroom charges that Goembel signed contract to purchase farm and half miles north of Geneseo for $18,000 that Goembel refuses to pay anything which the controlled. Goembel alleges he signed the paper last July but declares did not know was a contract of chase. He charges misrepresentations by receiver getting him sign the paper, and that he never had any intention of buying the farm. Price seeks damages for personal injuries received last summer when he fell from the rear of truck when the struck hole one of the city streets.