Article Text

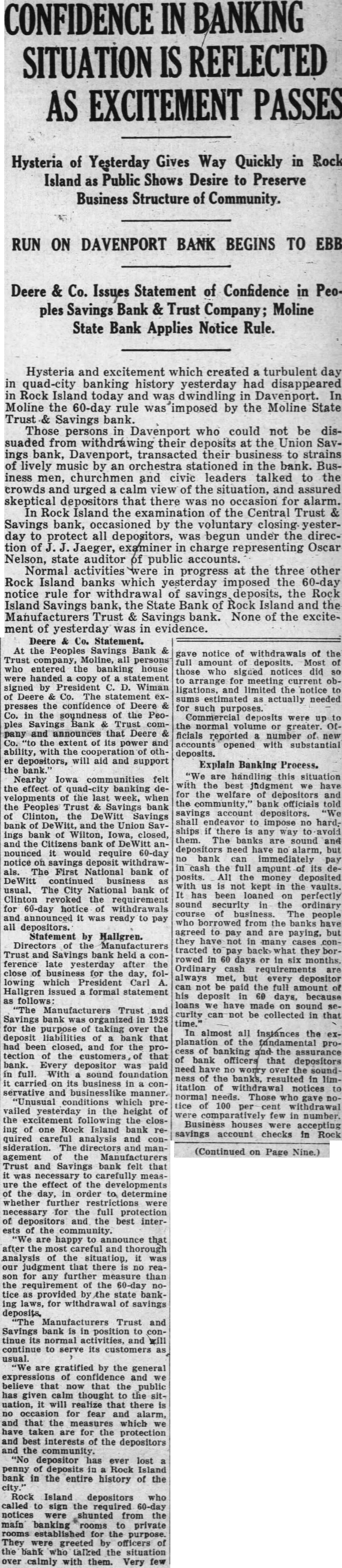

CONFIDENCE BANKING SITUATION REFLECTED AS EXCITEMENT PASSES Hysteria of Yesterday Gives Way Quickly in Rock Island as Public Shows Desire to Preserve Business Structure of Community. RUN ON DAVENPORT BANK BEGINS TO EBB Deere Co. Issues Statement of Confidence in Peoples Savings Bank Trust Company; Moline State Bank Applies Notice Rule. Hysteria and excitement which created turbulent day in quad-city banking history yesterday had disappeared in Rock Island today and was dwindling in Davenport. In Moline the 60-day rule was imposed by the Moline State Trust & Savings bank. Those persons in Davenport who could not be dissuaded from withdráwing their deposits at the Union Savings bank, Davenport, transacted their business to strains of lively music by an orchestra stationed in the bank. Business men, churchmen and civic leaders talked to the crowds and urged a calm view of the situation, and assured skeptical depositors that there was no occasion for alarm. In Rock Island the examination of the Central Trust & Savings bank, occasioned by the voluntary closing yesterday to protect all depositors, was begun under the direction of Jaeger, examiner in charge representing Oscar Nelson, state auditor public accounts. Normal activities in progress at the three other Rock Island banks which yesterday imposed the 60-day notice rule for withdrawal of savings deposits, the Rock Island Savings bank, the State Bank of Rock Island and the Manufacturers Trust & Savings bank. None of the excitement of yesterday was in evidence. Deere Co. Statement. At Peoples Savings Bank Trust company, Moline, persons who entered the banking house handed copy of statement signed President Wiman Deere Co. The statement presses the confídence of Deere Co. the soundness the Peoples Savings Bank Trust announces that Deere the extent of its power and ability, with the cooperation othdepositors, will aid and support the bank." Nearby Iowa communities felt the effect of banking velopments of the last week, when the Peoples Trust Savings bank Clinton, DeWitt Savings bank DeWitt, and the Union Savings bank of Wilton, Iowa, closed, and the bank nounced would require 60-day notice deposit withdrawThe First National bank of business usual. The City bank of Clinton revoked the requirement for 60-day notice of it ready to pay all depositors. Statement by Hallgren. the Trust and bank held ference late after the close of for the day, lowing which Carl issued formal statement follows: Manufacturers Trust and bank in for the purpose of taking over the deposit liabilities bank that had been closed, and for the tection the that Every depositor paid in full. sound carried on its business servative and businesslike "Unusual which vailed yesterday the height of the the closone Rock Island bank quired careful analysis and sideration. directors agement the Trust Savings bank felt that necessary carefully measeffect the developments of the day, in order determine whether further restrictions were necessary full protection of depositors and best interthe community. happy to announce that after the careful and thorough analysis situation, judgment that there no reaany further measure than the requirement the 60-day tice as provided by the state banking for withdrawal savings Manufacturers Trust and Savings bank in position to tinue normal activities, and will continue to serve its customers usual. are gratified by the general expressions confidence and believe that that the public has given calm thought to the will realize that there occasion fear alarm, that measures which have taken for the protection best interests of the depositors the community. "No depositor has ever lost penny of in Rock Island bank in the entire history of the Rock Island depositors who called to sign the notices were shunted from the main banking rooms to private established the They were greeted of the bank talked the situation calmly with them. Very notice of of the amount of deposits. Most of those signed did arrange meeting current and limited the notice to sums estimated actually needed for such purposes. deposits were to the volume greater. Officials reported number of new accounts opened with substantial deposits. Explain Banking Process. handling this situation the best judgment have the welfare of depositors and bank officials told savings account depositors. shall endeavor to impose no hardships there any way avoid them. The banks sound depositors need have no alarm, but bank immediately cash the full amount of its posits. All money deposited us not kept in the vaults. has been loaned perfectly sound security the ordinary course business. The people who borrowed from the banks agreed pay and but they have not many cases tracted to back they rowed in days in six months. Ordinary cash requirements always met, but every depositor be paid full amount deposit 60 because loans made sound can not be collected that In almost all instances the planation the fundamental proof banking the assurance bank officers that depositors need worry ness the banks. resulted in limitation notices normal needs. Those who withdrawal few number. houses accepting savings account checks in Rock (Continued on Page Nine.)