Article Text

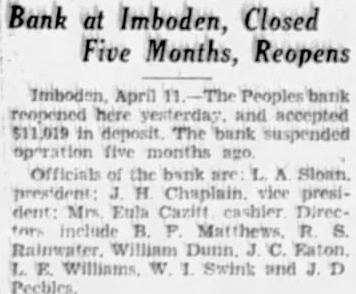

Bank at Imboden, Closed Five Months, Reopens Imboden April 11 The Peoples bank reopened here yesterday and accepted $11,019 in deposit The bank suspended five months ago Officials of the bank are L. A Slown. president: J Chaplain vice president: Mrs Eula Cazift cashier Direcinclude R S. Swink and J. D