Click image to open full size in new tab

Article Text

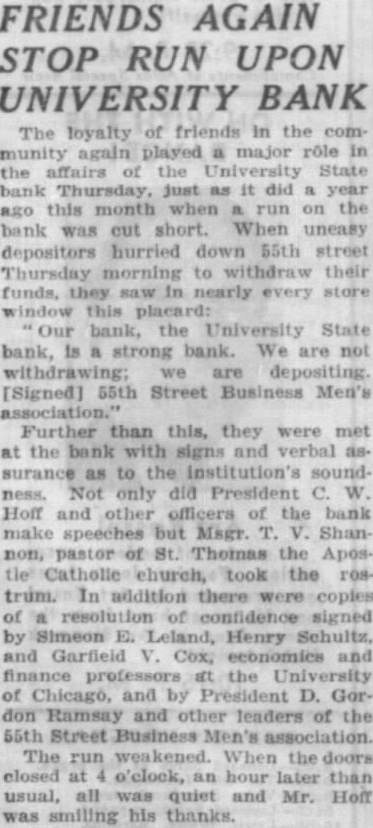

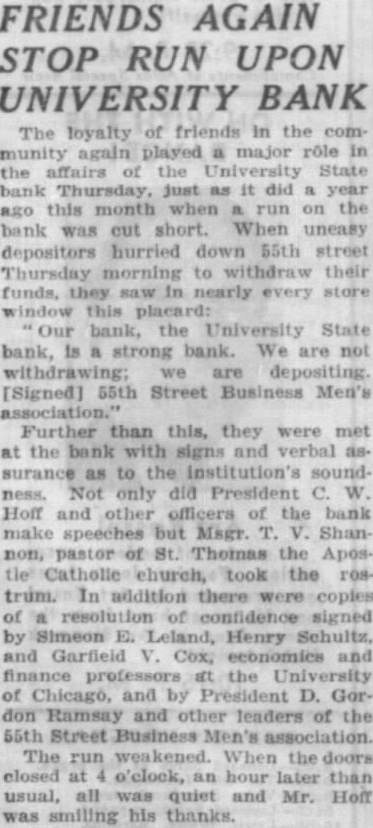

FRIENDS AGAIN STOP RUN UPON UNIVERSITY BANK

The loyalty of friends in the community again played major role in the of State just did year ago this month when run the bank was cut short. When uneasy depositors hurried down 55th street Thursday morning withdraw their funds, in nearly every store window this placard: bank, the University State bank, is strong bank. We are not withdrawing; [Signed] 55th Street Business Men's Further than this, they were met at the bank with signs and verbal assurance as to the Institution's soundNot only did President Hoff and other officers the bank make speeches but Msgr. Shannon, pastor Thomas the Aposchurch, took the rostrum. In addition there copies resolution signed Simeon E. Henry Schultz, and Garfield V. Cox, and the of Chicago, and by D. Gor don Ramsay and other leaders the 55th Street Business The run weakened. the doors closed o'clock, hour later than usual, all was quiet and Mr. Hoff was his thanks.