Article Text

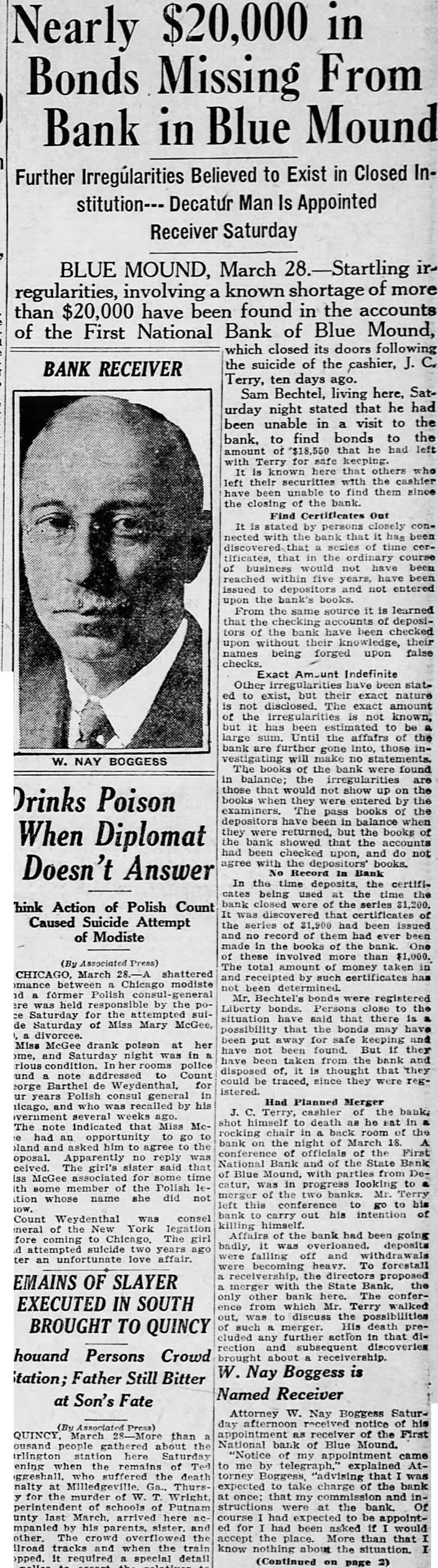

in $20,000 Nearly From Bonds Missing Bank in Blue Mound Further Irregularities Believed to Exist in Closed InMan Is Appointed Receiver Saturday BLUE MOUND, March irregularities, involving a known shortage of more than $20,000 have been found in the accounts of the First National Bank of Blue Mound, which closed its doors following the suicide of the cashier, BANK RECEIVER Terry, days ago. Sam Bechtel, living here, Saturday night stated that he had been unable in visit to the bank, find bonds to the to amount that left Terry safe keeping known that others left their securities with the cashier been unable find them since the closing of the bank. Find Certificates Out stated persons closely connected bank that has been series time tificates, that in the ordinary course business would not have been reached five years, been issued depositors not entered upon bank's books. From same source is learned that the checking accounts deposithe bank been upon their their names being forged upon false checks. Exact Amount Indefinite Other but their exact nature not disclosed. The exact amount the known, but been estimated to Until the affairs the bank further gone into, those will make no statements. The books the bank were found in irregularities those that would not show up on the books when they were entered by the The pass books the depositors balance when were returned, but the books bank showed that the accounts been checked upon, do agree the In time certificates being used the bank closed were of the series that certificates the series of had been issued no them ever been made in the books the these involved more than $1,000. The total amount of money taken and receipted by such certificates has been determined. Bechtel's bonds were registered Liberty bonds. Persons close the said that there possibility that bonds may been put away for safe and have not been found. But they been from bank disposed thought that could traced, since they registered. Had Planned Merger cashier the bank, himself death as he sat rocking chair back room the bank the night of March 18. conference officials First National Bank and the State of Blue Mound, catur, the to bank carry his intention killing himself. of the bank had been going badly, deposits falling off and becoming heavy. To forestall receivership, directors proposed merger the State Bank. the bank conferwhich Terry walked was discuss the merger. His death cluded further action in that rection subsequent discoveries brought receivership. Nay Boggess is Named Receiver Attorney W. Nay Boggess Saturday notice his as receiver of the First National bank Blue Mound. "Notice my appointment came me explained torney Boggess "advising that was expected to take charge the bank that my commission and structions the bank. Of course expected to be appointfor had been asked would accept the More than that know about the (Continued on page 2)