Article Text

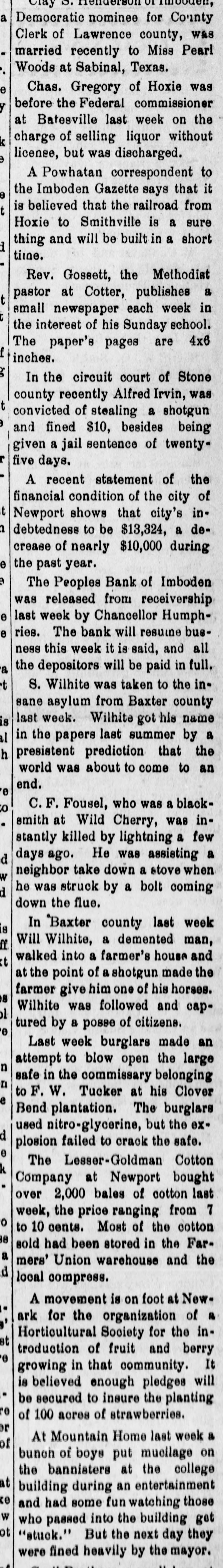

Clay N. on or a Democratic nominee for County Clerk of Lawrence county, was married recently to Miss Pearl Woods at Sabinal, Texas. . Chas. Gregory of Hoxie was e before the Federal commissioner y at Batesville last week on the charge of selling liquor without k license, but was discharged. e A Powhatan correspondent to the Imboden Gazette says that it is believed that the railroad from t Hoxie to Smithville is a sure thing and will be built in a short d time. Rev. Goseett, the Methodist pastor at Cotter, publishes a t small newspaper each week in the interest of his Sunday school. The paper's pages are 4x6 inches. So. In the circuit court of Stone county recently Alfred Irvin, was t convicted of stealing a shotgun and fined $10, besides being given a jail sentence of twentyfive days. A recent statement of the financial condition of the city of t Newport shows that city's inh debtedness to be $13,324, a decrease of nearly $10,000 during e the past year. e The Peoples Bank of Imboden was released from receivership e last week by Chancellor Humphries. The bank will resuine buse ness this week it is said, and all the depositors will be paid in full. a S. Wilhite was taken to the int sane asylum from Baxter county last week. Wilhite got his name is in the papers last summer by a al presistent prediction that the h world was about to come to an end. e C.F. Fousel, who was a blackto : smith at Wild Cherry, was instantly killed by lightning a few days ago. He was assisting a d neighbor take down a stove when w he was struck by a bolt coming d down the flue. In 'Baxter county last week is Will Wilhite, a demented man, ff walked into a farmer's house and t at the point of a shotgun made the farmer give him one of his horses. 8 Wilhite was followed and capbl tured by a posse of citizens. e Last week burglars made an attempt to blow open the large n safe the commissary belonging n to F.W. Tucker at his Clover e Bend plantation. The burglars used nitro-glycerine, but the exd plosion failed to crack the safe. e The Lesser-Goldman Cotton k Company at Newport bought over 2,000 bales of cotton last week, the price ranging from 7 o to 10 cents. Most of the cotton 88 sold had been stored in the Fara mers' Union warehouse and the d local compress. A movement is on foot at Newark for the organization of a ' Horticultural Society for the inat troduction of fruit and berry e growing in that community. It is believed enough pledges will be secured to insure the planting re of 100 acres of strawberries. or At Mountain Home last week a of bunch of boys put mucilage on the bannisters at the college at building during an entertainment ce and had some fun watching those w who passed into the building get ot "stuck." But the next day they were fined heavily by the mayor. .