Click image to open full size in new tab

Article Text

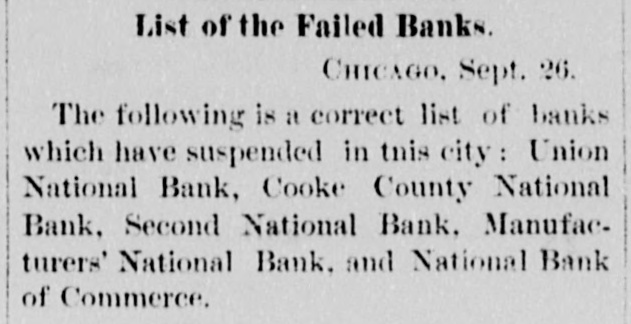

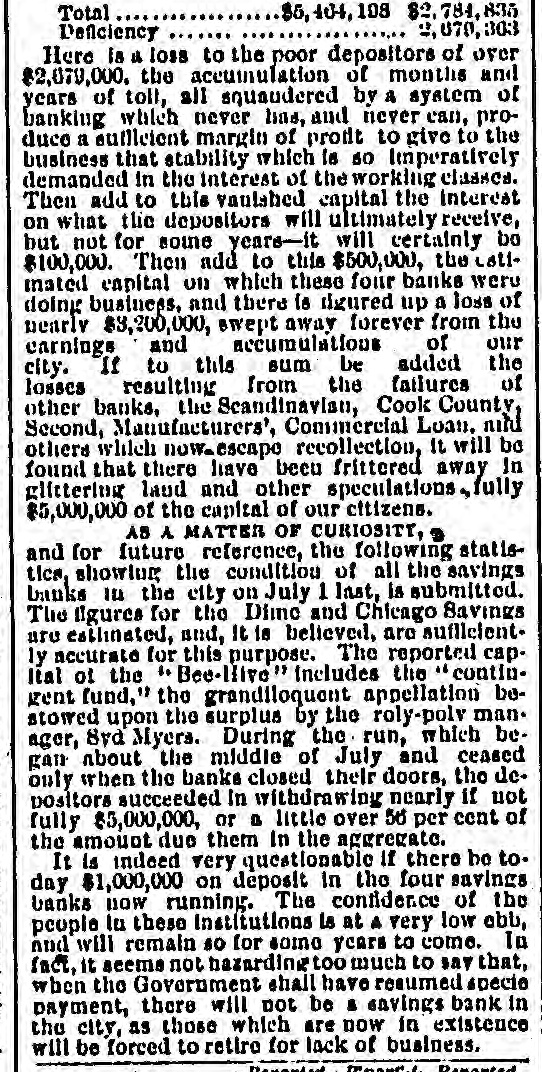

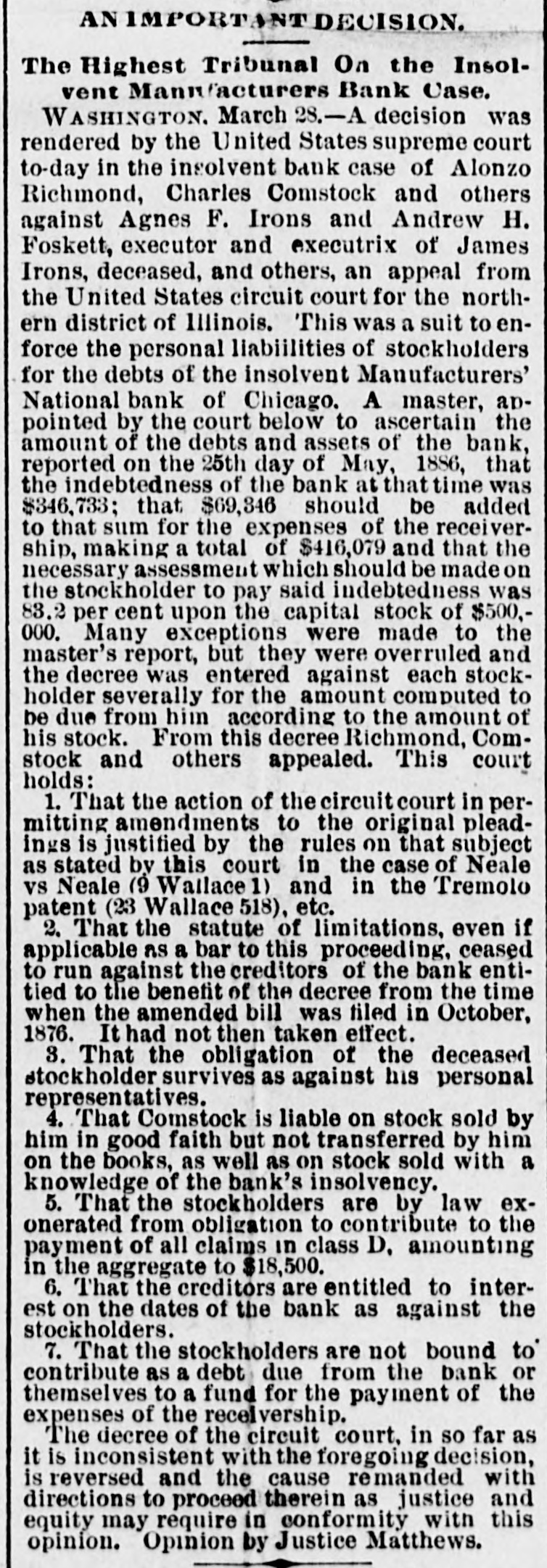

Federal, State, county or musicipal governments; opposes the present tariffs; favors taking solvent debts: favors the eight-hour law; opposed to Chinese immigration, and also opposed to the election of the President more than one term of four years. The last resolution indorses the stand taken by Governor Booth in behalf of popular rights against the encroachments of politicians and railway corporations. A dispatch from Deaver, Col., states that over vo-thirds of the mining town of Fairplay, Col., had been consumed on he 26th. All the stores, printing offices, the United States land office, post office, express office, als and other business places, three exceptions, had been utterly destroyed. The Right Rev. Geo. M. Randall, Episcopal Bishop of Colorado New Mexico and Wyoming, died at Denver, Colorado, on the 28th, of typhold pneumonia. The Third National Bank, of Chicago, closed its doors on the 27th. The Cook County National, one of the suspended banks of that city, had announced its resumption. The Manufacturers' and Second National banks had decided to go into liquidation. The Union National, the first of the Chicago banks that closed its doors, had announced its assets at $5,600,000, and its liabilities at $4,300,000. and given notice of its speedy resumption of business. The Clearing-Ho Association met on the evening of the 27th, and after an animated discussion resolved not to issue ClearHouse certificates. A dispatch from St. Louis of the 27th says that the rear wall of the five-story warehouse, on the corner of Second and Chestnut streets, had fallen, opening gap in the building fifty feet wide from the ground to the roof. One man had been killed and two seriously injured. In Chicago, on the 29th, business had resumed very nearly its normal condition. Three of the suspended banks had resumed business and were receiving deposits and paying out on checks as before the panic. Over $3,000,000 currency had been received during the preceding forty-eight hours. Traffic had fallen off on the various lines of railroad, and a large number of trains had been drawn off, and many men discharged. A St. Louis dispatch of the 29th says that while Joseph H. Fore, who attempted to kill his wife, on the 4th of June last, was being tried in that city on the 29th for that offense, hethrew heavy cut glass inkstand at his wife as she was giving in her testimony. The missile missed her, but struck her counsel full in the forehead, inflicting an ugly and danger wound. At a late hour on the night of the 29th the Union National Bank of Chicago, which had resumed business on that morning, and during the day had paid out $400,000, decided to go into liquidation, under the provisions of Sec. 42 of the National Currency Act. A call has been issued for a Northwestern Farmers' Convention, to meet at Chicago on the 22d of October, to consist of delegates from Granges and farmers' organizations. The South. A dispatch from Richmond, Va., of the 23d, says that the Merchants' National, the Planters', the Mechanics', the Peoples', the First National, and the Citizens' banks, of Petersburg, had suspended. A Baltimere telegram of the 24th announced that all the banks of that city had stopped currency payment. Brown, Lancaster & Cowell, agents of the Chesapeak and Ohio Railway, having houses in Baltimore, New York and Richmond, had also suspended. A Little Rock, Ark., dispatch of the 24th says the money panic in that city continued, caused not 80 much by Eastern financial complications as by the refusal of the city banks to take the shinplasters that have been current there. A dispatch from Richmond, Va., says that the Richmond Dollar Savings Bank had suspended, and that Taylor & Williams, bankers, had failed. A dispatch to the Associated Press, from Brownsville, Texas, of September 24, says that a series of butcheries and robberies had recently been committed in Mexico, the victime every case being Americans. The perpetrators of these crimes were arrested, and their guilt fully established, yet not one of them had been punished, the authorities being either indifferent or powerless. The facts had been reported by the Consuls to Washington, in the hopes that redress would be demanded. A Memphis dispatch of the 25th says that the First National and De Soto banks, of that city, had closed their doors. A dispatch from Nashville Tenn., says that the National Banks of that city had suspended currency payments on all balances exceeding $200. A dispatch from Selma, Ala., of the 25th. says the Savings Bank of Selma had suspended in consequence of an extraordinary run by depositors. All the banks of New Orleans partially suspended payment on the 25th, according to a dispatch from that city. The suspension was to remain in force for thirty days. Telegrams from various cities in Georgia, of the 25th, say the following banks had suspended: National Exchange, the Merchants' and Planters' National, the Planters' Loan and Savings Banks, of Augusta, Ga.; the Dollar Savings Bank, of Atlanta, Ga.: Savannah Bank and Trust Company, and the South ern Bank of Georgia. A dispatch from Shreveport, La., of the 25th, says the fever, which seemed to have abated on the preceding day, had broken out with renewed violence. The interments numbered twenty-two. A dispatch from Shreveport, La., of the 29th says that within the last four days sever al of the most prominent and useful citizens of that city had fallen victims to the epidemic. The dispatch adds: "The population has been fearfully thinned out by sickness and death We no longer have funerals. The hearses, followed by one or two carriages, dash through the streets like a section of artillery in a battle seeking position. A few men are drummed up, the coffins shoved into the hearse, and driven rapidly to the cemetery. This is the case even with the most prominent citizens. The Howards have opened an orphan asylum, and are feeding about two-thirds of the resident population. There are fewer deaths and new cases, because there are fewer people.' A Jackson, Miss., dispatch of the 29th says Governor Powers, acting under the advice of Attorney-General Morris, had issued proclamation postponing the State election. The Governor says that he will convene the Legislature in extraordinary session as soon as possible. The Pilot, the State organ, has pronounced the Governor's movement incendiary, and calculated to lead to revolution and anarchy.