Article Text

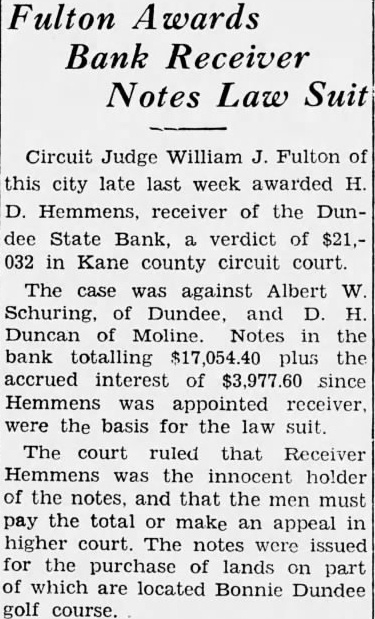

Fulton Awards Bank Receiver Notes Law Suit Circuit Judge William J. Fulton of this city late last week awarded H. D. Hemmens, receiver of the Dundee State Bank, a verdict of $21.032 in Kane county circuit court. The case was against Albert W Schuring, of Dundee, and D. H. Duncan of Moline. Notes in the bank totalling $17,054.40 plus the accrued interest of $3,977.60 since Hemmens was appointed receiver. were the basis for the law suit. The court ruled that Receiver Hemmens was the innocent holder of the notes, and that the men must pay the total or make an appeal in higher court. The notes were issued for the purchase of lands on part of which are located Bonnie Dundee golf course.