Article Text

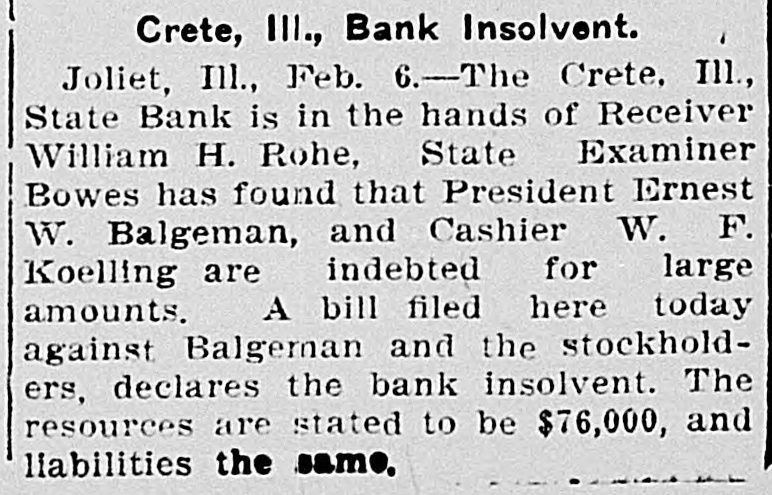

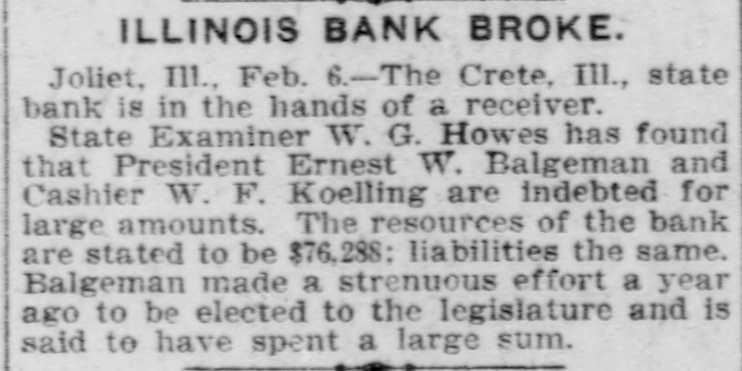

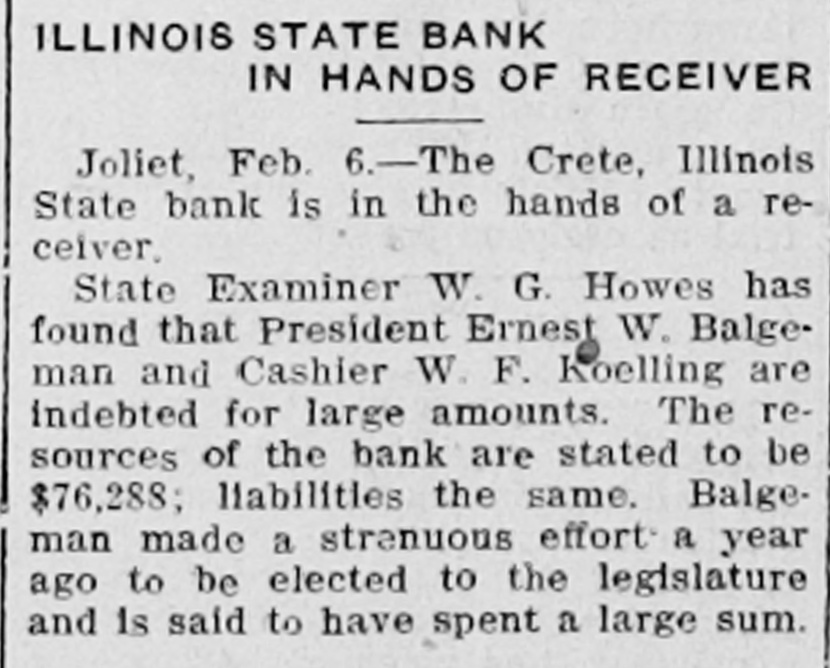

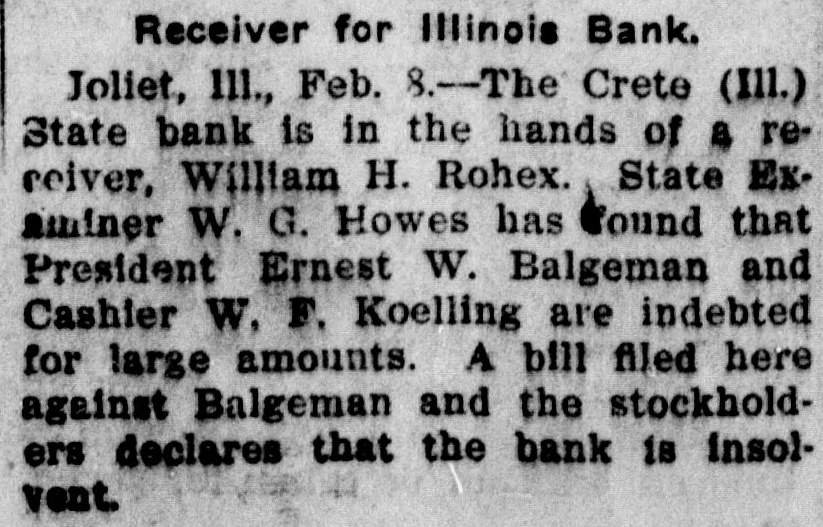

Crete, III., Bank Insolvent. Joliet, Ill., Feb. 6.-The Crete. Ill., State Bank is in the hands of Receiver William H. Rohe, State Examiner Bowes has found that President Ernest W. Balgeman, and Cashier W. F. Koelling are indebted for large amounts. A bill filed here today against Balgeman and the stockholders, declares the bank insolvent. The resources are stated to be $76,000, and liabilities the same.