Article Text

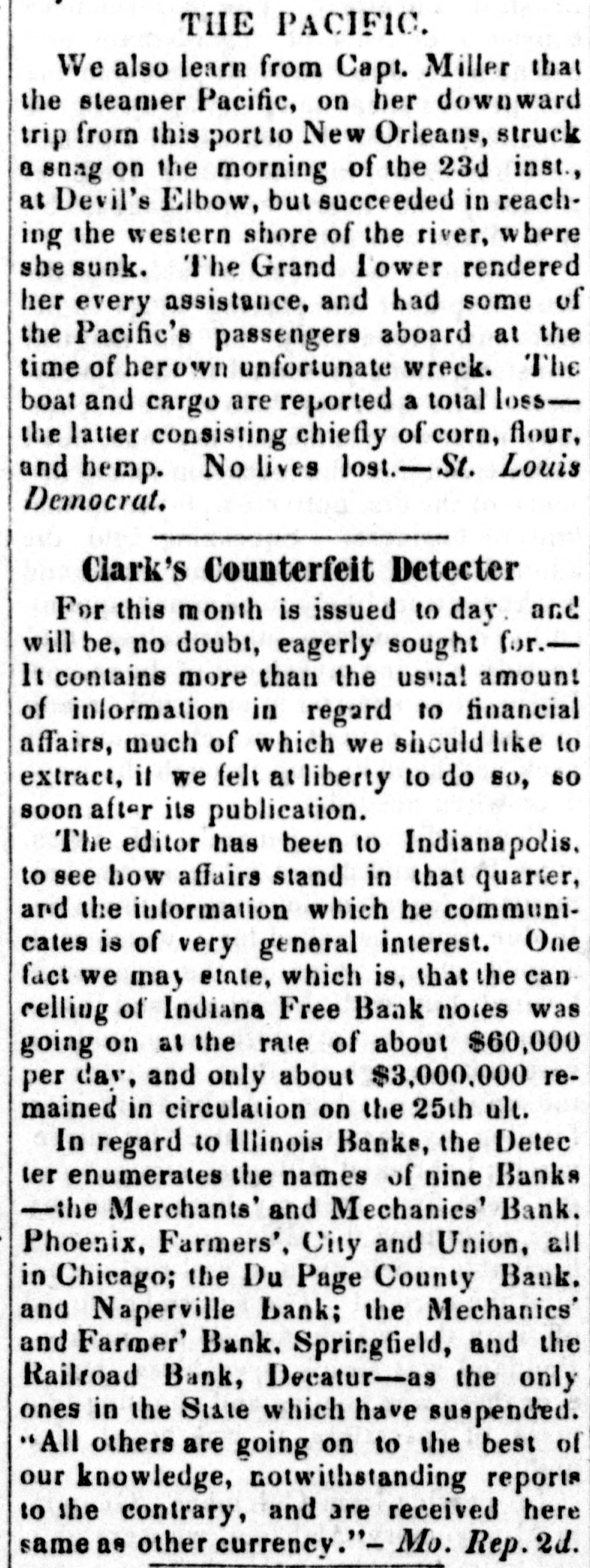

THE PACIFIC. We also learn from Capt. Miller that the steamer Pacific, on her downward trip from this port to New Orleans, struck a snag on the morning of the 23d inst., at Devil's Elbow, but succeeded in reaching the western shore of the river, where she sunk. The Grand lower rendered her every assistance, and had some of the Pacific's passengers aboard at the time of herown unfortunate wreck. The boat and cargo are reported a total loss— the latter consisting chiefly of corn, flour, and hemp. No lives lost.-St. Louis Democrat. Clark's Counterfeit Detecter For this month is issued to day and will be, no doubt, eagerly sought for.— It contains more than the usual amount of information in regard to financial affairs, much of which we should like to extract, it we felt at liberty to do so, so soon after its publication. The editor has been to Indianapolis. to see how affairs stand in that quarter, and the information which he communicates is of very general interest. One fact we may etate, which is, that the can celling of Indiana Free Bank notes was going on at the rate of about $60,000 per day, and only about $3,000,000 remained in circulation on the 25th ult. In regard to Illinois Banks, the Detec ter enumerates the names of nine Banks -the Merchants' and Mechanics' Bank. Phoenix, Farmers', City and Union, all in Chicago; the Du Page County Bank. and Naperville bank; the Mechanics' and Farmer' Bank. Springfield, and the Railroad Bank, Decatur-as the only ones in the State which have suspended. "All others are going on to the best of our knowledge, notwithstanding reports to the contrary, and are received here same as other currency."- Mo. Rep. 2d.